Germany: Maybe It’s Time (To Let The Old Ways Die)

From stellar growth to the brink of recession within less than a year. Germany needs more than good luck to return to the European pole position.

Only one year ago, German growth forecasts were being revised upwards almost by the day. No end to the ten-year supercycle was in sight. Instead, another year of stellar performance was on the cards, driven by strong domestic demand and rebounding exports on the back of a weak euro.

Now, it seems as if Germany’s growth prospects are diminishing by the day. A disappointing second half of 2018, bringing the economy close to a technical recession, has returned swan songs on the German Wirtschaftswunder, or economic miracle if you prefer. The truth, as so often in Europe, is probably somewhere in the middle.

Cars, cars, cars

The main reason for the unexpected cooling of the economy in the second half of 2018 is cars. Missed deadlines for the admission of new emission standards led to an enormous inventory build-up in the second and third quarter of the year and, consequently, very weak sales and now production performances. Also, the announced ban on cars with old diesel engines for several German cities has not only weakened car sales but also led to precautionary savings by households over the summer months. Lastly, still remotely related to cars, the drop in global oil prices did not initially bring relief to German customers as cheaper oil did not reach petrol stations or heating oil companies due to low water levels in many German rivers.

And even though the automotive industry is key for the entire economy with a direct and indirect impact on up to 10% of German employment, there is more to the industrial slowdown than simply cars. In fact, the last significant quarterly surge in industrial production dates back to the fourth quarter of 2017. Since then, industrial production has been treading water, first on the back of supply-side constraints and more recently on the back of weakening demand.

Still, the automotive industry illustrates the wider problem in the German economy: the slowdown is a combination of one-off and structural factors. Just think of the harsh winter weather, unusually high sick leave due to the flu, the timing of Easter and holiday, strikes and, more recently, low water levels in main rivers, but also of the lack of investment in digital and traditional infrastructure, delays of railways and airlines, and barely any significant new structural reforms for the past ten years. The future path of the economy clearly depends on which of the factors weighs more. If it’s one-off factors, then a rebound of the entire economy looks plausible. If it's structural factors, then the German economy should be prepared for a long period of underperformance.

Politics are changing swiftly

In the middle of this new economic uncertainty, politics are also changing swiftly. Angela Merkel has put an expiration date to her time in office, resigning as party chairwoman last December and by announcing that she would not run for a fifth term in office at the next elections (officially scheduled for 2021). While headlines were dominated by the leadership race in Merkel’s CDU, the more crucial factor in the question of whether or not the current German government coalition will make it until 2021 is actually the SPD. As in many other European social-democratic parties, the SPD has been suffering severe losses in almost every election. In our view, the SPD’s results at the European Elections will be key for the continuation of the current German government. It remains one of this year’s main political risks that the SPD steps out of the government towards the end of the year. In such a scenario, a minority government under Merkel or new elections (without Merkel) are our most probable scenarios.

The future path of the economy could have a significant impact on politics. In the case of a severe slowdown, we would expect the government to decide on fiscal stimulus, putting aside political and inner party controversies. Here, the SPD could, despite further lost elections, decide to stay within the government. A mild slowdown without any significant dents in the labour market would probably do little to divert inner-party considerations.

Technical recession avoided, rebound in the cards?

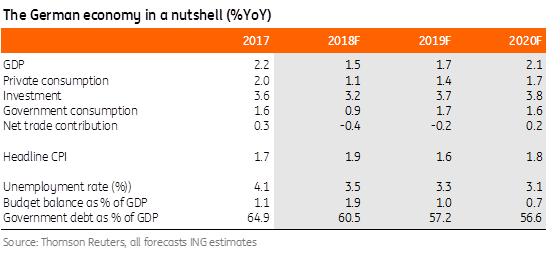

Latest data from the statistical agency suggest that the economy has just avoided a technical recession. With an annual growth rate of 1.5% in 2018, the economy should have grown by 0.1-0.2% QoQ in the fourth quarter. Looking ahead, there are still plenty of reasons to remain optimistic: despite a recent deflation in new orders, order books remain richly filled and companies still report assured production close to record highs, and while capacity utilisation has dropped to its lowest level since the third quarter of 2017, the lack of equipment is a more limiting factor to production than the lack of skilled workers.

In addition to this, the recent pick-up in orders in the automotive industry and favourable financing conditions across the economy also bode well for at least solid industrial and investment activity in 2019. Needless to say, in the short run the biggest risk to this optimistic outlook is a disorderly Brexit which would come at a most inconvenient time for the German economy.

Lady Gaga to the rescue

Admittedly, this rebound is driven mainly by another extension of a mature cycle. To tackle the structural nature of the recent slowdown, the German economy clearly needs a new investment initiative combined with structural reforms. To say it once again with Lady Gaga and Bradley Cooper: the German economy has not reached the shallow, maybe it's time to let the old ways die... if it wants to be born as the new (and old) growth star of Europe.

Disclosure: None.

What a nice read.