German Elections And The DAX: A Seasonal Opportunity?

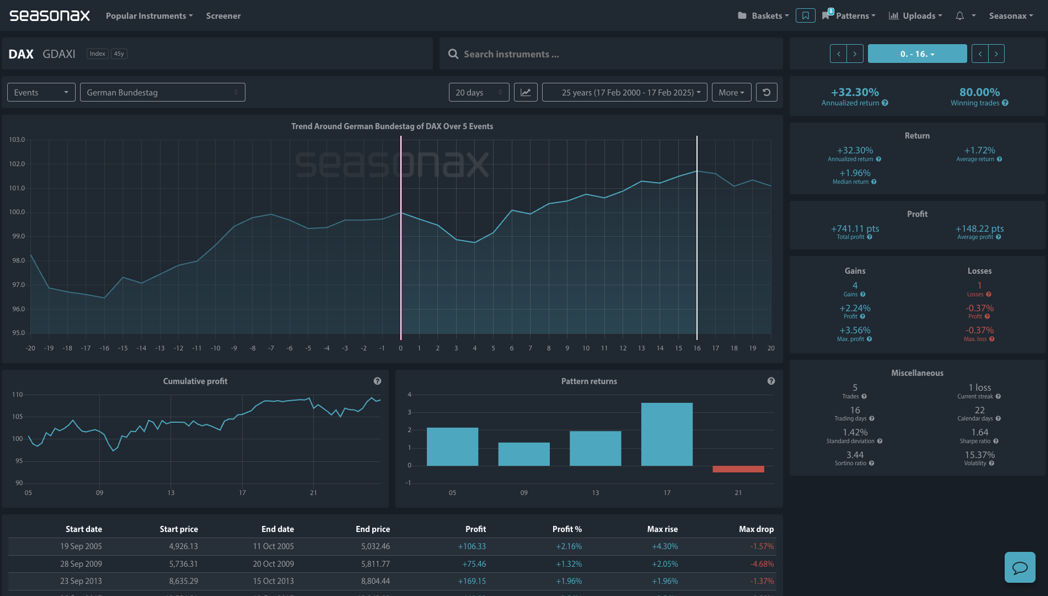

- Instrument: Dax

- Average Pattern Move: +1.72%

- Timeframe: 16 days after the election result

- Winning Percentage: 80%

Dear Investor, you may not realize how significant German elections can be for the DAX. Historically, these political shifts have influenced market performance, with past Bundestag elections exhibiting a +32.3% annualized return in the surrounding weeks. With coalition negotiations expected to be complex and analysts at ING forecasting mild fiscal stimulus alongside structural reforms, the key question remains: will this boost the DAX in line with previous election reactions?

DAX Performance Around German Elections

The chart shows you the typical development of the DAX around past German elections.

(Click on image to enlarge)

Analyzing five previous elections, the data reveals a consistent upward bias, with 80% of trades resulting in gains and an average return of +1.72% over the election window. Historically, once electoral uncertainty dissipates, the DAX has tended to move higher, particularly when the outcome favors market-friendly policies.

Key policy expectations for this election revolve around fiscal policy, industrial reinvestment, tax reforms, and consumer spending initiatives:

- Fiscal Policy: Germany’s constitutional debt brake, limiting borrowing to 0.35% of GDP, remains under scrutiny. Some analysts expect minor fiscal loosening, which could be supportive for equities but constrained in scope.

- Industrial Reinvestment: Weak industrial output, exacerbated by China’s slowdown and high energy costs, has made reinvestment a central agenda item, with potential targeted support for manufacturing and automation.

- Tax Reforms: The CDU proposes corporate tax cuts to 25%, which could enhance earnings for DAX-listed firms.

- Consumer Sentiment: Rising living costs and a housing crisis have squeezed consumers, prompting discussions on boosting affordable housing and reducing bureaucratic hurdles, potentially impacting real estate and retail sectors.

Technical Perspective

From a technical standpoint there is a strong weekly uptrend in place that has accelerated since the start of the year. Will this uptrend hold after the German election results?

(Click on image to enlarge)

Trade risks

Prolonged coalition negotiations could delay economic reforms and create near-term uncertainty. Market reaction will depend on the execution of fiscal measures—if stimulus efforts are underwhelming, the DAX’s upside could be limited.

More By This Author:

Shell’s Seasonal Strength: Will AI-Driven Oil Demand Fuel The Rally?

BP’s Seasonal Sweet Spot: A Bullish Window Amid Activist Uncertainty

Adidas A Seasonal Dip Before The Next Big Rally

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more