Gold & Silver Selloff Continues Into Monday

.webp)

Photo by Zlaťáky.cz on Unsplash

After an historic sell-off in the precious metals on Friday, despite a move higher during the Sunday night open in the Far East, the sell-off has continued again in New York today.

As we’ve talked about for the past year in this column, the volatility has been extreme, and it’s probably wise to expect that to continue. In both directions.

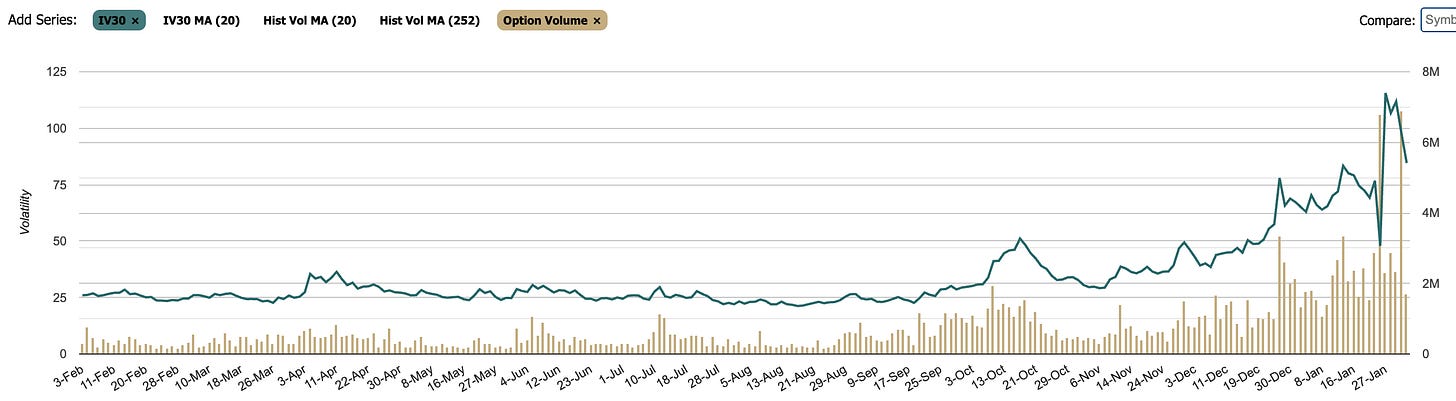

Here you can see a chart of the implied volatility for SLV, and you’ll notice how it surged in the past week.

For what it’s worth, I’m guessing the dip down at the very right of that chart has more to do with the way their model measures the volatility, as the formerly way out of the money puts are now the at the money strike, which leaves for a sometimes less than clean apples-to-apples comparison. But the volatility is still plenty high, and while I would imagine that it would come in from current levels, I would be surprised if we see the silver price just hover between the $75-$80 range for the next 6-12 months.

But with all of that said, where does that leave us in the silver market now?

First, while you may not want to hear this, I do feel it’s important to point out that silver is still the highest it had ever been prior to last Christmas. Of course it did keep climbing, and got as high as $121.78 in New York, and even higher in China and India, yet had it not gone higher and then come back down, people would probably have been excited that we have a $75 silver price today. But it did, and now we are where we are.

Perhaps most importantly, maybe what we just saw is a also good reminder that when a market soars like silver did, even if it does ultimately go higher, there will be corrections. And when the moves are as extreme as the rally was, the corrections will also be extreme. As we found out over the past two days.

Yet with that said, given how every indication is that the primary driver of this past rally was that there are legitimate physical supply issues in both China and India, I still don’t expect that we’re about to see a repeat of 1980 or 2011.

Especially when we’re still in the early stages of governments gone wild over critical minerals, of which of course silver is now on that list.

Also, if you’re an industrial manufacturer who uses silver for your products, and you were having that difficult of a time sourcing silver that you were willing to pay an $8-10 premium, even when the silver price was over $100, what do you do now?

I suppose there are some manufacturers who might think ‘the bubble has popped,’ and wait to see if the price drops lower. Although I would also have to think that if there were some groups scrambling to get whatever they could at a $100+ price, and then the price drops by $30, there would at least be somewhat of a scramble to take whatever’s available now.

Silver in India is currently trading at $82, while Shanghai is at $92 (although the Chinese market has been closed while the New York price has fallen further, so it would likely be a little bit lower now). So the spread in India has narrowed considerably on the move lower, while China remains elevated. But these are conditions that didn’t exist in 1980 or 2011, and we also didn’t have an environment where, ‘President Donald Trump is set to launch a strategic critical minerals stockpile with $12 billion in seed money from the U.S. Export-Import Bank’ in either of those two previous occasions where the silver price spiked either.

So where does that leave us now?

In the shorter term, I would be prepared for just about anything. There’s supply and demand, but again, as we were reminded of on Friday, there’s also still the ability of heavy chunks of sell orders to push the price lower, kick in the algorithms, trigger the stops, and create a cascade.

But in a silver market where there were already extensive indications of supply tightness, and that’s after the spot market in London got popped in October following when India experienced an overt shortage, the issues that led us to see silver break $120 per ounce in New York have not been resolved or gone away.

Yet, this is where it gets interesting, as we come back to the integration of supply and demand, and pricing that’s determined on the Comex, where a lot of other variables factor in. And that’s why I’ve been emphasizing the indications of the physical tightness over the past month, because when you end up in a situation like we are now, it’s helpful to at least have a framework for determining whether this was all just hot money speculation, or whether the lower price could actually exacerbate the supply concerns.

Some of the bullion dealers report being mobbed on Friday by physical buyers who were taking advantage of the sell-off.

I also already mentioned that there’s at least a case to be made that any industrial manufacturers that were willing to pay an $8-$10 premium when the price was over $100 might well be shopping for anything they can get their hands on today.

We’ll find out more in the weeks and months ahead, but these are the things that I will be keeping a focus on, and of course reporting back on in this column. And lastly, on days like Friday and today, I continue to find that the best question I ask myself during moments like these is, ‘five or ten years from now, where do I think the prices of gold and silver will have to be?’

I find that starting with that question, and then incorporating the specifics of any person’s own situation is a great foundation from which to make any trades or adjustments after the price has moved.

So hopefully that’s helpful on a day where the prices are lower, and if you have any questions on any of that, leave them in the comments field below, and I’ll address them tomorrow.

More By This Author:

The Gold & Silver Correction Finally ArrivesThe Global Silver Market Is Breaking Down

Silver Surges To Over $133 In China As 'They're Front Running Each Other'