GBP/USD Weekly Forecast: Bulls Looking At BoE, Capped By COVID-19 Fear

Image Source: Unsplash

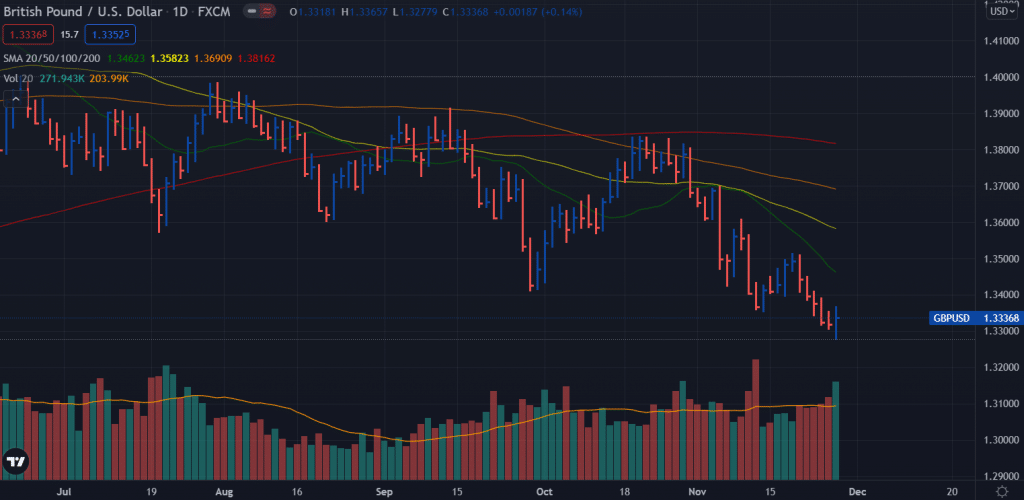

- The GBP/USD exchange rate ended the week in negative territory after a modest rebound on Friday.

- On renewed fears of the coronavirus, the markets are reassessing BoE and Fed rate hike prospects.

- The GBP/USD needs to break through 1.3450 to attract more buyers.

The weekly forecast for the GBP/USD pair is slightly bullish as the price found some respite just below the 1.3300 handle. However, rising COVID-19 fears may cap the gains.

The GBP/USD pair started the week under downward pressure after failing to recover 1.3500 the previous week. Dollar strength was accompanied by rising US Treasury yields, pushing the pair lower below 1.3300 to levels not seen since December 2020. However, a small part of the loss in the GBP/USD is offsetting.

IHS Markit reported on Tuesday that the UK manufacturing and service sectors continued to grow strongly in early November. However, the pound was unable to find demand despite the encouraging PMI data. IHS Markit Chief Economist Chris Williamson commented on the survey: “Policymakers should take heart from the noticeable increase in employment after the vacation program.”

Concerned about wage inflation, the Bank of England (BoE) may consider this positive and reconsider raising interest rates by 20 basis points in December.

Meanwhile, the dollar benefited from restrictive comments from officials of the FRS in the past week, and this weighed heavily on GBP/USD. A second four-year term for Fed Chairman Powell confirmed the market’s outlook due to President Biden’s appointment.

In October, the US Bureau of Economic Analysis reported that the Basic Personal Consumer Expenditure (PCE) price index increased from 3.7% in September to 4.1% annually. In addition, initial weekly jobless claims decreased from 270,000 to 199,000, while personal spending and income grew by 1.3% and 0.5% month-over-month.

The financial markets were dominated by safe havens on Friday due to rising fears over a new variant of the coronavirus, which is stifling global economic recovery. As a result, US Treasury yields fell nearly 8%, weakening the dollar. In the FedWatch CME Group tool, the Fed’s chance to hold its key rate steady until June 2022 increased from 18% in the middle of the week to 34%.

