Hungary’s Budget Challenges Are Far From Over

Image Source: Pexels

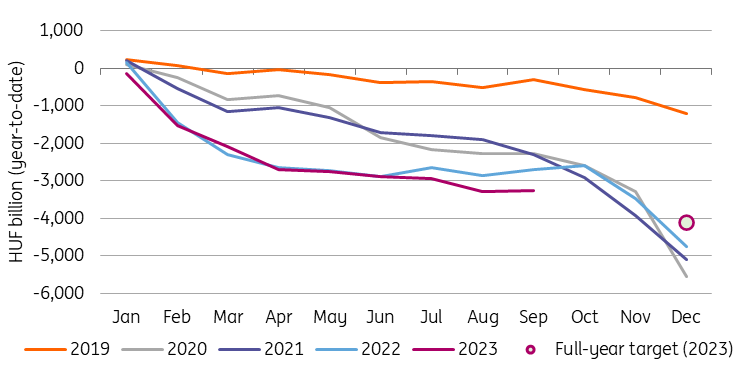

The budget generated a small surplus in September, which will be a short-term sticking plaster. The latest upward revision in the official deficit target underscores the remaining challenges

The monthly budget balance surprised to the upside in September, showing a small surplus of HUF 34bn. This is the first monthly surplus since October last year. Although this change is welcome, it is hardly due to a sudden improvement in the underlying budgetary challenges. Indeed, last year - when the budget accumulated a deficit of 6.1% of GDP - September and October brought monthly surpluses. In this respect, the improvement in September is more of a seasonal phenomenon and not necessarily part of an improving trend.

When it comes to the year-to-date performance, the deficit now stands at HUF 3.265tn. Considering the updated financing target, this means that 79% of the cash flow-based target for the year as a whole was met in September.

Budget performance (year-to-date, HUFbn)

Image Source: Ministry of Finance, ING

Revised financing needs and Maastricht-based deficit target

First, the Government Debt Management Agency changed its financing plan in early September, raising this year's financing needs by HUF 704bn to HUF 4.113tn. We use this as a proxy for the new cash flow-based deficit target. A month ago, we signalled that this revision could be a precursor to an imminent change in the official fiscal target as well. After all, the government also changed the official – accrual-based – Maastricht deficit target at the beginning of October. The new 2023 full-year target is 5.2% of GDP, a 1.3ppt increase. Part of the change is due to a downward revision of the government’s nominal GDP forecast (0.2ppt) and the rest reflects the budgetary slippage. The latter is the result of underperforming indirect tax revenues, higher pensions and higher debt service costs, which are the main budgetary issues.

In its press release, the government drew attention to the fiscal burden associated with the Overhead Protection Scheme. In the first nine months of this year, the money spent on this programme totalled HUF 1.1056tn. Out of this, the monthly expenditure in September was only HUF 20.5bn, according to our calculation.

The press release also highlights the problems related to EU funds, as the year-to-date gap between expenditure (pre-financing of projects) and revenue (from the previous programming period and the Common Agricultural Policy funds) related to EU projects stands at HUF 832.1bn. This is only HUF 59.1bn higher than in August, clearly indicating a significant slowdown in government spending on public investment. More significantly, the new EDP report revealed that the government plans to spend the same amount in nominal terms on gross fixed capital formation (e.g. public investment) as it did a year ago. This is a clear signal that investments are being postponed and that the expenditure side of the budget is being tightly controlled.

After the September surplus, we expect yet another monthly surplus in October, too. However, as the heating season is about to start, budgetary burdens related to the Overhead Protection Scheme will start to increase at a fast pace. Moreover, we hardly see any major turnaround in the revenue side of the budget, as we expect domestic demand to remain a drag on growth in the fourth quarter as well. Based on our technical assumption, we still see a possibility of some budget slippage this year, despite the recent revision.

More By This Author:

Oil Rallies On Middle East TensionFX Daily: Middle East Conflict May Provide Another Leg Up To The Dollar

G10 FX Talking: Tighter Financial Conditions To Support The Dollar

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more