India’s Reserve Bank Hikes 50bp

Reserve Bank of India Governor Shaktikanta Das

50bp, the mode not the median

While more forecasters were expecting the RBI to hike by 50bp today than by any other number, the median, which is what is usually referred to as the consensus expectation, was for a hike of only 40bp. Even so, the market response has been relatively muted. USD/INR started today trading at about 77.69, slightly stronger than at the end of trading yesterday, but it weakened throughout the day and experienced only the most fleeting of rallies on the announcement.

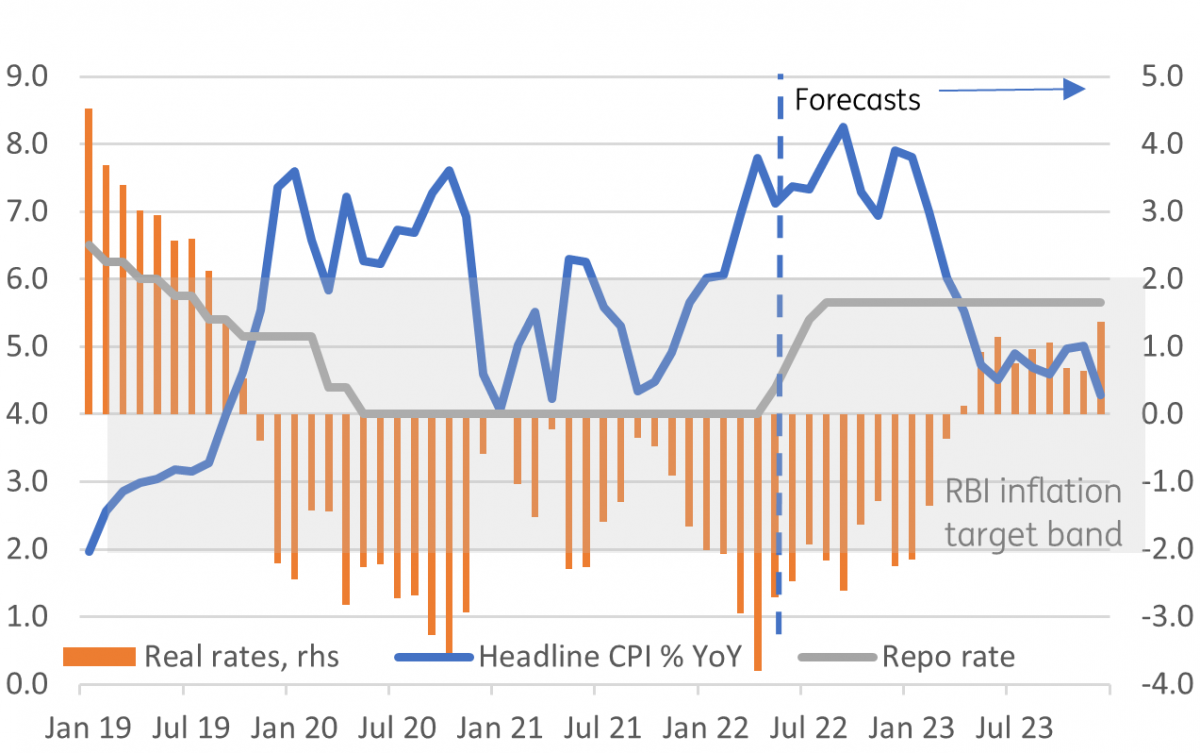

India's inflation and policy rates

(Click on image to enlarge)

Source: CEIC, ING

india inflation

Governor's statement indicates more to come

The governor's statement is well worth a read and contains a number of useful pointers about the path ahead. Here are some of the highlights we note, together with our interpretation:

- "The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward while supporting growth. It may be noted in this context that the repo rate still remains below its pre-pandemic level". The pre-pandemic repo rate was 5.15%, so today's hike still leaves it 25bp lower than it was then. At a minimum, there is this much more tightening to come.

- "There are growing signs of a higher pass-through of input costs to selling prices. The MPC noted that inflation is likely to remain above the upper tolerance band of 6 percent through the first three quarters of 2022-23". We are likely to see policy being moved steadily towards a much less accommodative setting over the remainder of the year, but rates could start to come down in 2023.

- "Available information for April and May 2022 indicates that the recovery in domestic economic activity remains firm, with growth impulses getting increasingly broad-based." The economy is resilient and can weather tighter monetary policy.

Where will this end?

Figuring out where and when all this will end is something of a wet-finger waving exercise. But at a very simplistic level, we would expect policy interest rates to rise to a point where by the end of the year, they are at or slightly higher than the inflation rate, so delivering a modestly positive real rate. We currently have rates peaking at 5.80 in 1Q23, though it would probably make sense to bring that forward to 4Q22. That in no way would mark a restrictive policy rate, but would remove much of the extraordinary accommodation that is still present today. It is of course subject to considerable uncertainty - the path of the Russia-Ukraine war and its ongoing impact on global commodity prices, China's on-off lockdowns, as well as the impact of international interest rates on the global economy (growing recession concerns).

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more