Harsh New Reality For Homeowners As Listings Rise And Buyer-Pool Shrinks

In its 2023 Financial System Review, The Bank of Canada notes growing concern about the ability of households to service their debt, with mortgage holders facing payment increases of up to 40%.

Compounding the issue is the fact house prices are falling and reducing the amount of equity owners have:

Higher interest rates have also contributed to declines in house prices across most regions of Canada over the past year (Chart 10). For households that purchased homes near the peak in prices and made smaller down payments, this decline could result in limited or negative equity in their home. Lower home equity limits a household’s ability to refinance and extend their amortization period to reduce their monthly payment.

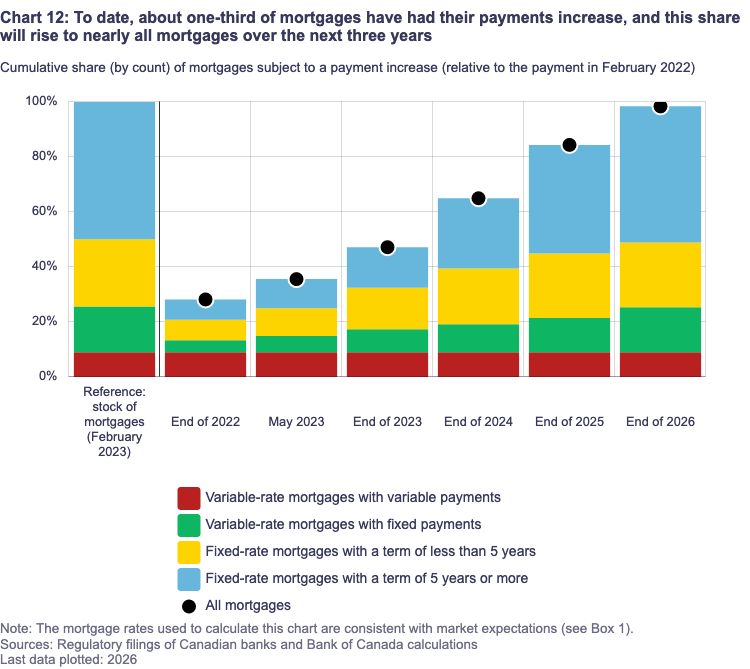

The Bank notes that one-third of mortgages have already experienced payment increases since 2022. And, by 2026, all Canadian mortgage holders will feel the burn, with the largest shock hitting those whose previous term was taken out during the ultra-low rate (and bubble price) era of 2020-2022. The chart below shows the percent of mortgages by type and year due for renewal.

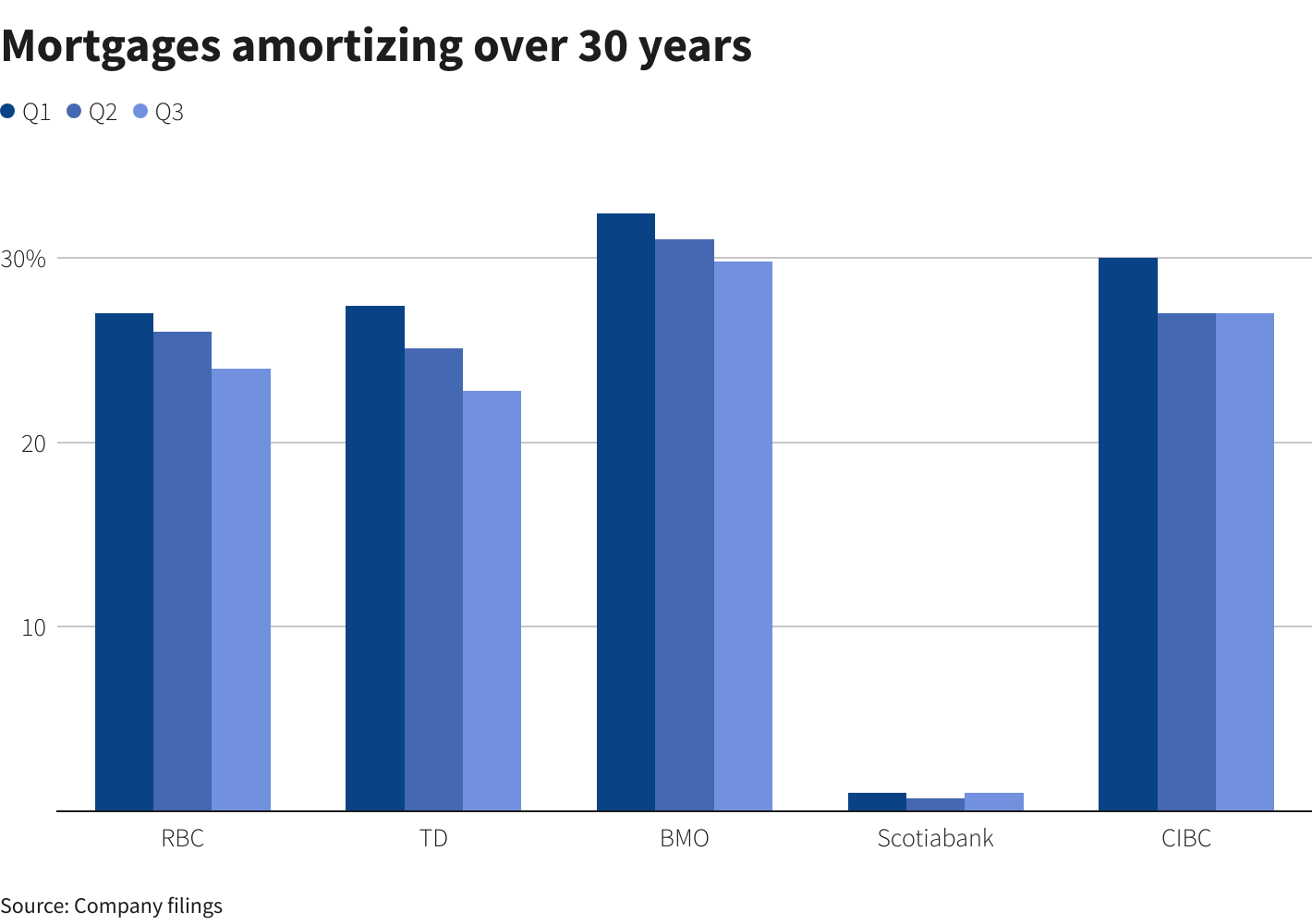

By kicking the can and letting variable-rate customers make fixed payments that do not cover the interest costs of their loans, four of the Big Six Canadian banks now have more than 23% of their mortgages with amortization greater than 30 years.

Of the Big Six, National Bank has a more conservative book, with two-thirds of its mortgages in fixed rate terms. Even then, as noted by CEO Laurent Ferreira last month, about 85% of its mortgage customers will face “a harsh new reality” when they need to renew those loans in 2024 through 2026. Not surprisingly, for-sale listings are on the rise.

Who can buy homes at present prices and rates? Very, very few. Who wants or needs to reduce their real estate holdings and related debt–more and more every day.

Home Builders will likely be cutting home prices over the winter of 2023 due to a big drop in home buyer traffic. The National Association of Home Builders reported that buyer traffic is collapsing again due to higher mortgage rates. This suggests that builders will need to begin cutting prices of houses again to avoid a big run-up in inventory.

More By This Author:

Oh CanadaDesperation Spreads From China Property Crisis

Mind The Credit Cycle