GBP/USD Weekly Forecast: Will BoE’s Hike Outshine The Fed’s?

- The Federal Reserve may help the economy land safely.

- The private sector of the British economy contracted at its fastest rate in two years.

- The BoE is set to increase its benchmark interest rate by a half-point to 4%.

![]()

The GBP/USD weekly forecast is bullish as investors expect a bigger hike from the Bank of England than the Federal Reserve.

Ups And Downs Of GBP/USD

On Friday, signs of decreasing inflation raised expectations that the Federal Reserve may help the economy land safely and pull back its hawkish monetary tightening next week. This saw the pound weaken slightly against the US dollar.

The Commerce Department reported that US consumer expenditure fell in December for the second consecutive month. The report also showed that personal income growth was at its slowest rate in eight months, partly due to mild wage growth.

There was also PMI data from the UK. According to a report on Tuesday, the private sector of the British economy contracted at its fastest rate in two years in January.

Investors anticipate that the slowdown in the British economy will soon bring a stop to the Bank of England’s (BoE) tightening cycle, which could temporarily weaken the pound.

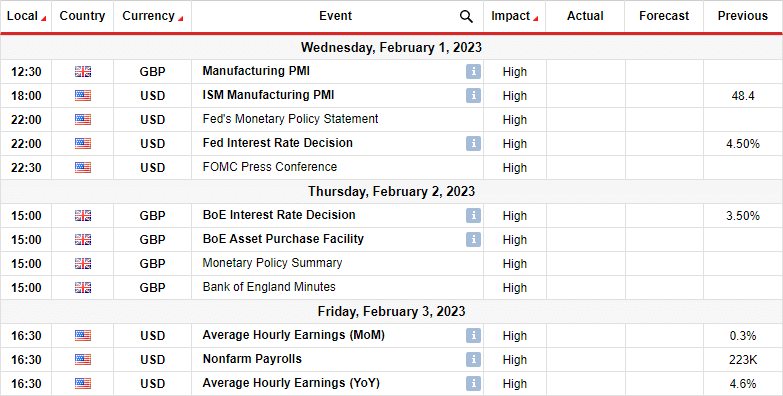

Next Week’s Key Events For GBP/USD

On February 2, the BoE is set to increase its benchmark interest rate by a half-point to 4%, but analysts will watch for signs that this will be the last time the BoE raises rates.

Investors also expect the Fed to raise interest rates by 25bps next week. Apart from that, they will pay close attention to the nonfarm payrolls showing the state of the US labor market.

GBP/USD Weekly Technical Forecast: Second Attempt At Breaking 1.2401

GBP/USD weekly forecast

The daily chart shows GBP/USD trading near the 1.2401 resistance level. It also trades above the 22-SMA, indicating buyers are in charge. The RSI trades above 50, favoring bullish momentum. On the larger scale, the price is chopping through the 22-SMA, a sign that the price is caught in a sideways move. It is trading between the 1.1905 support and the 1.2401 resistance levels.

Although bulls have control at the moment, if the resistance holds strong, bears will take over, and the price will likely retest the 1.1905 support. The bullish trend will only continue if bulls can gather enough momentum to break above the 1.2401 resistance.

More By This Author:

AUD/USD Weekly Forecast: Australia’s Inflation to Rise in Q4

Gold Price Facing Selling Pressure amid Higher Dollar Demand

Gold Price Stalls At $1,929 As Dollar Gains Ground