Inflation Cools In Japan On The Back Of Energy Subsidies And Base Effects

Image source: Pixabay

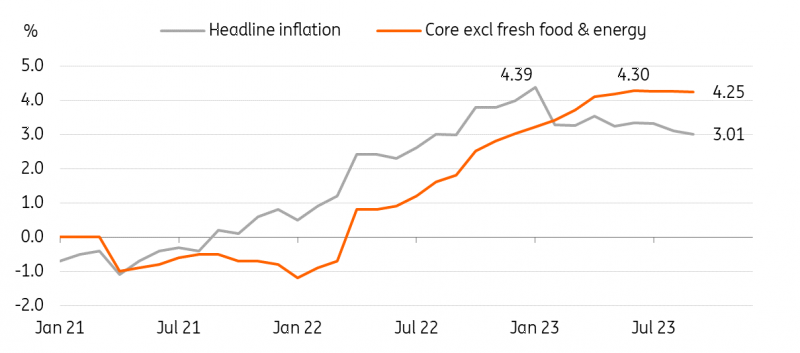

Headline inflation continued to ease in Japan on the back of ongoing support from the energy subsidy programme and base effects. Core inflation, the Bank of Japan's preferred measure, only edged down slightly. With inflation holding steady, we expect more policy changes to forward guidance and YCC at the October meeting.

Utilities are the main reason for the cooling

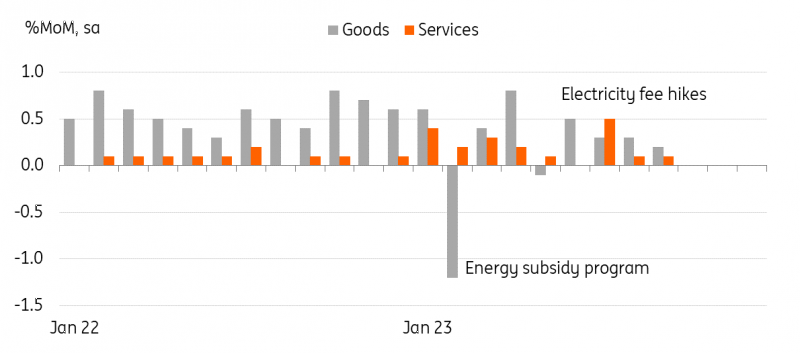

Japan's consumer inflation slowed to 3% year-on-year in September, in line with the market consensus, from 3.2% in August. Despite the recent pick-up in global energy prices, government subsidies continued to drag down utility prices (-14.3%). Goods prices moderated, with household goods and clothing prices decelerating – but service prices such as housing and medical care are still on the rise. A monthly comparison shows the headline index rising 0.3% month-on-month sa, with both goods (0.2%) and services (0.1%) prices picking up.

Japan's core inflation is stickier than expected

CEIC

Inflation outlook

The energy subsidy programme was originally set to be wrapped up by the end of September but has now been extended to year-end amid growing concerns over the strong rise in global commodity prices. Pipeline prices, such as import prices and producer prices, suggested upside pressures building up again on the back of the weak JPY and the spike for commodities. However, base effects will likely dominate to bring down headline inflation, and core inflation (excluding fresh food and energy) is expected to stay above 4% throughout this year.

Energy subsidy programme will be extended to year-end

CEIC

BoJ watch

The Bank of Japan will likely revise up its quarterly forecasts for GDP and CPI for 2023 and 2024 reflecting the latest data developments. Aside from the recent rise in global commodity prices, service prices have also continued to rise, and this is expected to remain the case for some time. Escalating geopolitical tensions are also likely to increase the pressure on prices in the near future. Core inflation excluding fresh food and energy still remains at the 4% mark and is likely to slow only marginally, so we think inflation will stay above the BoJ's target of 2% throughout 2024.

Surging JGB 10Y yields and renewed weakness in the JPY could also mean that the Bank of Japan will likely adjust its policy gradually. We believe that the rate hike will only come in the second quarter of next year when the GDP output gap turns positive and the BoJ can confirm another solid increase in wages. Before that, however, the central bank will likely provide proper guidance on its policy stance to the market and ensure the flexibility of its policy decisions. We expect to see the BoJ's comments shift closer to neutral from its current dovish stance.

The BoJ has also intervened in the JGB market, with 10y JGB hitting 0.845%, its highest since July 2013. Technically, the upper limit under the current yield curve control is set at 1.0% but clearly, the BoJ doesn't want a sharp rise and is aiming to slow down the pace. With the UST approaching the 5% handle, JGB is also likely to retest temporarily over 0.85%, but we think that it will likely come down to settle at the 0.80% level. We think the Bank of Japan will shorten its anchor year of the YCC from the current 10y to 5y in order to provide itself with more flexibility.

More By This Author:

China’s Green Sector Is Boosting Its Appetite For AluminiumPolish Manufacturing Bottoming Out And Producer Prices Starting To Stabilise

Asia Week Ahead: Regional Inflation Readings Plus Growth Figures From Korea

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more