Gold & Silver Selloff Arrives, But India Drops Solar Bombshell...

.webp)

Photo by Zlaťáky.cz on Unsplash

Given the stunning ascent of the gold and silver prices over the last few weeks, at some point there was going to have to be a day when they didn’t soar higher yet again. And at least as of midday Friday, so far that day is today.

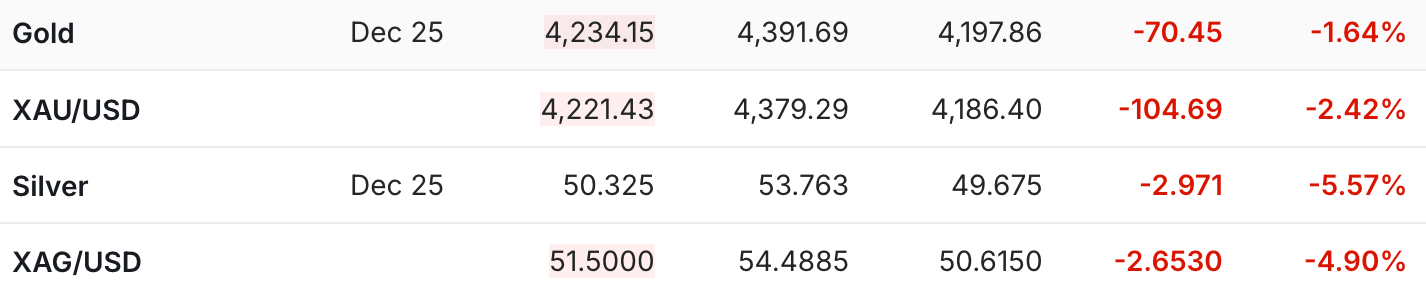

The gold futures are currently down $72 to $4,233.

Meanwhile, the silver spot and futures prices are down even more.

Here’s the silver spot price, which is down $2.64 to $51.51.

And here are the silver futures, which are down $2.97 to $50.33.

Although of note regarding silver, is that the inversion of the London/New York spread has widened out again. It had come back down to the 60-70 cent range over the past few days after blowing out to $3, although it’s now back up to $1.20, with the December futures front month still in backwardation to the spot price.

I’ve been hearing more in recent days about credit issues, so it was interesting to notice in this Bloomberg article about gold and silver that they mentioned that loan blow-ups have contributed to the rush into precious metals.

Bullion hit a fresh all-time high near $4,380 an ounce on Friday, extending this week’s breakneck rally to roughly 8%, the most since March 2020. The gain of more than $300 this week is the biggest on record in dollar terms. Silver also hit new highs.

Loan blowups in the US and renewed trade friction between the world’s top economies are just the latest worries luring investors into precious metals. Geopolitical risks, ballooning public debt and threats to the Federal Reserve’s independence have also stoked demand for haven assets.

Yet another big piece of news that came out on Friday was that India released a draft plan that says they need $21 trillion worth of net zero investment!

And yes, you guessed it….a large portion of that investment would be directed to solar to support India’s electrification.

“The cost of power from nuclear plants is still unknown, but I don’t expect regulators to approve plants with high price tariffs,” said Neshwin Rodrigues, senior Asia energy analyst with the think tank Ember. Regardless of climate targets, the country is expected to build out a huge amount of solar and wind power, alongside batteries. “India will rely heavily on electrification,” he said.

So even on a day where the metals are down, there’s not all that much that’s changed about the longer-term picture. Also, hopefully it comes as encouraging news that gold and silver could be down as much as they are, yet the gold futures are still over $4,200, while both silver prices are still over the $50 mark.

I’ll also be going live with a recap at 2:30 PM eastern, which can be seen here.

But hopefully you will still remember the great positives from this week. And if not, the Sunday night open is not all that far away.

More By This Author:

London Silver Shortage Spreads To Royal MintSilver Surges Back Over $53, Gold Nears $4,300

Gold & Silver Surge Again As Powell Admits Inflation's Going Higher