Goldman Says China Politburo "Less Dovish" As Policymakers Gear Up For 2024 Fiscal Support

Image Source: Unsplash

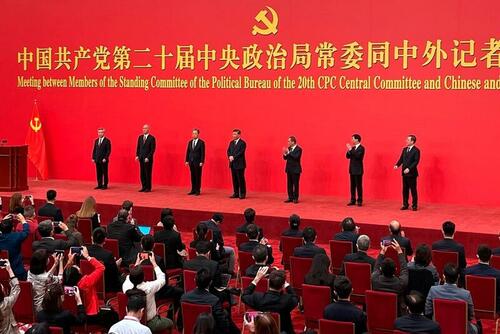

The Politburo of the Chinese Communist Party held its monthly meeting on Friday. According to the statement, policymakers want to stabilize the economy and boost growth with more fiscal measures in 2024.

State-run media Xinhua News Agency reported Politburo, which includes the ruling Communist Party's top 24 officials and chaired by President Xi Jinping, plans to ramp up fiscal policy "appropriately" amid the souring backdrop of a real estate crisis, increasing local government debt risks, slowing global growth, and rising tensions with the West.

According to Bloomberg, the Politburo said monetary policy should be flexible, appropriate, targeted, and effective, with the previous wording "forceful" dropped from the statement.

Economists who reviewed the statement said the change indicates Beijing might be less focused on a monetary cannon and instead utilize targeted tools.

Xing Zhaopeng, a senior strategist at Australia & New Zealand Banking Group, said the statement indicates the size of interest rate cuts and bank reserve requirements might be smaller in 2024 compared to 2023.

Goldman Sachs said, "The overall tone appears less dovish compared with the July Politburo meeting statement."

"In particular, policymakers pledged to step up fiscal policy support "at an appropriate pace" in today's readout, and vowed to enhance consistency in macro policies. These statements appear consistent with our expectation that fiscal policy will do the heavy lifting of supporting growth next year," Goldman continued.

They added: "Today's readout mainly aims to provide the broad guidance of policy tone for next year. The CEWC may offer more discussion around fiscal, monetary, property and local government implicit debt resolution plans, in our view."

Here's Goldman biggest takeaways from the Politburo meeting:

1. As the December Politburo meeting is the preparation meeting for the Central Economic Work Conference, today's readout only aims to set the broad tone for policy stance, rather than offering detailed discussions on various policy measures for next year. The statement continued to send pro-growth signals, but appears less dovish compared with the July Politburo meeting statement.

- When assessing the recent economic developments, the authority shifted to a less cautious tone in today's readout compared with the July Politburo meeting (Exhibit 1) by only highlighting the economic recovery this year after the end of pandemic. This is likely because Q3 real GDP growth picked up from 0.5%qoq in Q2 to 1.3% in Q3.

- Policymakers pledged to conduct "both countercyclical and cross-cycle policy adjustments" next year according to today's statement, in comparison with only the "countercyclical policy adjustment" in the July statement. Specifically, the authority required stepping up fiscal policy easing "at an appropriate pace" and claim that prudent monetary policy should be precise and effective. Policymakers also vowed to enhance consistency in macro policies, and acknowledged the importance of managing expectations around economic growth.

- The authority softened the tone on significant reforms by stating that economic policies should be supportive first before being reformative ("先立后破"). This phrase was previously used in 2021 when policymakers tried to correct for the aggressive decarbonization efforts which contributed to coal shortages and power outages in many parts of the country.

- Besides the broad stance, the authority reiterated promoting technology and innovation, enhancing resilience and security of supply chains, pushing forward opening-up, and effectively containing and reducing risks. Policymakers will also better coordinate deepening supply-side reforms and expanding domestic demand, urbanization and rural revitalization, high-quality growth and high-level of security.

2. The December Politburo meeting statement continued to send pro-growth signals. The statement around fiscal policy is consistent with our expectation that fiscal policy easing will do the heavy lifting of supporting growth next year. However, the discussion around high-quality growth and emphasis of "appropriate pace of easing" imply policy support will likely still be measured rather than being aggressive. The CEWC, which will likely be held over the next few days, should offer more discussions around fiscal, monetary, property and local government implicit debt resolution plans.

Exhibit 1: The December Poliburo meeting continued to highlight measured policy easing

The key message from the meeting is that growth is crucial to policymakers. And the days policymakers flooded the system with credit are over as Moody's Investors Service warned earlier this week that China risks a sovereign credit rating outlook downgrade.

More By This Author:

US Bank Deposit Outflows Continue To Surge As Regional 'Stress' AcceleratesGoldilocks: Jobs Rise 199K, Beating Estimates As Striking Workers Return; Unemployment Rate Drops

Oil Rebounds After DOE Seeks To Buy 3 Million Barrels For SPR In March

Disclosure: None