Indonesia: Bank Indonesia Hikes Again To Support The Currency

Image Source: Pexels

Bank Indonesia hikes rates by 25bp, as expected. BI is set to continue tightening in early 2023.

BI hikes again but downshifts to less aggressive tightening

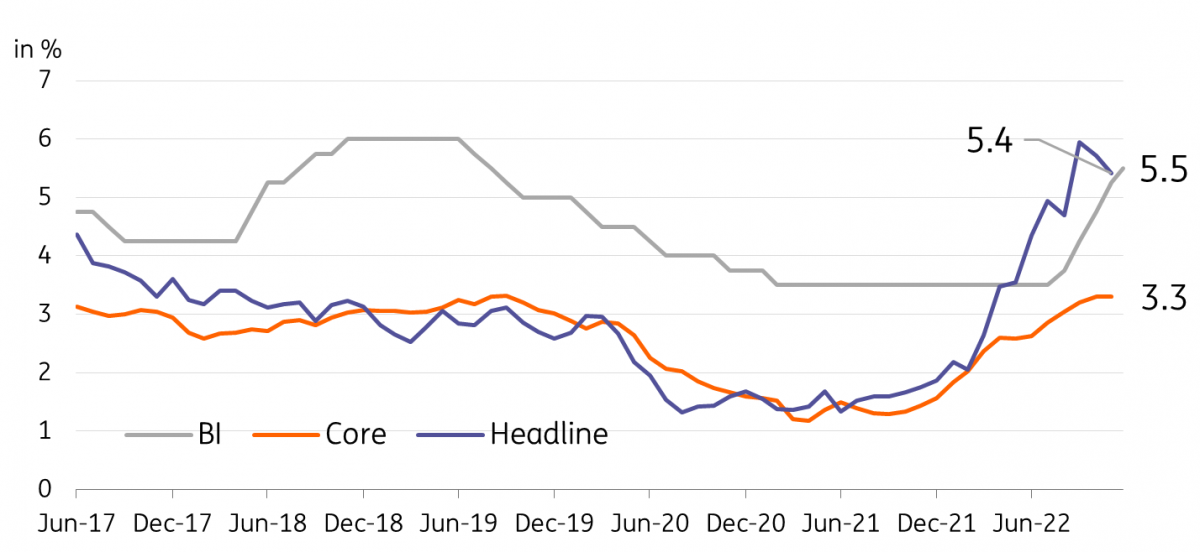

In a move widely anticipated by market participants, Bank Indonesia (BI) has hiked policy rates by 25bp to 5.5%. Price pressures have abated somewhat, as evidenced by the recent slip in headline inflation and we believe that inflation in Indonesia may have peaked.

The softer inflation reading - combined with the general outlook for growth challenges in 2023 - convinced the central bank that a less forceful rate hike should be rolled out today. A similar downshift in the pace of tightening from global central banks also allowed BI to implement the 25bp increase in policy rates today.

BI rolls out 25bp rate hike as inflation pressures ease

Image Source: Badan Pusat Statistik

Rate hikes set to continue in early 2023

Despite the pullback in the pace of tightening, we believe BI will continue with the current tightening cycle next year. BI believes that the Fed will continue to hike rates in the first half of 2023 and we could see BI following suit with rate hikes of their own. The IDR has come under some pressure to close out 2022 and we believe BI will need to match Fed rate hikes to help maintain FX stability.

With BI’s policy rate at 5.5%, IDR should move sideways to close out the year - with investors monitoring the fallout from the recent bond buyback announcement from the national government.

More By This Author:

Poland’s Retail Sales In November Are Another Sign Of Strong Economic Resilience

Poland: Construction Output Rises In November Amid Favorable Weather

FX Daily: What To Watch In Markets During The Festive Period

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more