How Elections And The RBNZ Disinflation Gamble Can Steer The Kiwi Dollar

Image Source: Pexels

The Reserve Bank of New Zealand is widely expected to keep rates on hold this week while awaiting new data and given the pre-election environment. The RBNZ’s assumptions on disinflation are quite optimistic, and there are risks of a November hike. Polls suggest a National-led coalition may win: NZD might benefit from a promised change in the RBNZ remit.

Growth and housing outlook not as bad as expected

This week’s RBNZ announcement is widely expected to see another hold by New Zealand policymakers. A key reason is that the Bank still hasn’t seen the third-quarter inflation and jobs data, which will be released on the 16th and 31st of October, respectively.

The New Zealand data calendar hasn’t, however, been totally quiet since the August RBNZ meeting. Growth figures were quite surprising: showing activity rebounded 0.9% quarter-on-quarter in the second quarter, more than doubling consensus expectations, and significantly above the 0.5% projected by the RBNZ. Also, a revision of first quarter figures indicated the country had not actually been in a recession into March.

Growth should cool again in the second half of the year, but the RBNZ’s projections of two negative QoQ GDP readings in the third and fourth quarters by the RBNZ may be overly pessimistic. The Treasury, which has generally been quite more upbeat than the RBNZ, currently forecasts no more negative quarterly GDP reads.

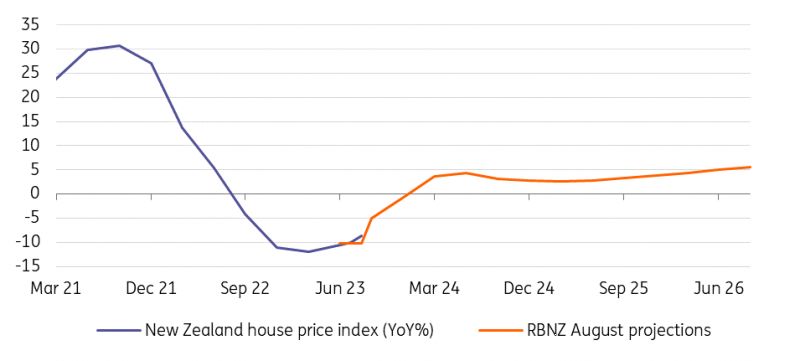

The house price correction, which has been a major cause for concern and might have argued for less restrictive monetary policy, has eased, largely in line with the revised RBNZ August projections. The latest monthly figures showed the house price index has declined by only 0.2% MoM, and 8.7% year-on-year, reinforcing the view that the worst of the housing correction is past us.

Housing correction has cooled off in New Zealand

Image Source: RBNZ, CoreLogic, ING

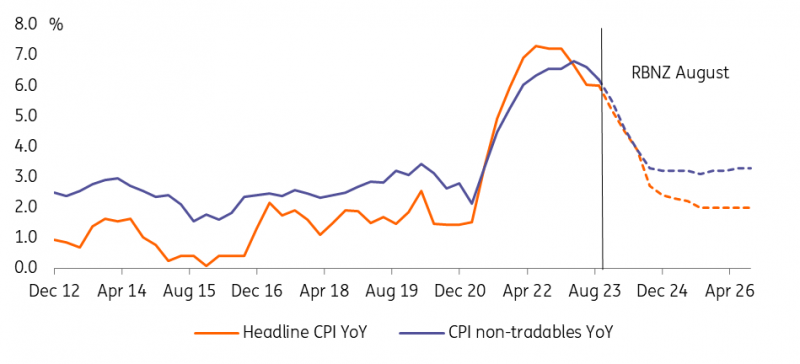

RBNZ inflation forecasts still look like a gamble

The RBNZ’s latest inflation projections – from the August Monetary Policy Statement – show an optimistic scenario for disinflation, largely based on assumptions about the impact of restrictive monetary policy and slowing domestic as well as external demand.

Those assumptions are, however, met with the risks associated with: a) the extra spending deployed by the government from May, b) the recent spike in oil prices, c) residual supply-related inflationary effects of severe weather events, and d) the still unclear impact of booming net migration on wages and prices (easing labour supply, but raising demand for housing and other services).

We think that the RBNZ will continue to acknowledge those risks to inflation and strike a generally hawkish tone this week, with the aim of keeping inflation expectations capped. However, a rate hike seems unlikely a week before the elections and before having seen official CPI and jobs data. Once inflation figures are out, the RBNZ may tolerate a slightly higher-than-anticipated third quarter headline CPI (the projection is for 6.0% YoY), but expect greater scrutiny on non-tradable inflation (projected at 6.2%).

