High 2024 Borrowing Needs In Poland No Longer Fundable Locally

Poland’s government unveiled the 2024 draft budget bill with a cash-basis deficit of PLN164.8bn and record-high net borrowing needs. Next year’s deficit is boosted by a strong rise in spending, while revenues should grow slower due to disinflation. Given the high borrowing needs the Polish budget should become more reliant on foreign financing in 2024.

Ministry of Finance building in Warsaw, Poland

The budget draft

The 2024 draft budget bill approved by the government envisages the central deficit (cash-basis) at PLN164.8bn (vs. PLN92bn targeted this year). The reasons behind the strong rise in the deficit are spending, which grew by 22.5% year-on-year, while total revenues are projected to rise by 10.5% YoY amid further disinflation.

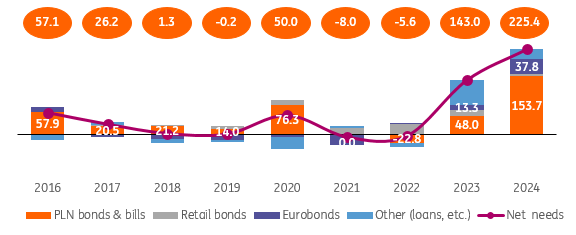

What is even more striking is a strong increase in borrowing needs. Net borrowing needs for 2024 are projected at PLN225.4bn (c.6% of GDP). This is up by 55% vs. an already high PLN143bn planned for this year and close to zero in 2020-21. Combined with maturing debt it means that gross borrowing needs are expected to exceed PLN400bn next year.

In 2023 net savings in banking sector covers substantial part of borrowing needs

In 2023 the financing of (central budget) borrowing needs is based mainly on local sources, ie, the net savings in the banking sector. It grew fast as high interest rates trimmed demand for new loans, while deposits continued expanding. As a result, the net savings in the domestic banks are expected to cover around two-thirds of the state budget net borrowing needs this year, which are estimated at PLN143bn. Also, the government turned more open to external financing and tapped the Eurobonds markets more eagerly than in the previous year, so overall funding of the budget is very safe.

A strong rise of net borrowing needs requires more external funding on hard currency bonds and POLGBs

Net borrowing needs and its financing in 2023 and 2024 (PLNbn)

MinFin, ING

In 2024 net savings of local banks to grow much slower, while borrowing needs rise and budget requires more external funding than in past years

We estimate that in 2024 the net savings in local banking sector may reach an equivalent of about 30% of total borrowing needs, estimated at PLN225.4bn. That is why the Ministry of Finance changed the funding plan, which requires much more external savings.

In 2024 the authorities plan to expand Eurobonds issuance by nearly PLN37.8bn vs. PLN13.3bn in 2023 (net). Also, foreign investors’ engagement in Polish government bonds (issued domestically in PLN) may also need to increase as the domestic banking sector may not have sufficient capacity to absorb supply of PLN160.7bn in new PLN-denominated government securities (compared with some PLN62.9bn this year).

In detail, the net supply of PLN-denominated government securities is the following: (1) the government intends to sell over PLN54.5bn T-bills in 2024; they will be issued for the first time in a long time (are usually purchased by domestic banks), (2) the supply of POLGBs should reach PLN99.2bn vs. PLN48.2bn in 2023, and (3) the supply of retail bonds is expected at PLN7bn vs. PLN14.9bn in 2023.

On the top of that the borrowing needs assumes raising PLN28.6bn from the EU Recovery and Resilience Facility. This source of funds is currently locked due to Warsaw’s conflict with Brussels over the rule of law in Poland.

Summary

We expect the Ministry of Finance to keep sizable offers of POLGBs in the second half of the year to take advantage of favourable market conditions. Also, the high cash buffer of MinFin (over PLN130bn at the end of July) will be held and used as a safety buffer to prevent problems with funding. Yet, given that net savings in domestic banks may prove insufficient to cover high government funding in 2024, MinFin is likely to rely on foreign investors, who refrained from increasing holdings of POLGBs in past years.

More By This Author:

Inflation’s Second Wave: Are We Really Watching A 70s Rerun?

Rates Spark: Losing Buoyancy

FX Daily: Eurozone Inflation, Round One

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more