Gold Weekly Forecast: Bulls Emerging Ahead Of NFP, Barred By $1,800

Image Source: Pixabay

- The gold price fell amid the Fed’s tapering talks as the week started.

- The rise in oil and gas prices lent to the global energy crisis that gives room to gold prices.

- The correction in US yields from multi-month highs helped the gold bulls to overcome certain hurdles.

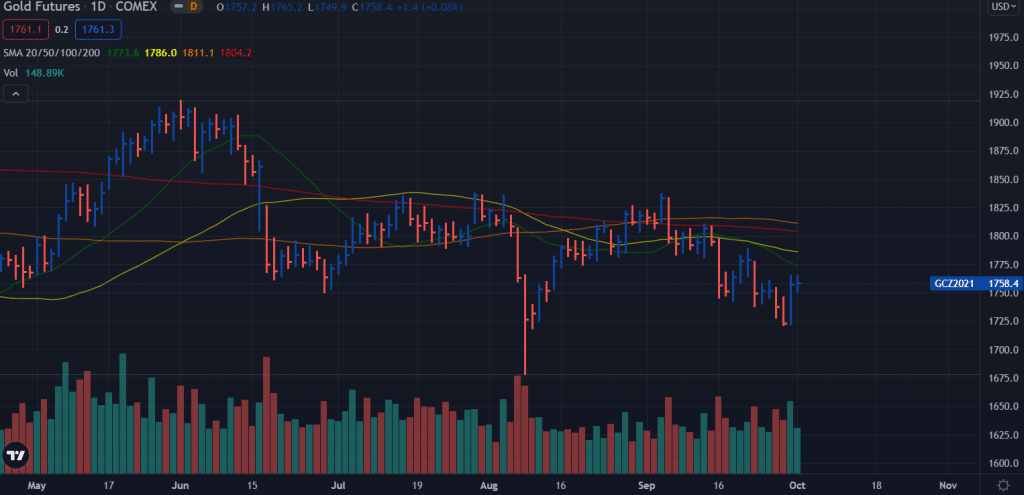

The gold price weekly forecast is bullish as the price ended the week in the green after falling to the multi-week lows at $1,722.

Gold Fundamental Weekly Forecast: The Fed and the US Yields to Guide

As Federal Reserve sentiment and US political drama predominate, gold has seen tremendous volatility this week despite a lack of top-tier macro news from the US. In response to the deepening energy crisis, the Evergrande debt problem in China, and the easing of Fed fears, investors have sought out the US dollar as a safe haven, with gold being displaced.

Even so, gold rallied late in the quarter as it managed to regain the vast majority of its weekly losses and overcome three weeks of falling prices. Gold fell hard in the first half of the week, hitting a seven-week low of $1,722, as last week’s hawkish Fed move pushed US Treasury yields higher and led to a stronger dollar.

The market began pricing in a rate hike in 2022 in response to several appearances and speeches by Fed Chairman Jerome Powell and his colleagues. These hawkish expectations reflected the underlying economy’s growth potential.

Furthermore, the skyrocketing price of oil and gas has raised inflation expectations, spurring the Federal Reserve to call for a reduction in assets purchases. According to the St. Louis Federal Reserve System (FRED), inflation expectations in the US reached a two-week high of around 2.40% on Tuesday. Moreover, the benchmark 10-year government bond yield rose to a three-month high of 1.567%, leading the dollar index to a new high around mid-94.00.

As gas and oil prices continue to climb, the focus gradually shifted from the Fed’s efforts to reduce asset purchases to escalating tensions over the global energy crisis. Eurozone and UK factories were threatened with closing, and the economic recovery was undermined by empty pumps. A power outage in China has halted factories, as well.

Risk appetite and concerns about stagflation stimulated demand for safe assets such as US Treasury bonds. Bond yields then dropped sharply from their multi-month highs, which provided a floor to the gold price.

