Huize Holdings - Right Market At The Right Time?

[TM Editors Note: This article discusses a penny stock and/or microcap. Such stocks are readily manipulated; do your own careful due diligence.]

The first fundamental of business is to be in the right market at the right time. Selling a luxury good like insurance into a market where incomes are rising strongly is exactly that.

As such there is a landrace going on, companies leaping to mark out their territory. This means expense in the short term but significant profit opportunities once a position is established.

Huize Holdings (HUIZ) is right there in this position now. We've thus an interesting medium term speculation to look at.

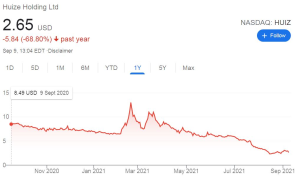

(Huize Holdings stock price from Google)

This isn't the sort of stock chart we'd like to see if we were already holding this stock. A couple of bounces in an otherwise steady decline from the IPO price would not please. However, the question is rarely what has happened, rather, what will happen? This could be an interesting entry level for us.

Is there something here for that future?

Business plans

Business success is really made of supplying the right product, at the right time, in the right market. The execution of the plan matters too, of course it does, but those basics need to be right first. Which gives us a way of testing whether a proposal makes sense. Is that base idea right for that time and place?

There's an economic concept called "luxury goods". This is the idea that as our incomes rise we spend greater portions of those new incomes on these things. Inferior goods are when we spend smaller portions as incomes rise. Basic carbohydrate is an inferior good, meat a luxury one as our incomes rise. One of these luxury goods is insurance.

So, if you're supplying insurance in a place that is rapidly getting richer you're in the right place at the right time. It's not just that people will have more to spend on that luxury good, the nature of it means that they'll spend a great portion of their total incomes on it.

We know there are regulation problems in China

The Chinese government isn't exactly helping the business plans of those in the education sector by insisting that foreign capital, for profit business models, cannot be used in anything that mirrors the school curriculum. The games industry is seeing limits on hourly play by children. There's also a change in insurance regulations.

However, the changes are about who may be an insurance company, not who may be a broker. This is something that actually benefits brokers by cleaning up the sector as a whole. As our own experience shows it's far too easy, in an unregulated market, for insurance scams to be perpetrated, making consumers wary of the whole sector. Cleaning this up benefits those who remain in the sector.

This is where Huize is

A country rapidly growing richer will have swiftly expanding markets for luxury goods. Insurance is one of these. We've got the sector being cleaned up by regulatory action. This is all good stuff for the background to someone being an insurance broker.

The more detailed points

Now that we've examined the basics, the business sector, we want to know more about the details of execution here. We know there won't be significant, or perhaps any, profits given the landrace nature of the current environment. But are we seeing the growth that we really should be at this stage?

- Gross Written Premiums (“GWP”) facilitated on our platform increased by 72.7% to RMB2.06 billion (US$319.1 million) from RMB1.19 billion in the first half of 2020. Of the total GWP facilitated, first year premiums (“FYP”) accounted for RMB1.19 billion (57.9%) and renewal premiums accounted for RMB868.8 million (42.1%).

- Operating revenue increased by 97.1% to RMB953.6 million (US$147.7 million), from RMB483.7 million in the first half of 2020.

Yes, OK, we are seeing that growth then. We're also, as expected, not seeing profit as yet:

Net loss in the first half of 2021 was RMB48.7 million (US$7.5 million), compared to a net loss of RMB6.0 million in the same period of 2020.

Well, obviously, we'd like to see profit but understand why it's not there. Conquering the territory is the order of the day, not exploiting it as yet.

As of June 30, 2021, the combined balance of the Company's cash and cash equivalents amounted to RMB430.7 million (US$66.7 million), compared to RMB404.6 million as of December 31, 2020.

We do though have positive cashflow, which is good. This means that the business isn't swallowing capital as it goes. Cash has to be paid out a little later than it is paid in, meaning we don't see ever increasing amounts of working capital required. This is pretty normal for an insurance broker too. Folks pay upfront their first premium and they don't have to be handed over to the insurance company until the end of the month perhaps.

This also tells us that the current capital stock is enough to power this growth near indefinitely. There could be a cash call, of course there could. But it's not necessary for that organic growth, it's not necessarily built into the business model that there must be one.

Our investment view

Risk is everything in investing. We should only take the risks we're happy with, only those where the reward is suitably adjusted to said risks. Here, we've gone through the basic market background and matters look sensible. An expanding market and a company suitably funded that is growing fast. On the other hand this is China, that's a risk we might not be happy with.

My estimation of the two sets of factors is that for those into the Chinese market this is a suitable speculation. Medium term, this isn't about to have a pop. And of course of suitable size for the risk. Definitely not a widows and orphans stock but as part of the risk end of a diversified portfolio, why not?

Disclosure: None.

Quite an interesting take on the insurance brokering/sales business. And certainly a lot of profit to be made short term. That explains the motivation. Selling a product without having to produce or hold the product is certainly an excellent business plan, no question there. No expense to buy or store the product, and not much shipping cost either.

The concept sounds almost too good to be true, or at least too good to be that simple.

Execution does indeed matter, this is also all obvious enough that there are other people trying it too.