GBP/USD Weekly Forecast: Bulls May Rest Under 1.38 Ahead Of NFP

Photo by Colin Watts on Unsplash

- GBP/USD closes the week in the green, yet risk can still pause the rally.

- The Fed signaled a continuation of the bond purchases program despite the hawkish tone.

- The negative impact of Brexit and the Coronavirus may weigh on the pair.

- Technically, the bears may appear amid the death cross of 20/200 DMA.

The GBP/USD weekly forecast shows no clear bias despite the recent weekly gains. The COVID-19 concerns and Brexit issue may weigh on the pair. The hawkish chorus among Powell’s peers also differed from his perspective, and he changed the narrative. However, earlier signs pointed to the inevitable.

Early in the week, the dollar fell after two encouraging Federal Reserve messages. First, to respond to the Delta COVID-19 variant, Dallas Fed President Robert Kaplan was willing to reconsider the $120 billion a month bond-buying program. In addition, the bank announced it will host a virtual symposium in Jackson Hole.

If the Fed is forced to curtail its activities, this would also imply additional support from the bank for the economy. Markets have responded to this optimism by moving ahead despite virus-related delays.

Regarding the Coronavirus, the FDA endorsed the Pfizer (PFE) /BioNTech (BNTX) vaccine for all times. Formalizing vaccination regulations simplifies the process and facilitates its diffusion. The current wave of viral infections appears to be nearing its peak, another positive development on the pandemic front. The overall infection rate fell to double digits and fell in those countries that were initially hard hit.

Despite Boris Johnson’s desire for an irreversible reopening, consumers may still be cautious about buying food and shopping. Along with the daily virus reports, the apparent suspension of the vaccination campaign may be of interest.

The negative impact of Brexit on supermarket shelves – both now and before Christmas – is also evident in the comments made by politicians on both sides of the English Channel. So, the Northern Ireland Protocol may be a great spot to let your voice be heard when officials return from vacation at the end of August.

During the Brexit armistice, border controls were suspended between the UK and Ireland, which may impede the pound’s progress. No news was good news, but it might end as early as next week.

Key Data from the UK during the Week of Aug. 30 – Sept. 3

![]()

The economic calendar is light next week. The only interesting events are the manufacturing and services PMIs. Meanwhile, the UK has a bank holiday on Monday.

Key Data from the US during the Week of Aug. 30 – Sept. 3

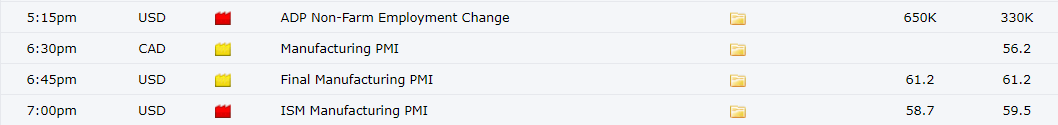

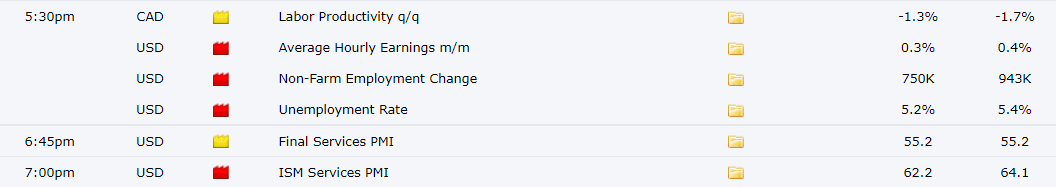

The most important event next week in the US is the NFP data, which is expected to decline to 750 thousand from the expected 943 thousand jobs created in July. The ADP nonfarm employment numbers are expected to rise to 650 thousand against the 330 thousand reading in July. ISM PMIs for manufacturing and services are also expected next week, which may provide some impetus to the market.

