GBP/USD Weekly Forecast: Bulls In-charge Above 1.37, Awaiting Fed

The GBP/USD weekly forecast is bullish. The GBP/USD pair traded very actively this week. All the pair movements are very difficult to explain from the point of view of fundamental analysis. Simply put, the EUR/USD pair has been practically in one place all the week, while the GBP/USD pair went down 260 points and up 200. Why? Did the data from the UK provoked such a movement? But no special news of a macroeconomic nature came from the UK this week. It turns out that this is not about macroeconomics (FXB, FXE, UUP).

The main reason was some nervousness of the traders themselves, which can only be based on data on the fourth wave of the pandemic. We already explained last week that the powerful fall of the Pound Sterling does not seem entirely logical since the data on the pandemic is certainly important. Still, nevertheless, the foreign exchange market must respond to the macroeconomic impact of the pandemic, not the pandemic itself.

The more cases and deaths in Britain, the worse its economic prospects become, and the more chances for a new quarantine. However, London, on the contrary, lifted all quarantine restrictions this Monday. Thus, we believe that the markets just panicked about the fourth wave initially and then realized that this was not entirely logical and began to restore the pair.

The next week comes with two major events. CB consumer confidence data is expected on Tuesday. The figures are not expected to surprise the market.

![]()

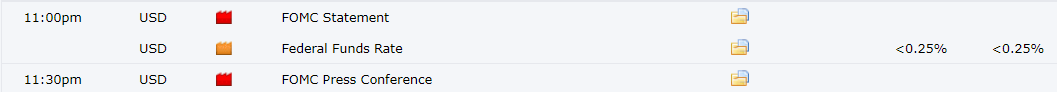

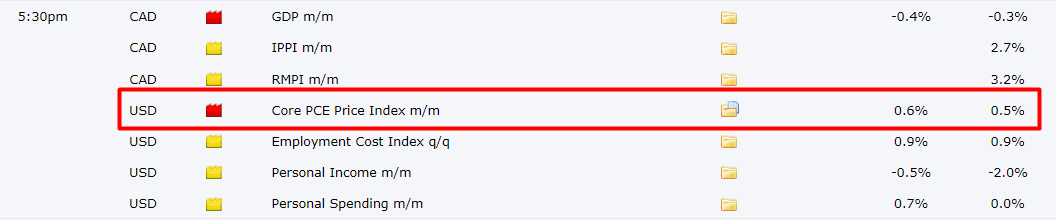

Second is the US federal funds rate and FOMC statement due on Wednesday. We have to look for the tone of the FOMC in their statement. On Friday, we have personal spending and income data as well which includes PCE inflation as well. PCE inflation is a hot variable of inflation measure for the Fed.

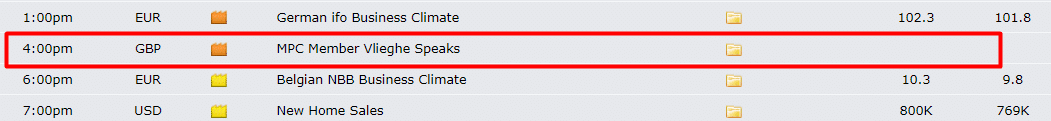

The GBP side of the equation comes with no major data release next week. Only MPC member speech can trigger slight volatility.

GBP/USD Weekly Technical Forecast: Bulls To Tap 1.38

The GBP/USD whipsawed in the week. The pair managed to recover most of its losses, found buying traction near 1.3570 and jumped to 1.3800. However, the pair closed its week at 60 pips below the weekly highs. Right now, the price is lying above the 200-day SMA but remains capped by the 20-day SMA. The upside can continue to find more bids to target 100-day SMA and 50% Fibbo congestion at 1.3910. If bulls remain successful, the price may target a 1.4100 handle which is an order block zone.

On the flip side, the 200-day SMA at 1.3700 provides interim support ahead of 1.3570 (weekly lows). However, the path of least resistance lies on the upside.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more