German Housing Market Has Yet To Bottom Out

The correction in the German housing market continued in the first quarter of 2024. Despite signs of a tentative recovery at the start of the year, the just-released official data for the first quarter shows that house prices have dropped once again

Don't expect the housing market correction to be followed by a boom

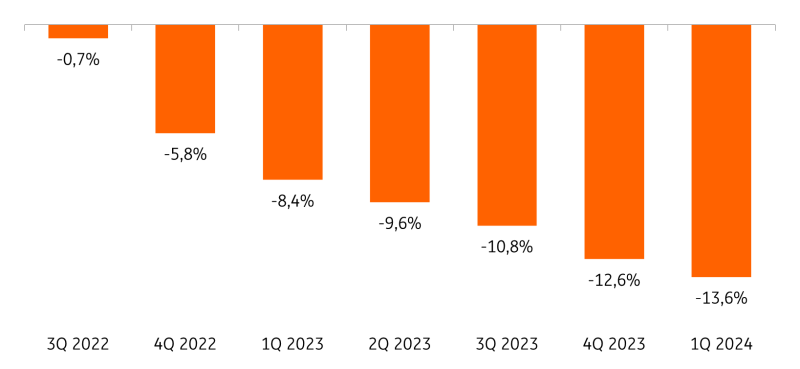

According to the German Statistical Office’s just-released house price index, German house prices fell by 1.1% quarter-on-quarter in the first quarter of 2024. The bottoming out of the German housing market has thus proved to be lengthier than expected. House prices are now some 14% below their peak.

House prices compared to the peak level reached in 2Q 2022

Source: German Federal Statistical Office; ING Economic & Financial Analysis

Looking ahead, the price correction in the German housing market should be followed by a tentative recovery. Unfortunately, however, just as for the German economy as a whole, we do not expect a powerful upswing. The housing market is like a mirror of the German economy, which means that, despite some cyclical improvements, the market continues to be impacted by more structural headwinds.

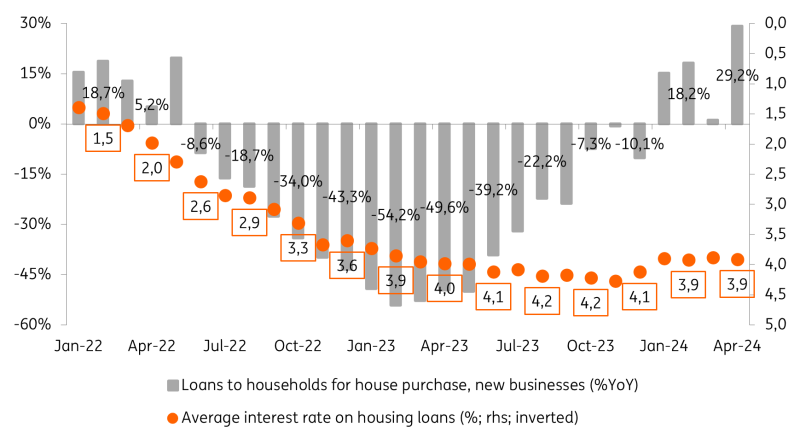

Financing conditions to remain restrictive despite ECB cutting interest rates

At the beginning of the year, mortgage interest rates had fallen by some 40bp as a result of financial market participants' expectations that the European Central Bank would cut its policy rate this year almost as aggressively as it had raised them in 2022 and 2023. At the same time, house prices were at their lowest level in around three years and real wage growth accelerated to 3.8% YoY in the first quarter of 2024, the strongest pace since the beginning of the time series in 2008. As a result, purchasing affordability improved slightly in the first quarter of this year. Although this improvement came from extremely low levels and affordability was still some 25% below its 2011 level in March, demand for housing loans increased by some 11% YoY in the first quarter of 2024.

Average mortgage rates & demand for housing loans

Source: LSEG Datastream; ING Economic & Financial Analysis

In the first month of the second quarter, new lending growth accelerated further to 29% compared to April last year, illustrating the positive momentum in the market. Nevertheless, the volume of new mortgage business is still 35% lower than in April 2022.

Looking ahead, mortgage rates are expected to hover around their current levels until the end of the year. Any significant downside shift would require the ECB to cut interest rates much more than markets are currently pricing in.

Even though we expect wages to rise at the fastest pace in a decade this year, this will not be enough to significantly reduce the burden of high financing costs for households. Therefore, the purchasing affordability of residential real estate will only improve very gradually this year, making a strong rebound of the entire market unlikely.

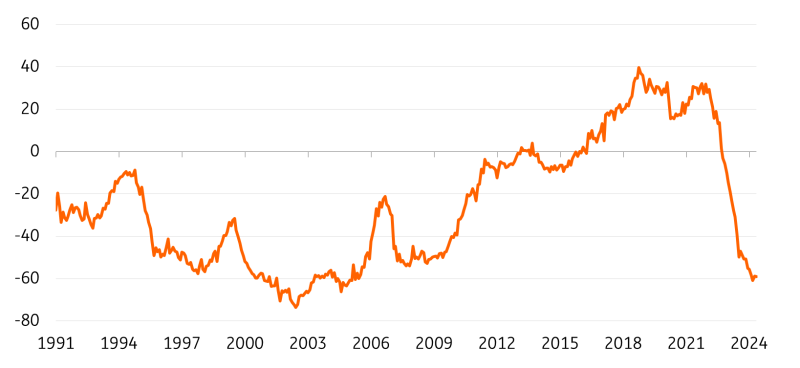

The residential construction sector remains under pressure, exacerbating structural problems

As a result of the bottoming out of the real estate market and supported by the mild winter weather, the residential construction sector has also improved. In May, sentiment in the sector climbed to its highest level since July last year but remained well below its average of the 10 years prior to the housing market correction. The improvement in sentiment has mainly been driven by an increase in the expectations component, which has recently risen to its highest level since the summer of 2022. As incoming orders are still at their lowest level in almost 20 years and the number of dwellings approved for construction in the first four months of 2024 was down by more than 20% YoY, improved expectations currently look more like wishful thinking rather than fundamentally justified.

Orders on hand in the residential construction sector

(net balance)

Source: LSEG Datastream

With the situation in the residential construction sector remaining tight, the lack of housing supply, and in particular affordable housing, remains pressing. Driven by the rise in construction costs and the shortage of workers in the sector, prices for newly completed buildings are expected to remain elevated. In addition, the costs of renovating energy-inefficient buildings are high and any initial purchase price reductions for energy-inefficient houses will not necessarily be able to compensate for these high costs.

The tense situation in the construction sector and the lack of new housing supply should exert upward pressure on prices while also weighing on volumes. Although demand will continue to recover in the months ahead, a swift return to levels seen prior to the ECB’s interest rate hike cycle is unlikely. It will be a gradual recovery. In our view, this gradual recovery, in combination with the structural shortage of housing, will result in house price growth of some 1% this year.

More By This Author:

FX Daily: European doves help the dollarNational Bank of Hungary Review: Season finale with a cliffhanger

Eurozone Recovery Gets Reality Check In June