GBP/USD Weekly Forecast: Sterling Rises As Trump Trade Fades

Photo by Colin Watts on Unsplash

- The US economy expanded by 2.8% as expected.

- The US core PCE price index increased by 0.3%, in line with expectations.

- Optimism over Trump’s win and policy changes faded.

The GBP/USD weekly forecast suggests a rebound in the pound as the fading Trum trade puts downward pressure on the greenback.

Ups and downs of GBP/USD

The pound had its strongest week since September as the dollar eased from its peak with the fading Trump trade. Data during the week showed that the US economy expanded by 2.8% as expected. Meanwhile, the core PCE price index increased by 0.3%, in line with expectations. Consequently, market participants were more confident that the Fed would cut rates in December. Meanwhile, optimism over Trump’s win and policy changes faded, leading to a decline in the dollar and Treasury yields. Markets will now wait to see if Trump will pass his policy proposals in the coming year

Next week’s key events for GBP/USD

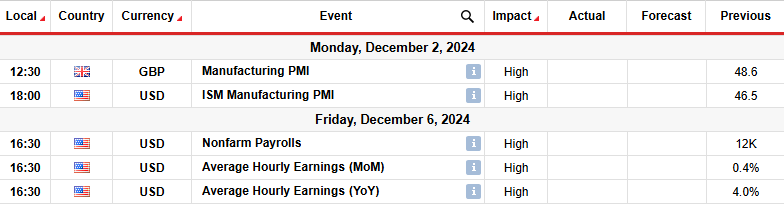

Next week, the UK will release figures on business activity in the manufacturing sector. Flash figures recently showed a slowdown in the economy, pushing market participants to increase the likelihood of a more aggressive Bank of England rate cut cycle. Meanwhile, US reports will include the manufacturing PMI and nonfarm payrolls report. Recent flash PMI numbers robust business activity in November. Therefore, there is a chance this trend will continue, lowering the likelihood of a Fed rate cut in December.

Meanwhile, the nonfarm payrolls report will show the state of the labor market. If job growth remains slow like last month, it will increase expectations for a rate cut in December. On the other hand, if job growth jumps, the Fed might end the year with a pause.

GBP/USD weekly technical forecast: 1.2500 support prompts pullback

GBP/USD daily chart

On the technical side, the GBP/USD price has rebounded to retest the 22-SMA resistance after finding support at the 1.2500 level. The rebound has also allowed the price to retest the 1.2750 resistance level. Therefore, there is a strong barrier for bulls which might see the price bouncing lower. If bears return at the 22-SMA, they will aim to make a new low below the 1.2500, continuing the downtrend. On the other hand, there is a slight chance that bulls will break above the SMA next week. Such an outcome would signal a reversal and allow the price to revisit the 1.3007 resistance level.

More By This Author:

USD/CAD Forecast: Tariff Negotiation Hopes Ease DollarUSD/CAD Outlook: Dollar Soars While Loonie Slides On Tariff Vows

AUD/USD Weekly Forecast: Hawkish RBA Fuels Rebound

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more