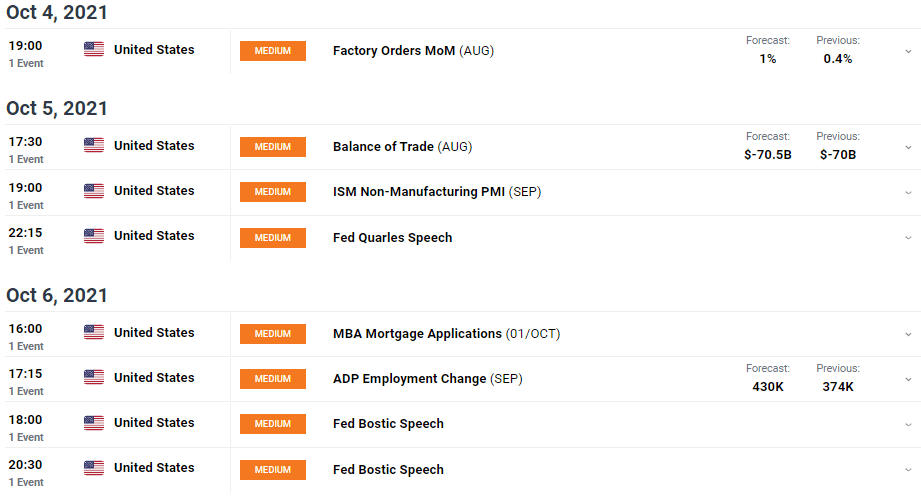

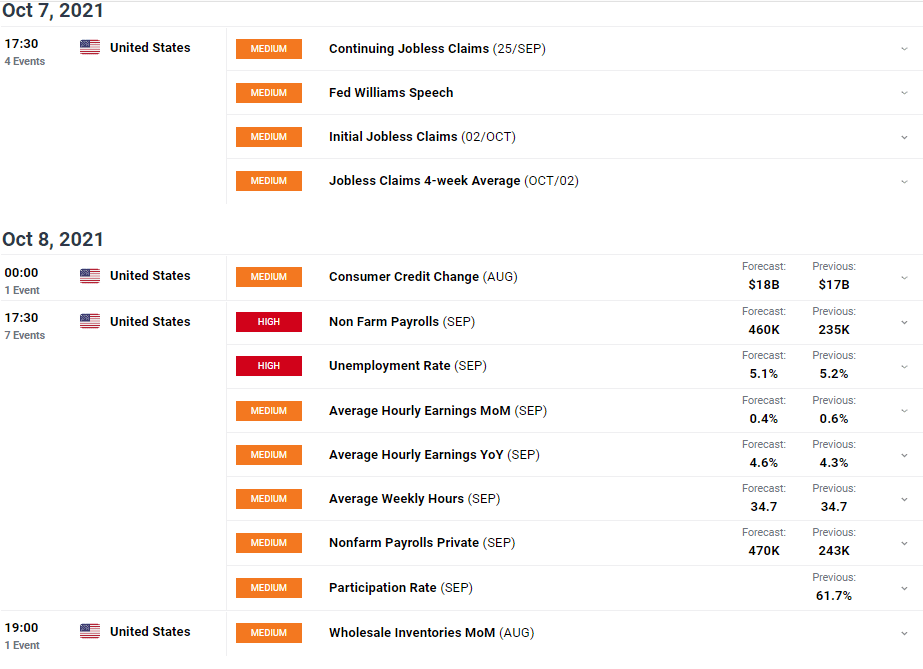

Key Data/Events For Gold Next Week

Traders will be looking at Tuesday’s US Services PMI report, followed by the employment sub-index before Wednesday’s ADP non-farm payrolls. Finally, for new clues about Fed policy, we will closely monitor comments from Atlanta Fed President Raphael Bostic.

Thursday’s weekly report by the Labor Department will be followed by a speech by the New York Federal Reserve’s President John Williams. A US labor market report, expected to show 500,000 jobs added in September, up from a shocking 235,000 in August, will be released on Friday. We will closely monitor the NFP data, demonstrating the Fed’s progress to its maximum employment goal.

The gold price depends not only on economic data, but also on profitability dynamics and the behavior of the market. At the same time, investors are keeping a close eye on the US political scenario and the growing global energy crisis.

Gold Price Weekly Technical Forecast: Bulls to Aim at $1,800

Although the gold prices lie well below the congestion of key moving averages, bulls strongly emerged at $1,722, forming a bottom reversal pattern. The volume shows a significant positive change on the last two trading days of the week.

However, the price is now standing at a horizontal level (support turned resistance). Gold prices may correct lower from here. However, if the price manages to pop higher, the next target will be at the $1,800 level, which is a pivot point. Staying beyond the pivot point may trigger an uptrend.

Disclosure: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more