Grim Home Affordability Finally Starting To Dent Buyer Demand

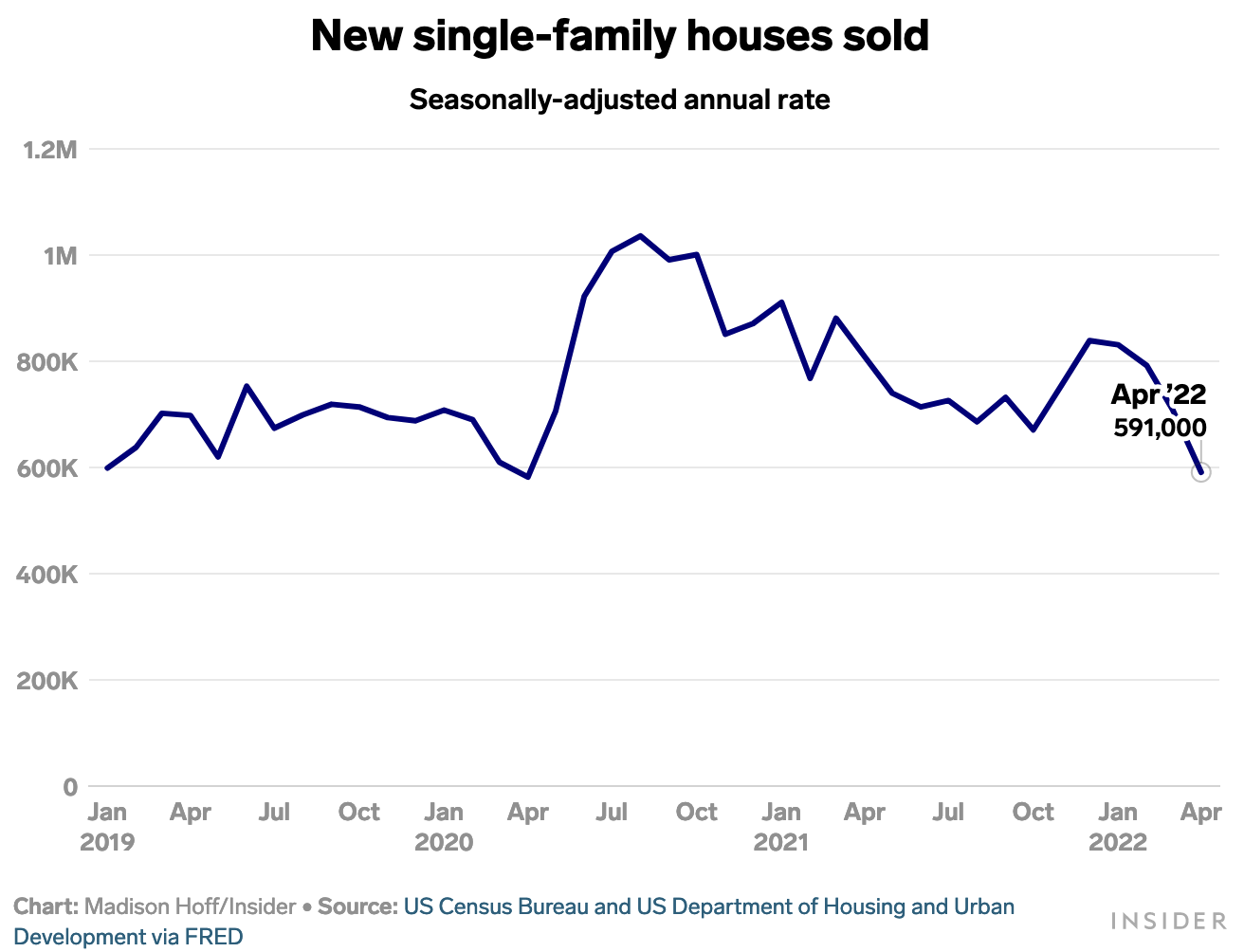

Sales of new US homes plummeted last month to the slowest rate since April 2020 as buyer ability shrank under the weight of inflated home prices, higher rates, food, and fuel. See Business Insider: New Home Sales just plunged to pandemic era lows.

At the same time, the unsold inventory of new homes suddenly doubled over the past year to 9 months’ supply (a balanced market is considered six months’ supply). Homebuilder stocks tumbled 3% on the day, taking the overall decline for the S&P Homebuilder’s ETF (XHB) to -33% from last December.

In Canada, similar forces are at work: average sale prices nationally fell 8.6% to $746,146 from $816,720 in February.

With national average home prices still an insane 50% higher than two years ago, Canada’s average five-year fixed-rate mortgage has risen 56% since January to 4.19% from about 2.69%.

Moreover, Canadian homebuyers applying for a fixed-rate mortgage through a federally regulated lender—as well as those refinancing their current mortgages or switching to a new lender—must meet a ‘stress test’ notional interest rate of 6.19% (2% beyond the offered rate or the 5.25% stress test floor, whichever is higher). See: Mortgage stress test rules may change as interest rates rise and the housing market cools, says the regulator.

In response, more borrowers are seeking variable-rate mortgages (at about 2.4% today compared with 2.15% last year) and applying to non-bank lenders where interest rates are generally higher but not subject to the federal stress test. While this keeps their interest cost lower than a locked-in rate, it does not protect them from the net worth evaporation of falling prices. A CIBC study last fall found nearly 30% of first-time buyers got down payment money from parents (averaging $82,000). The decline in average home prices since may well have deleted at least some of that capital.

It’s no wonder the latest TD survey found that only 36% of this year’s prospective homebuyers believed now was a good time to buy — a steep decline from 59% in 2021 and 68% in 2020.

Disclosure: None.