Has The Pound Bottomed Out?

The British Pound is on the rise, now trading at 1.2470. The GBP/USD pair has gone from 1.2108 to 1.2470 over the period of six days (including today). The rally was triggered by the last week’s dovish Fed rate hike and is now being extended due to rising UK inflation.

Food and fuel prices drove the consumer price index to the highest level in almost three-and-a-half years in February. The CPI printed at 2.3%, the highest rate for more than three years. As per Reuters poll, the economists were expecting a print of 2.1%.

The latest buzz in the market is that a sharp rise in the inflation would force the Bank of England to hike rates this year. However, it is easier said than done. Bauxite negotiations are yet to begin and could easily take an ugly turn. The housing market has weakened considerably and the recent economic data have shown the post-Brexit gloom is fading.

Nevertheless, the Pound is on the rise and the speculation is gathering pace that the currency may have bottomed out. Let us take a look at the technical charts and the BIS REER index.

Daily chart - Bullish break from the falling channel

(Click on image to enlarge)

- A bullish break from the falling channel if confirmed today would open doors for 1.2652 (dotted trend line hurdle), above which the 200-DMA line would offer resistance at 1.2760.

- The 200-DMA line is still sloping downwards, hence gains beyond 200-DMA are unlikely, at least in the short-run.

- The daily RSI is above 50 and sloping upwards.

Weekly chart - rounding bottom on price and RSI

(Click on image to enlarge)

- The rounding bottom on the RSI and price chart suggests the spot has bottomed out.

- On the weekly, chart, stiff resistance is seen directly at 1.2775 (Dec 2016 high) and 1.30 (weekly 50-MA).

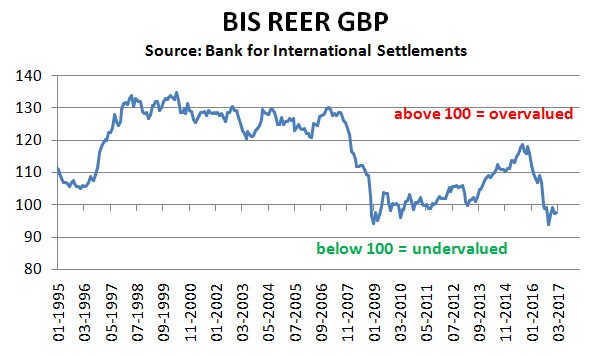

As per BIS REER Pound is fairly value

- The latest BIS data released on March 16 show the Pound is close to being fairly valued. That means there is a potential for a two-way action. The technical charts show a potential to rally.

- However, the UK still runs a huge current account deficit. Thus, in the long-run there is plenty of scope for a sharp sell-off in the Pound.

Disclosure: None.

Hi There are good reasons to suggest the a meaningful low has bene formed and that we could see bullish cycle develop of GBPUSD. Here is my arlticle showing my reasons for such aniticpation. Link - www.talkmarkets.com/.../pound-sterlings-prospects-seeing-through-the-brexit-fog-update