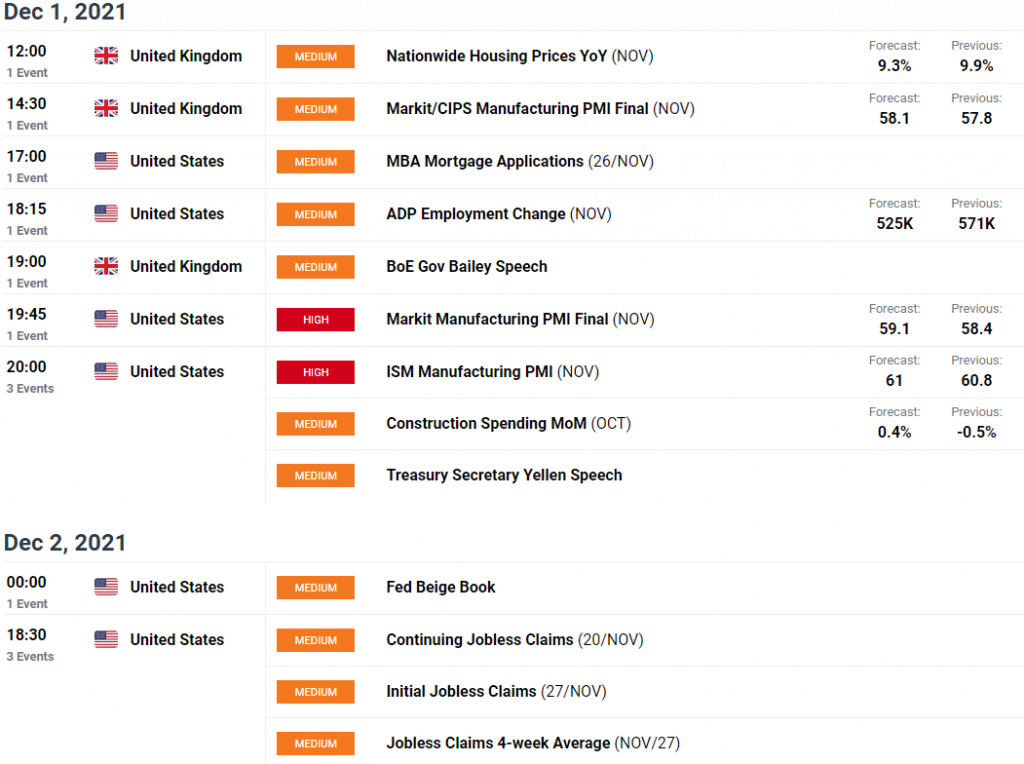

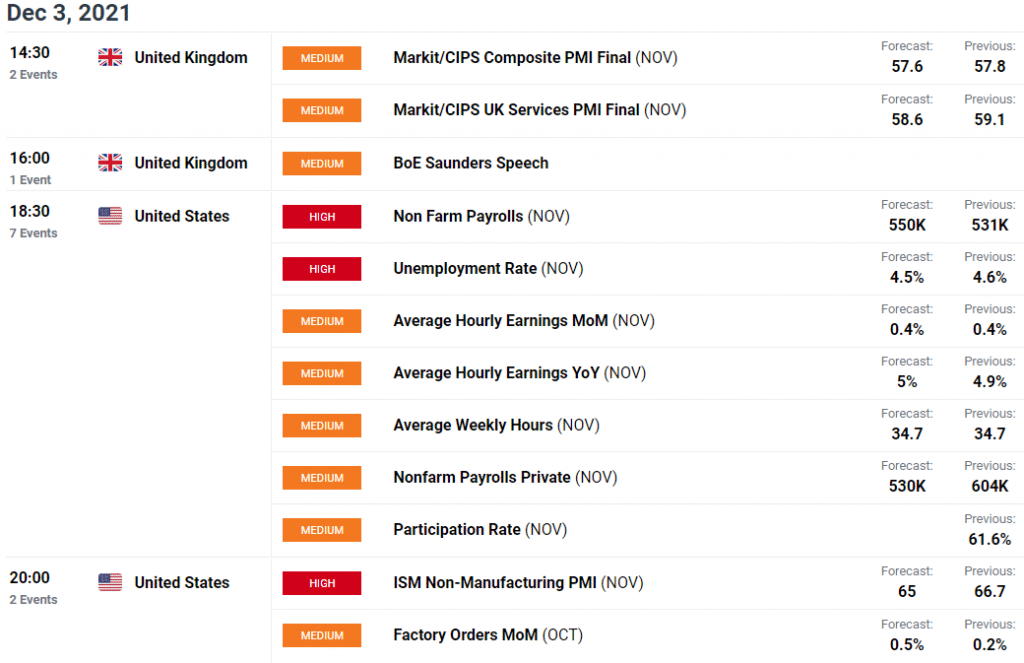

Key Data/Events for the GBP/USD Pair

On Friday, the Bureau of Labor Statistics released its November employment report. Stronger-than-expected growth in nonfarm payrolls (NFP) could boost the dollar’s value. The Fed will enter the power outage period on Saturday, Dec. 4, so investors will pay attention to the effects of the coronavirus on the Fed’s policy outlook. The dollar is likely to lag.

A 15-basis point rate hike by the Bank of England was priced last in December with a 55% probability, up from a 75% probability on Thursday. British Health Minister Sajid Javid announced Friday that flights from six African countries will be banned from 12:00 GMT. Investors may wish to stay away from the British pound if the new coronavirus variant affects interest rate forecasts.

GBP/USD Price Weekly Technical Forecast: Bulls to Overcome Several Hurdles

The GBP/USD price attempted to form a bottom reversal on Friday, but the price closed of the highs on the daily chart. The price is still below the demand zone, around 1.3400. However, the volume points at buying strength, and the price may attempt another run towards 1.3400 ahead of 1.3450. However, any effort below the 1.3450 mark will not change the bearish trend.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more