GBP/USD Weekly Forecast: Bullish Momentum Ahead Of FOMC Minutes

Ups And Downs Of GBP/USD

Bulls tried to make a recovery at the beginning of the week after completing the previous week severely in the red amid a robust US Nonfarm Payrolls report. Strong job data-driven gains in the US dollar could not be maintained as Treasury yields dropped ahead of the crucial Consumer Price Index (CPI) report.

Investors carefully considered the deputy governor of the Bank of England (BOE), Dave Ramsden. He demonstrated the central bank’s willingness to keep selling gilt even if a recession forces it to begin cutting the policy rate.

The US CPI delivered a surprise on USD bulls on Wednesday, sending the US dollar index and yields tumbling as the world’s largest economy’s inflation plummeted more than anticipated.

Next Week’s Key Events For GBP/USD

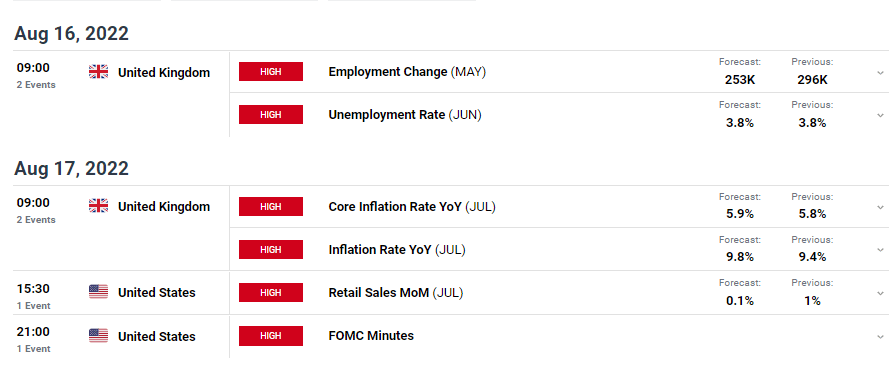

The labor market report for the UK will be released on Tuesday. The UK inflation and US retail sales figures will be released on Wednesday, which is a significant day for cable traders as they come before the crucial minutes of the July Fed meeting. After the US jobs boom and a weaker CPI reading, hints on the Fed’s future policy course will be anxiously anticipated.

The UK Retail Sales report, which summarizes consumer spending in the country, will be released on Friday, capping off a busy week for the currency pair.

GBP/USD Weekly Technical Outlook: Bulls Paused At Channel Resistance

Looking at the daily chart, we see a descending channel. The price has paused at the channel resistance and is trading above the 22-SMA. It is a sign that bulls are in charge of this market. However, if this trend continues, they will have to break above the 1.22795 resistance level.

The RSI trades above 50, supporting bullish momentum. If bulls cannot break above 1.22795, the price might break below the 22-SMA and push lower to retest support at 1.18034. For now, the trend will remain bullish as RSI and the 22-SMA support an uptrend.

More By This Author:

USD/CAD Outlook: US Inflation To Soften Decline In Commodity PricesAUD/USD Price Halts Rally by 0.70 Ahead Of US Inflation Data

Gold Price Bidding Higher Towards $1,800, Awaiting US NFP Data

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more