Germany: How To Make The Economy Great Again

Image source: Pixabay

In Germany’s case, the often-repeated saying that the upcoming election is crucial holds true. The February elections will determine the economic direction for the coming years.

A crucial topic in the election campaign is the dire state of the German economy, which has now been in contraction for two consecutive years. However, economic problems have been around for longer. In fact, the economy is currently the same size as it was in early 2020, marking five years of de facto stagnation.

The reasons for this stagnation have been discussed endlessly here. In short, a combination of cyclical and structural headwinds has paralysed the economy. While cyclical headwinds like high inflation, high interest rates, high inventory levels, or even high policy uncertainty can fade away rather quickly, the structural headwinds remain.

Germany has realised that the old macro business model of cheap energy and easily accessible large export markets is no longer working. Ten years of underinvestment, deteriorating competitiveness, and China’s shift from an export destination to a fierce industrial competitor have taken – and will continue to take – their toll on the German economy. For more on Germany’s three most pressing structural problems, read here.

The near-term outlook doesn't look rosy

Even if some of the cyclical headwinds fade away, it doesn't look like this will happen in the near term. Looming tariffs and the expected modern version of ‘beggar-thy-neighbour’ policies by the new US administration don’t bode well for the German economy. Not just because of the potential impact on German exports, but because of the effect on German investments if companies were to move production to the US. At the same time, the increase in bankruptcies since mid-2023 is likely to enhance the already gradual turning of the labour market, potentially denting hopes for a private consumption rebound.

The only hope for a cyclical rebound in the early months of the year comes from technical factors, such as a shift in the inventory cycle or an increase in private consumption. An unusually prolonged period of high inventory levels has sparked hopes for a turning inventory cycle. However, instead of decreasing, inventories have recently risen again. Additionally, order books have not yet started to recover, indicating that any turnaround in the inventory cycle is not imminent.

In terms of private consumption, real incomes will return to their early 2020 levels this year, which together with lower interest rates could re-spark consumption. However, as the labour market begins to deteriorate, policy uncertainty remains high, and there is growing awareness of the unsustainability of the public pension system. These are all strong reasons to remain cautious about a rebound in private consumption this year.

What to expect from the elections

After five years of de facto stagnation, last year finally brought broad awareness in German politics and society that the economic problems are not just cyclical. The country is still one of the richest economies in the world, but it needs an overhaul to stop its gradual deterioration. Just addressing the main issues of energy, China and competitiveness will be a challenge. Add to this unfavourable demographics and the impact on healthcare and pension systems and it’s clear that there is no easy way out of the current situation.

In the absence of any new policy initiatives after the elections, the German economy looks set for another year of stagnation and possibly even a third consecutive contraction. A sad new record.

Looking at the economic ideas of the political parties, it is becoming increasingly clear that even in a best-case scenario with reforms and investments, any new government will not try to overhaul the old economic business model, but rather try to rejuvenate the old one. Less red tape, some tax cuts to stimulate spending and investments, possibly attempts to lower energy costs and infrastructure investment – all of which feature in any European economist’s wish list, and a growth booster for the economy; at least temporarily. However, a closer look at the proposals shows that they are often rather superficial and that the financing of the ideas is anything but solid.

Our hope still is that any new German government will decide on a longer-term plan for economic reforms and investments. Just to make up for the investment gap accumulated over the last decade, Germany would need additional investments of 1.5% GDP per year over the next 10 years. This is not all public investments, but the government will have to play an important role in providing public goods like infrastructure and education and creating incentives for private investments. This is why in our base case scenario, we see some reforms combined with infrastructure investments after the elections. If we are right, this should bring at least a small boost to confidence and growth from the second half of the year onwards.

Whether these measures will be sufficient to compete against China and the US is a completely different question. What Germany gets after the elections is a refurbished model of its economy – better than the old one with cracks, battery failures and very few gadgets, but also not a brand-new, dazzling model that leaves the competition speechless. The biggest risk we are currently seeing is that the political system in Germany will be even more fragmented after the elections, making coalition negotiations complicated and increasing the risk that any new government will start with the smallest instead of the largest common denominator.

To make the German economy great again, the country will need time. A decline that spanned more than a decade cannot be turned around in a few months. The February elections will be crucial for the fate of the economy. It simply cannot afford further stagnation.

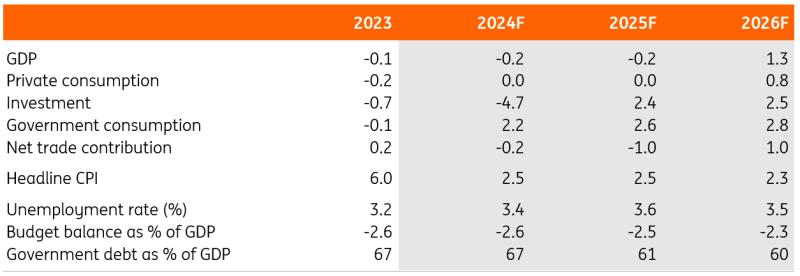

The German economy in a nutshell (%YoY)

Source: Thomson Reuters, all forecasts ING estimates

More By This Author:

An ECB Rate Cut Next Week Looks Like A No-brainer

Minutes Of The ECB’s December Meeting Confirm Easing Bias

German Economy Sees Its First Two-Year Contraction Since Early 2000s