Global Islamic Indices Declined Over 20% YTD, Underperforming Conventional Benchmarks In 2022

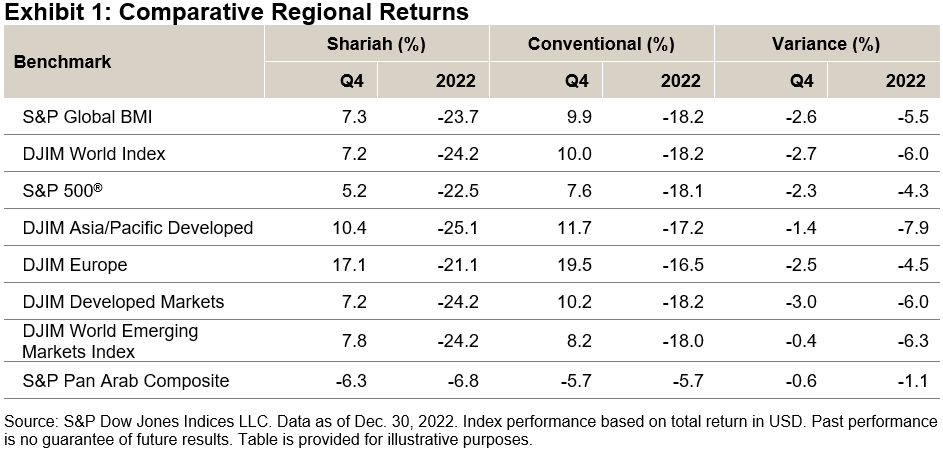

Global equities partially recovered from the losses accumulated throughout the year by increasing 9.9% during Q4, as measured by the S&P Global BMI, ending 2022 with a loss of 18.2%. Meanwhile, Shariah-compliant benchmarks, including the S&P Global BMI Shariah and Dow Jones Islamic Market (DJIM) World Index, also increased during the quarter, but they underperformed their conventional counterparts by 2.6% and 2.7% respectively.

Overall regional broad-based Shariah and conventional equity benchmarks posted a positive quarter, as inflation started to cool down across the world. However, the Pan Arab region declined 5.7% in Q4, and its Shariah benchmark finished the quarter with a decrease of 6.3%.

(Click on image to enlarge)

Drivers of Shariah Index Performance in Q4 and in 2022

While 2022 was a negative year in terms of equity index performance, Q4 saw a partial recovery. Nevertheless, Shariah benchmarks underperformed their conventional counterparts during the quarter and over the year. Sector composition can provide some explanation to this quarter’s results. Higher exposure to Information Technology stocks within Islamic indices continued to weigh on returns, as IT shares didn’t benefit as much from this rally, up only 5.7% in Q4, while the sector was down 31.6% for the year.

Meanwhile, other sectors posted double-digit gains. For example, Energy went up by 19.6% in Q4 and finished the year with a gain of 45.7% but had a relatively small weight of 3.6% in the S&P Global BMI Shariah. The same can be said for Materials, which gained 14.6% during the quarter but only represented 6% of the index’s weight.

Consumer Discretionary and Communications Services were the only sectors that decreased during Q4. The impact from the latter was muted by its small weight; however, Consumer Discretionary made a negative contribution of 0.7% to the index’s return owing to its larger share of 13.3%.

(Click on image to enlarge)

Mixed Results in MENA Equities in 2022

MENA regional equities experienced mixed results in Q4 and in 2022. The regional S&P Pan Arab Composite ended the year down by 5.7%. GCC annual country performance was also mixed, with positive returns for Oman (up 25.8%) and Bahrain (up 9%), and losses in Qatar (-8.3%), Saudi Arabia (-7.2%) and the UAE (-3.7%).

For more information on how Shariah-compliant benchmarks performed in Q4 2022, read our latest Shariah Scorecard

This article was first published in IFN Volume 20 Issue 2 dated Jan. 11, 2023.

More By This Author:

When The Winds ChangeStyle, Size, And Skewness

Contextualizing Style Shifts

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.