GBP/USD Weekly Forecast: UK Jobs & Inflation To Help Bears Cope

Image Source: Unsplash

- In response to high US inflation data, the GBP/USD pair has been declining.

- The US retail sales and British inflation data stand out.

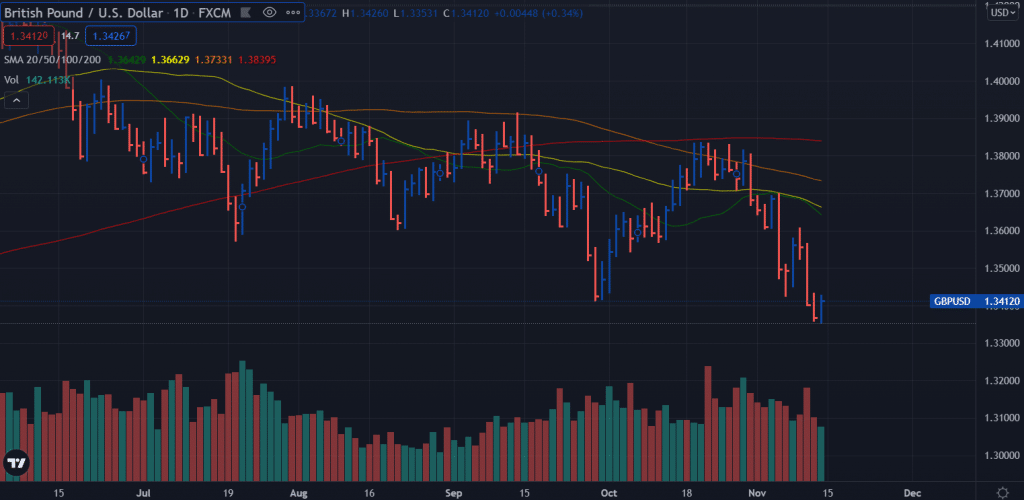

- In mid-November, the daily chart paints a decisively bearish picture.

The GBP/USD weekly forecast is bearish as the pound faced strong selling pressure amid Brexit concerns. There was some support near the mid-1.3300 level, and the pair recovered from its lowest level since December 2020, which was reached this Friday and broke through a three-day losing streak.

As a result, the GBP/USD pair posted significant losses after the US dollar hit 16-month highs. Nonetheless, a meaningful recovery is still out of reach, and trying to recover quickly could result in failure.

Market expectations were confirmed on Wednesday that the Fed would be forced to raise rates sooner rather than later. It appears that the first rate hike may come as early as July 2022, based on Fed funds futures. Together with higher yields on US Treasuries, this should help contain a sharp decline in the dollar and prevent aggressive rates around the GBP/USD pair amid Brexit concerns.

There has been a lot of talk in the UK about how important it is to suspend the Northern Ireland portion of the Brexit deal. The EU, on the other hand, is preparing a retaliatory package if the UK introduces Article 16. On Friday, the two sides are expected to begin new negotiations to avoid an impending trade war. Additionally, the Bank of England’s dovish decision last week may spur more coordination to limit the significant gains in the pound sterling.

To confirm that the recent pullback of the very important 200-day SMA has been exhausted, it is advisable to wait for strong subsequent buys. Participants are now looking forward to BOE MPC member Jonathan Haskell’s arrival as a boost to the market. In addition, the Michigan Consumer Sentiment Index could influence the US dollar’s dynamics later in the session, creating some trading opportunities for GBP/USD at the start of the North American session.

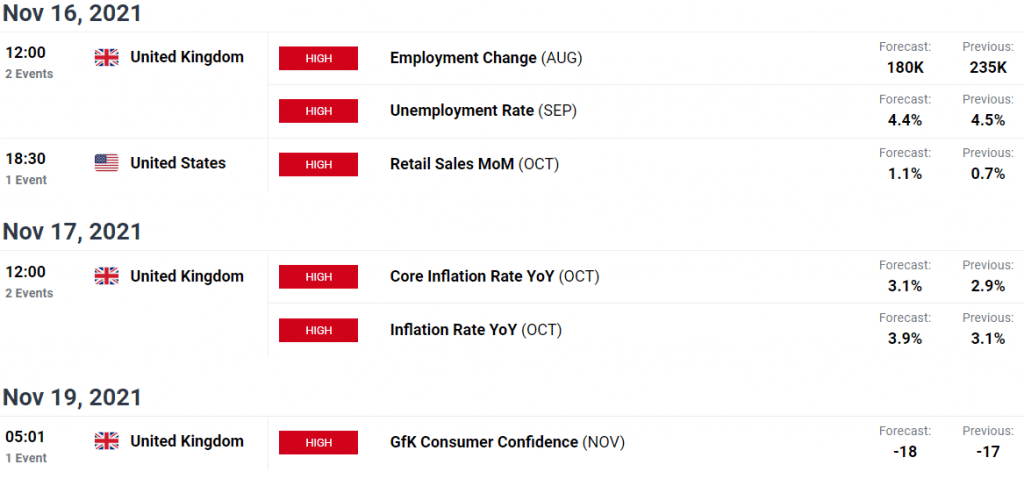

Key Events/Data for the GBP/USD Pair

For the Bank of England and the pound, Wednesday’s CPI numbers are even more significant. With headline inflation at 3.1% year-over-year in September, a rate hike should seal the deal. A drop below 3%, however, could cast doubt on such a move. The manufacturing price index is also important in addition to the main consumer price index. Sterling could also rise due to price pressures unrelated to the increase in energy prices.

The pound might also be affected by Friday’s retail sales. September’s drop of 0.2% is expected to be followed by a rise of 0.5% in October.

The British pound’s market movrt is likely to remain Brexit, aside from a busy economic calendar. Currently, UK and EU negotiators are negotiating the revision of the Northern Ireland Protocol, and threats to apply Article 16 could put further pressure on the pound.

GBP/USD Weekly Technical Forecast: Thin Probability of Upside Correction

The GBP/USD price saw a huge dip during the week. However, the pair found a temporary bottom around the 1.3350 area and closed the week above the 1.3400 handle. The key daily moving averages are still pointing to the downside.

The volume is still below the average for the last up bar. However, the market is absorbing previous selling, and we may see a rebound towards 1.3450 and 1.3500 before the resumption of the downtrend.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more