RBNZ inflation forecasts

Image Source: RBNZ, ING

Polls point to a National-led coalition

Advance voting in New Zealand has already been going on for a couple of days, while physical election day will take place on Saturday 14 October, with the preliminary results starting to be released from 7 PM local time.

Latest opinion polls suggest that the incumbent Labour Party (of former Prime Minister Jacinda Ardern) should lose its parliament majority to the opposition National Party. A centre-right coalition, led by the National Party and supported by the right-wing ACT New Zealand is currently projected to secure somewhere between 45% and 50% of parliament seats, possibly short of a majority. A coalition may need to include the nationalist NZ First to secure enough seats: latest polls give NZ First just above the 5% threshold required to enter parliament without winning a single-member seat.

Single party and coalition opinion polls ahead of the 14 October election

Image Source: Verian polling, ING

The monetary policy implication of a potential shift in government

First of all, the past few years have taught me to take pre-election polls with a pinch of salt. Secondly, the impact of politics on NZD is generally quite limited.

This time though, a change of government (assuming the polls are right and NZ First joins a National-led coalition) might have some implications for the RBNZ further down the road. The National Party recently published its pre-election fiscal plan, where it pledged more fiscal discipline compared to Labour. Specifically, National said it would spend around NZD3bn less than Labour over four years, with the aim of reducing debt at a faster pace. If the RBNZ links any rebound in CPI to additional fiscal spending, the change in government could suggest a less hawkish RBNZ in the long run.

Another aspect to consider is the RBNZ remit. Over the summer, the National Party Finance spokesperson Nicola Willis pledged to restore the central bank’s sole focus on the inflation target. This would imply removing the RBNZ’s dual mandate (maximum sustainable employment) and potentially reviewing the additional housing stability objectives that were added in 2018 and in 2021 respectively.

The first – and more impactful – effect would suggest higher RBNZ rates in the medium and long term; while removing the housing affordability objective would in theory be a dovish argument, the stricter inflation target would likely overshadow any housing-related considerations.

FX: Domestic factors can determine relative NZD performance

The Kiwi dollar has resisted USD appreciation better than other commodity currencies in the past month, and we have seen AUD/NZD fall from the recent 1.0900 peak to below 1.0700 – also thanks to the Reserve Bank of Australia hold this week.

We think that the RBNZ will continue to signal upside risks to their inflation forecasts and keep the door open to more tightening if needed this week, but it is very likely that November will be a much more eventful policy meeting for NZD, with the new rate and economic projections being released and after the inflation and jobs data for the third quarter are released. Expect some significant NZD volatility around the two data releases this month: we are still of the view that inflation can surprise the upside, so expect some positive impact on NZD. Markets are currently pricing in 15bp of tightening by November.

When it comes to the election outcome, a hung parliament with parties failing to find a working coalition would be the worst scenario for NZD. Should either Labour or National manage to lead a government after the vote, we expect the market implications to be mostly bonded to those for the RBNZ remit (and less so to fiscal spending). So, very limited in the event of Labour staying in power, and moderately positive for NZD (negative for NZ short-dated bonds) in a win by the National Party as markets may speculate on the remit being changed to focus solely on a strict inflation target. The chances of a hike in November will, however, depend almost entirely on CPI and jobs data, not on the vote.

Expect any meaningful swing in NZD to be mostly visible in the crosses, especially in the shape of relative performance against other commodity/high-beta currencies. A combination of a National electoral win (and workable coalition) and CPI surprise could make AUD/NZD re-test the 1.0580 May low and slip to 1.0500. NZD/NOK is another interesting pair, with more room to recover after a large summer slump: a return to 6.60 is possible in the above scenario.

When it comes to NZD/USD, the swings in USD continue to be an overwhelmingly dominant driver. With US 10-year yields still moving higher and our rates team pointing at 5.0% as a potential top, we see more downside for NZD/USD in the near term. NZD-positive developments domestically would not prevent a drop to 0.5800 if US bonds remain under the kind of pressure we have seen in recent weeks. In the medium run, we still expect US data to turn negative and the Fed to start cutting in the first quarter of 2024, which should pave the way for a sustained NZD/USD recovery.

More By This Author:

Turkey’s Annual Inflation Continued To Rise In SeptemberFX Daily: Back To The Status Quo

Rates Spark: Bear Steepening Momentum Is Unbroken

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more