Gold Monthly: Rally Might Not Be Over Just Yet

Image Source: Pixabay

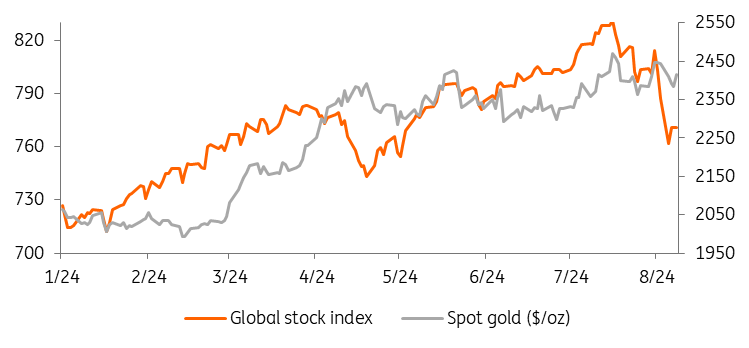

Gold joined the global sell-off of equities at the start of this week, driven by growing concerns over the risk of recession in the US. Gold, usually a safe haven during such uncertainty, sold off sharply on Monday amid likely liquidations to cover margin calls on other assets.

Gold drops amid rout in stocks

Source: MSCI, Refinitiv, ING Research

Looking ahead, we believe gold should regain its footing once again, amid the ongoing geopolitical uncertainties and expectations of interest rate cuts from the US Fed.

Despite Monday’s sharp drop, gold is still up about 15% so far this year and is one of this year’s best-performing commodities, aided by central bank buying, Asian consumers and expectations the Fed is getting close to cutting rates. It hit an all-time high in July amid strong appetite from central banks and Asian consumers. We believe, after a consolidation phase, gold will maintain its upward momentum.

US Fed in focus

Gold’s focus continues to be on the scope and timing of the Fed’s likely move to cut rates. Lower borrowing costs are positive for gold as it doesn’t pay interest.

The Fed has held its key policy rate in a target range of 5.25% to 5.5% – the highest level in more than two decades – since last July.

Our US economist now sees a 50bp cut in September followed by a series of 25bp moves that would get us back to a Fed funds rate of around 3.5% by next summer.

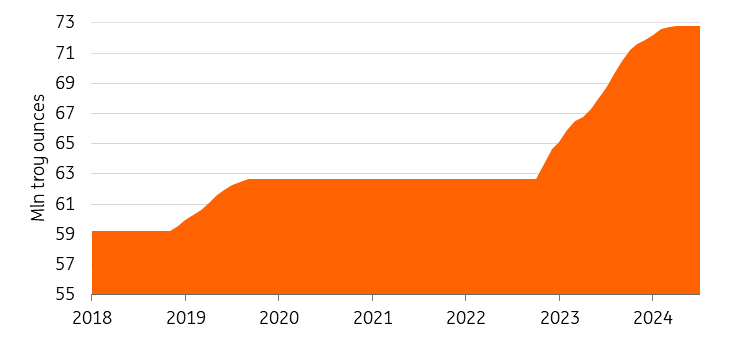

China keeps gold buying on hold

Central bank buying continued in June, with 12 tonnes of net buying reported during the month, data from the World Gold Council (WGC) showed. June’s purchases were once again led by emerging market central banks. Uzbekistan and India both added 9 tonnes to their gold reserves during the month.

However, China has seen a slowdown in gold purchases over recent months. The People’s Bank of China didn’t add gold to its reserves for a third consecutive month in July. In May, China’s central bank didn’t add gold to its reserves ending an 18-month buying spree that had driven gold prices to record highs, with high gold prices likely to have deterred further purchases for now. Bullion held by the PBoC was unchanged at 72.8 million troy ounces at the end of last month, according to official data.

Meanwhile, Singapore was the largest seller (-12 tonnes) in June – it reduced its gold reserves in June by the most since at least 2000. Buying strength continues this year, although gross purchases and sales are lower compared to the same period last year. In 2023, central banks added 1,037 tonnes of gold – the second-highest annual purchase in history – following a record high of 1,082 tonnes in 2022.

However, we still expect central bank demand to remain strong looking ahead amid the current economic climate and geopolitical tensions and as prices retreat from record highs.

China doesn’t add any gold for a third straight month in July

Source: The People’s Bank of China, ING Research

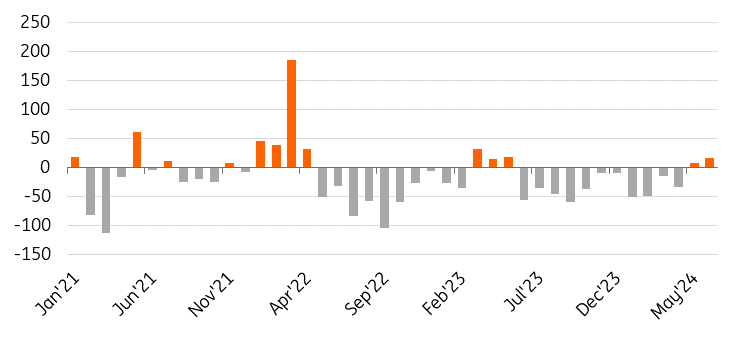

ETF inflows continue

Following the strongest month since May 2023, global gold ETFs have now seen inflows for two months in a row, according to data from the WGC. In June, notable European and Asian buying offset outflows from North America. Although June and May inflows helped limit global gold ETFs’ year-to-date losses to US$6.7bn (-120t), this remains the worst first half of the year since 2013 – both Europe and North America saw hefty outflows while Asia was the only region with inflows.

Investor holdings in gold ETFs generally rise when gold prices gain, and vice versa. However, gold ETF holdings have been in decline for much of 2024, while spot gold prices have hit new highs. ETF flows finally turned positive in May.

Monthly ETF changes (tonnes)

Source: World Gold Council, ING Research

Prices set to peak in the fourth quarter

We believe that geopolitics will remain one of the key factors driving gold prices. The war in Ukraine and the Middle East and tensions between the US and China suggest that safe-haven demand will continue to support gold prices in the short to medium term. The US presidential election in November and the long-awaited US Fed rate cut will also continue to add to gold's upward momentum through to the end of the year, in our view. Central banks are also expected to keep adding to their holdings, which should offer support.

We see gold averaging $2,380 in the third quarter and prices peaking in the fourth quarter at $2,450/oz, resulting in an annual average of $2,301/oz.

More By This Author:

China’s CPI Inflation Rebounded Due To A Smaller Drag From Food PricesRBNZ Preview: Hold Now, Bigger Cuts Later?

July Brings A Surplus In The Hungarian Budget

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more