Indian Share Markets End Flat, Realty And IT Stocks Witness Selling

Indian share markets ended today's volatile session on a flat note.

Benchmark indices staged a gap-down opening today tracking an overnight dip in US markets last week, as solid jobs report ate into hopes for a pause in the Federal Reserve's aggressive policy-tightening.

At close, equity markets recovered from the day's low as US futures turned positive.

At the closing bell, the BSE Sensex stood lower by 94 points (down 0.2%).

Meanwhile, the NSE Nifty closed lower by 15 points (down 0.1%).

Oil India and Tata Steel were among the top gainers today.

Asian Paints and UltraTech Cement, on the other hand, were among the top losers today.

The SGX Nifty was trading at 16,569, down by 36 points, at the time of writing.

The BSE MidCap index and the BSE SmallCap index ended down by 0.2% and 0.5%, respectively.

Among sectoral indices, selling was seen in the IT sector, realty sector, and capital goods sector.

On the other hand stocks in the auto sector, banking sector and metal sector witnessed buying.

Shares of Sumitomo Chemical India and Oil India hit their respective 52-week highs today.

With stocks rising across the board, you must be excited to see that volatility has eased and things are going back to normal. Several Indian stocks have delivered multi-bagger returns in a span of one month.

But remember that not all are worthy. Many could be trading in uncharted territory and may be overvalued.

Asian stock markets ended on a positive note today. The Nikkei ended 0.6% higher while the Shanghai Composite added 1.3%.

US stock futures are trading on a positive note with the Dow Futures trading up by 260 points.

The rupee is trading at 77.66 against the US$.

Gold prices for the latest contract on MCX are trading flat at Rs 50,989 per 10 grams.

In news from the insurance space, the government is in discussion with the insurance regulator to ease norms for new insurers to diversify the industry.

The norms under discussion include relaxing minimum entry capital requirements for setting up the insurance venture, along with tax sops and lower solvency margin or extra capital requirements.

At present, a minimum investment of Rs 1 bn is required to set up an insurance firm.

According to the government, the move will help widen the reach of the insurance industry and pave the way for regional and mini-insurers with limited product offerings.

Earlier, a committee constituted by the insurance regulator which had representation from the Economic Advisory Council and the finance ministry, suggested allowing mini or monoline insurance companies on a regional basis with lower capital of around Rs 200 m.

The insurance industry generated Rs 9.2 tn of premium in the financial year 2022. Whereas the insurance penetration (premiums as a percentage of gross domestic product) stood at 4.2% in the financial year 2021.

The penetration for life insurance in India is 3.2% and non-life insurance penetration is 1%.

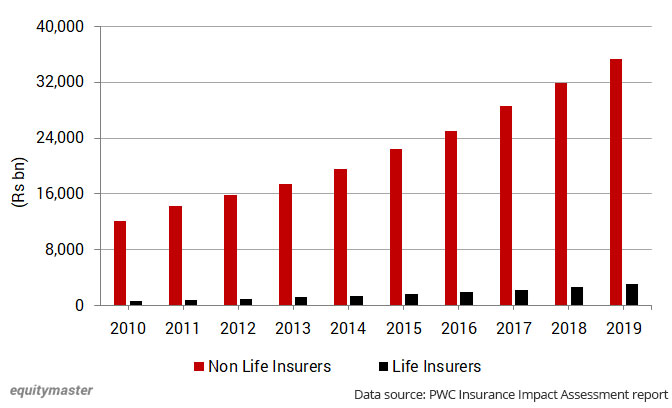

Speaking of the insurance sector, have a look at the chart below which shows the investment assets of non-life insurers and life insurers over the past 10 years:

Investment Assets of Non-Life Insurers 11x That of Life Insurers

Moving on to news from the EV space, India's largest EV charging solutions provider, Tata Power has partnered with Kolte-Patil Developers Limited (KPDL), a leading Pune-based real estate developer.

Under the partnership, KPDL will install charging stations across its projects in Pune, Mumbai, and Bengaluru, providing comprehensive charging solutions to EV owners.

Through this partnership, EV owners at KPDL properties will have access to Tata Power's EZ Charge mobile app, which will provide charging, monitoring, and e-payments throughout the day.

With over 1,500 public and semi-public EV chargers deployed and another 550+ chargers in various phases of installation, Tata Power is India's top provider of EV charging solutions.

In another development from the EV space, Tata Motors won an order to deliver a fleet of 10,000 EVs to BluSmart Electric.

Tata Motors claims the deal, which was signed on World Environment Day, is the biggest ever EV fleet order in the country.

Earlier in April, Tata Motors also said it is looking to ramp up the production of EVs as demand continues to outpace the manufacturing activity by a huge margin.

The Mumbai-based automaker, which led the passenger EV space in the domestic market in the last fiscal year, has been receiving an average of 5,500-6,000 bookings in the past two months for its EV range.

We will keep you updated on the latest developments in this space. Stay tuned.

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity research ...

more