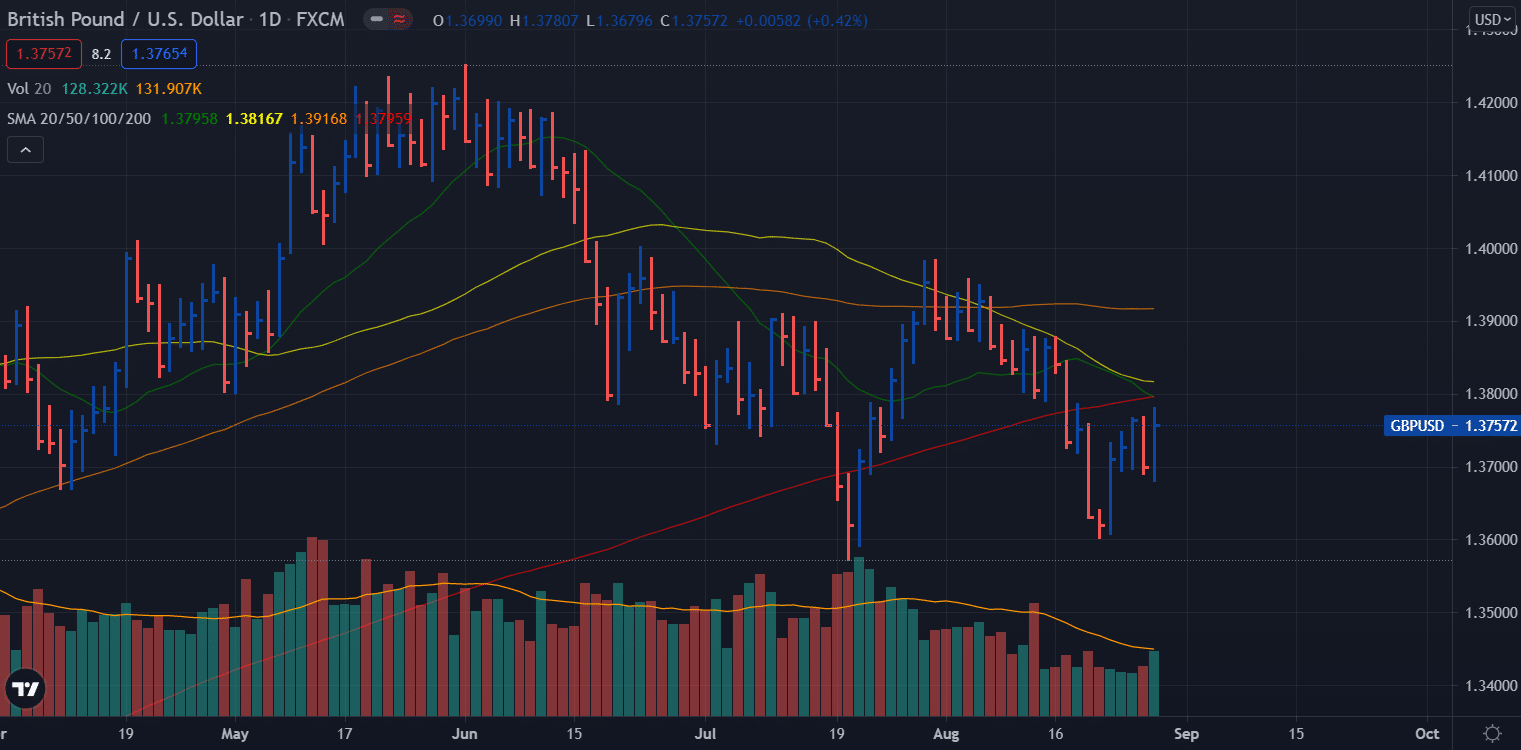

GBP/USD Weekly Forecast – Daily Chart

GBP/USD Weekly Technical Analysis: Death Crossover to Pause Gains

Despite the decent gains on the daily chart, the price remains below the key moving averages. The 20-day and 200-day SMAs are going to make a death crossover. This may halt the bull run. However, the volume is increasing, and the pair may find some strength before gaining further. The upside targets remain at 1.3800 ahead of 1.3850.

On the flip side, the support can be found at 1.3750 ahead of 1.3700. However, the pair has no clear technical bias. So, we cannot determine the path of least resistance.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more