How Strong Is The Case For Helicopter Drops?

David Beckworth has a recent podcast with Frances Coppola that discusses the case for a “People’s QE”. Not having read her book, I am not certain about the details of her proposal, but I gather it’s a sort of combined monetary/fiscal stimulus, where the new money is distributed to a cross-section of society, not just a few big institutions.

This sort of policy might well “work”, and it might well have been better than what the Fed actually did during the Great Recession. Nonetheless, I remain skeptical of the claim that helicopter drops are superior to stimulus policies that rely exclusively on ordinary monetary policy, such as open market purchases of assets.

Coppola suggests that Japan’s experience provides support for the basic concept:

Beckworth: Frances, do we have any examples of helicopter drops, say pre-2008?

Coppola: Various governments have used forms of what we might call helicopter money, and in the book I do distinguish between different forms of it. But for example, in the 1930s, Japan actually, quite successfully used monetary financing of its government, very successfully, amid dire warnings from American pundits that it was all going to end in hyperinflation, and they were heading for the Weimar wheelbarrows, and they didn’t. They actually came out of the Depression rather more quickly than America did.

And then a bit later this:

I mean Japan, the Japanese Central Bank has been fighting deflation for a quarter of a century. I think we sometimes forget that. So been totally unable to get inflation off the floor.

I have a very different interpretation of the Japanese case. There was a combined monetary/fiscal stimulus in the early 1930s, but the key factor was probably Japan’s (wise) decision to leave the gold standard (in 1931), not the fiscal stimulus. During the Great Depression, countries tended to recover after leaving the gold standard. And Japan was one of the first to leave.

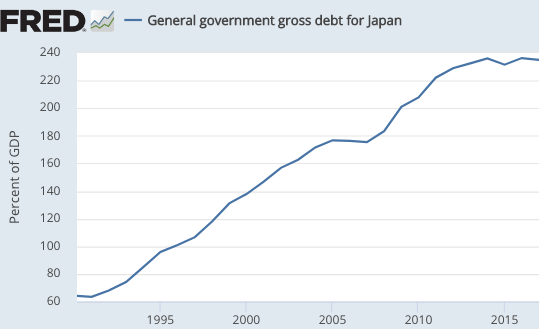

If you want to point to combined monetary/fiscal stimulus, a much better example occurred during the early 2000s when Japan combined QE with massive budget deficits. Indeed the Japanese fiscal stimulus of 1993-2012 might have been the biggest in world history, for a country not at war. The national debt soared until Abe introduced fiscal austerity via tax increases:

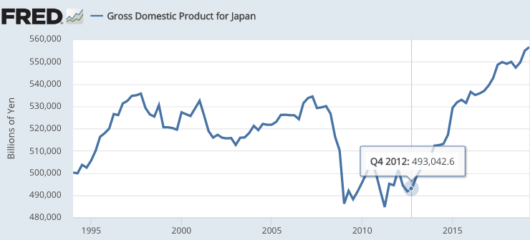

Ironically, Japanese NGDP began to finally recover at almost the same time that Japan ended its two-decade-long program of fiscal stimulus.

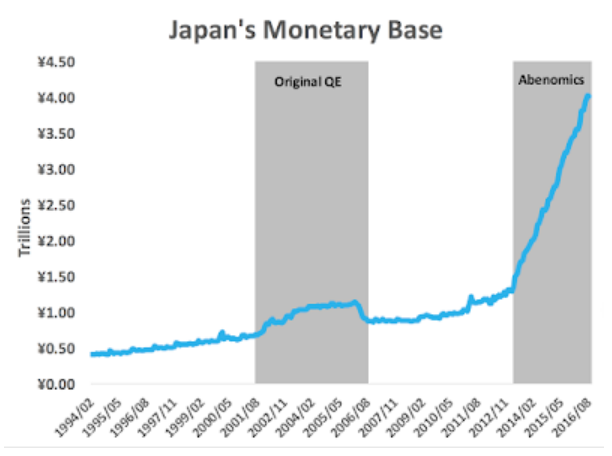

Why did NGDP rise after 2012? Because the Abe administration took office and instituted a policy of monetary stimulus. Most notably, the BOJ began a more aggressive policy of QE (graph from a David Beckworth post):

In fairness, the new BOJ policy has not been completely successful. While Japan is no longer mired in deflation, and both NGDP and employment have been rising, the inflation rate remains far below the 2% target. The new BOJ policy is far from optimal.

Some readers might wonder if my market monetarist outlook is leading to a biased analysis of the Japanese case. OK, consider what Paul Krugman had to say in 2000 when the BOJ raised interest rates:

Consider the contrast: in this country the markets expect the Fed to hold off for a while on interest rate increases even though inflation is running at more than 3 percent. Meanwhile the B.O.J. has just raised interest rates in an economy where consumer prices are actually falling, G.D.P. is lower than it was three years ago, and unemployment is at a postwar high. This says something about what kind of policy Japan can expect from its central bank in the future — and it’s not the sort of thing that would encourage people to go out and spend.

My personal guess is that in the near future, whatever optimism people are now feeling about Japan’s economy will evaporate, and the nation’s malaise will be deeper than ever — thanks in large part to Friday’s action. And while others are more sanguine, both the International Monetary Fund and Japan’s own Ministry of Finance pleaded with the Bank of Japan not to raise rates.

