Housing Downturn In Motion

The higher the ratio of investors and secondary buyers in a housing market, the less stable prices tend to be.

In urban areas within an hour’s drive of Toronto (broad GTA), the average sale price topped $1,000,000 in February 2022, and so-called investors bought an estimated 40% of properties sold over the prior two years. Most used lines of credit to buy.

Many more properties were bought as secondary residences (vacation chalets, cottages etc.) with downpayments taken from HELOCs and mortgages against primary residences.

The Canadian median home sale price touched $816,000 in February–more than 12x the median after-tax household income of $70,000 and compared with a long-standing affordability norm of 3 to 4x.

With high prices, rental properties purchased in the past few years mainly were low or negative-yielding but bought on the presumption that prices could only rise. Now that carrying costs have risen sharply over the past year, property prices are stagnant and falling in most areas, and the urge to sell is contagious.

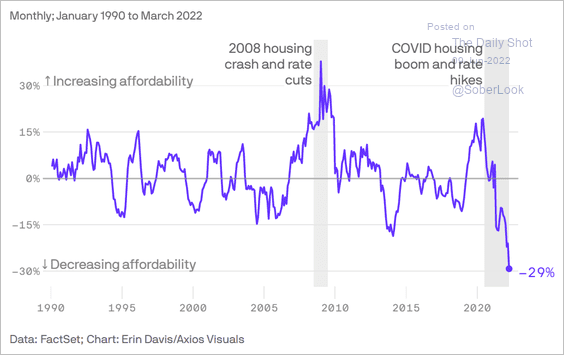

In America, median home prices recently reached some 6.5x the median household income. While much more affordable than Canadian home prices, the record 29% deterioration in US housing affordability since 2020 is the worst since 1987 and nearly twice as bad as the last housing bubble top in 2006.

Chart below courtesy of TheDailyShot.com

Housing analyst Nick Gerli explains that high prices and interest rates have driven low home affordability and set the foundation for another bust cycle.

Housing analyst Nick Gerli returns to the program to warn how swiftly the prospects for home prices are eroding. Confidence in the housing market was supreme just a month or two ago, and suddenly that confidence is vaporizing as an increasing number of experts now caution of a “full-blown” correction ahead. Rising mortgage rates are a huge part of the equation, but we’re already starting to see sales slowing and even price cuts in a number of markets — especially the markets that have been the hottest in past recent years. Does Nick still think prices could come down by as much as 30% on average? Could we see price declines on par with the 2008 crisis? Here is a direct video link.

Disclosure: None.