So why did the Bank of Japan do it? Its officials have been talking up the need for higher rates for months, yet have never been able to provide any coherent rationale. Mainly, they claim that ZIRP makes life too easy for corporations, that it lets them put off tough decisions. But there’s no evidence for this — on the contrary, despite the zero interest rate, corporate Japan has lately been experiencing an unprecedented series of high-profile bankruptcies. And anyway, since when is it the central bank’s job to strengthen the private sector’s moral fiber?

And it gets even worse. The BOJ again raised interest rates in 2006. And even worse, they withdrew much of their previous QE (see monetary base graph above.) While the popular view of Japan is roughly what Coppola suggests, i.e., that they tried and failed to stimulate their economy for decades, the truth is that until Abe took office in 2013 they made no serious attempt to push inflation above higher. Whenever inflation seemed about to rise above zero they tightened policy.

In 1998, Krugman had argued that central banks stuck at the zero bound needed to “promise to be irresponsible”. The BOJ did the exact opposite, promising to be ultra “responsible”. I use scare quotes because in this case being “responsible” is not responsible. And of course, Krugman’s prediction came true. By not following his advice they pushed Japan much deeper into its zero rate trap, requiring much greater effort when a change of policy did finally occur (in 2013.) If Japan had pushed trend inflation up to 2% in the early 2000s, at a time when it would have been much easier to do so, their job today would be much easier.

In my view, the Japanese case of 1993-2012 shows that combined monetary/fiscal stimulus is no panacea. Rather we need to do monetary stimulus in the right way. Back in 2000, Krugman seemed to agree:

The government’s answer has been to prop up demand with deficit spending; over the past few years Japan has been frantically building bridges to nowhere and roads it doesn’t need.

In the short run this policy works: in the first half of 1999, powered by a burst of public works spending, the Japanese economy grew fairly rapidly. But deficit spending on such a scale cannot go on much longer. Japan’s government is already deeply in debt (about twice as deep, relative to national income, as the U.S. was before our own budget turned around). For the policy to do more than buy a little time, the recovery must become “self-sustaining”: consumers and businesses have to start spending enough to allow the government to return to fiscal responsibility without provoking a new recession.

Carping critics (like me) warned that there was no good reason to think this would happen. Sure enough, it hasn’t; as the big public works projects of early 1999 have wound down, so has the economy.

What can Japan do? . . .

Although the Bank of Japan has already reduced the short-term interest rate to zero, Western economists have pointed out that there are other things it can and should do: buy longer-term bonds, announce a positive target for inflation to encourage businesses to borrow. Indeed, textbook economics tells us that to adhere to conventional monetary rules in the face of a liquidity trap is not prudent; it is irresponsible. (Full disclosure: I personally have been the most visible and vociferous advocate of inflation targeting).

In 2000, Krugman clearly believed that monetary stimulus was more prudent than fiscal stimulus. I think he was right. But he also understood that monetary stimulus would not be effective if it were viewed as temporary. Rather the key is in shifting expectations. Abe’s BOJ has been modestly more effective than the previous version, but much more needs to be done. A good place to start would be “level targeting” of Japanese NGDP along a 3% growth path, with a “whatever it takes” approach to open market operations. Do that and you don’t need fiscal stimulus.

One final point. Some people believe it’s “fairer” to give money to the public as a whole, and not just to big institutions. But ordinary QE doesn’t give money to anyone; it sells money to big institutions at market-clearing prices.

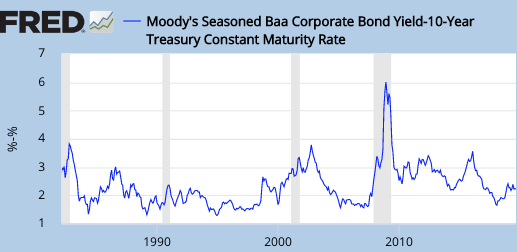

A more sophisticated version of this argument is that QE boosts asset prices. There are two problems with this view. Bond yields often rise with expansionary monetary policy, and this reduces bond prices. That was obviously true in the 1960s and 1970s, but even in the mid-2010s you can argue that when Bernanke did a more expansionary policy than the ECB’s Trichet, the long-run effect was to produce stagnation in the Eurozone, and ultimately this produced lower long-term interest rates in Europe. If the ECB had been more aggressive when Bernanke was doing QE, rates in the Eurozone today might actually be higher than they currently are.

The second problem is that when QE boosts the prices of assets such as stocks, it’s largely because QE helps the economy. But a people’s QE would also help the economy, and thus boost stock prices. So “fairness” is not the right way to evaluate alternative monetary strategies.

Certainly the big issue is the need to maintain adequate growth in demand, and on that big issue, Frances Coppola and I largely agree. But on the technical question of helicopters drops versus ordinary monetary policy, I still see little need to add fiscal stimulus to the equation, and on efficiency grounds, I prefer a clean monetary stimulus.

If there’s a shortage of safe assets, then borrow money to create a sovereign wealth fund. But with trillion dollar budget deficits I doubt there’s a shortage of safe assets.

Real helicopter drops have nothing to do with the fiscal budget. It is Fed money, Fed balance sheet. Japan has a law against real helicopter money. Everything has to be sterilized. So, these have nothing to do with Lonergan's view of real helicopter money.