GBP/USD Technical Analysis: Cautious Stability In Place

Amid continued attempts to rebound upwards, the GBP/USD currency pair moved towards the 1.3500 resistance level that supports the bulls. The British pound was one of the best performing major currencies of the week on Wednesday. This month the Bank of England (BoE) really started the process of normalizing its policy in December when it raised the bank rate from 0.10% to 0.25% in what was already a supportive development for the British pound. But fears of the rapid spread of the new Corona variant may hamper sterling's endeavors.

Image Source: PixaBay

This week, Britain's health minister, Sajid Javid, said there would be no further restrictions on coronavirus in England before the new year, but urged people to be careful and celebrate outside if possible. COVID-19 data has been erratic over the Christmas holidays, but the latest official figures showed 98,515 new infections in England on Monday and 143 people died from the virus. England's National Health Service reported there were 1,281 hospitalizations due to coronavirus on Christmas Day, an increase of more than 70% compared to the previous week. The four parts of the UK have taken different approaches to the restrictions of the Corona virus as the omicron variant has spread rapidly in the country. While orders have been issued to close nightclubs and impose restrictions on gatherings in Scotland, Northern Ireland and Wales, officials have resisted tightening restrictions in England.

Javid added that about 90% of cases across England were omicron.

After the sudden decisions of the Bank of England, the market is taking a hawkish stance as possible, given that the UK economy will be hit hard by the energy crisis this winter and will be more limited on the supply side than the US and Canadian economies. Finally, if a hawkish US Federal Reserve ends up causing a crisis in the financial markets, the US dollar will tend to outperform the safe-haven pound sterling.

Expectations are that the US dollar will turn lower, both due to the US economy slowing sharply, which means that the Fed's expectations have peaked and the market will start the next easing.

Technical Analysis

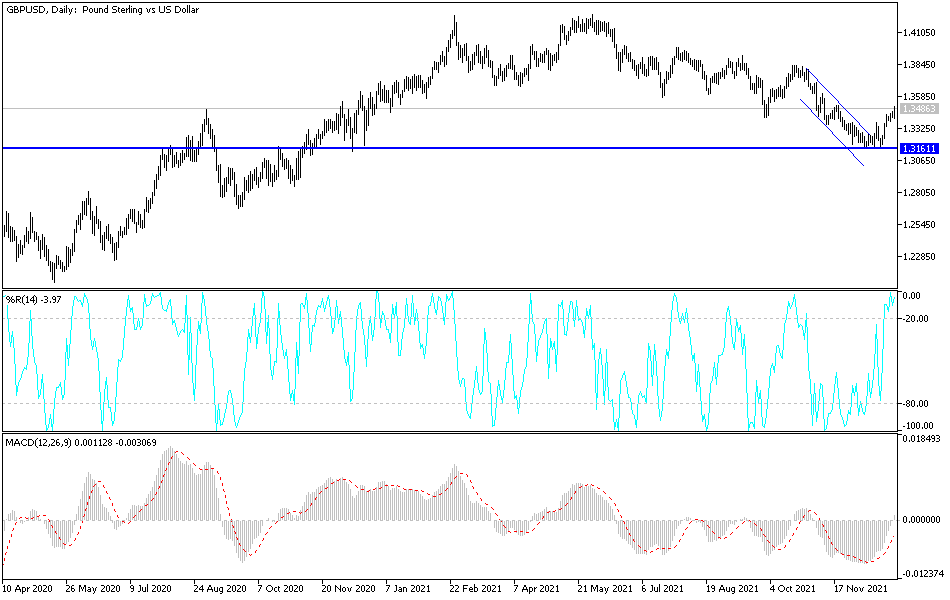

On the daily chart, the GBP/USD is still moving at a cautious pace within an opposite bullish channel that was formed recently, and it will need more momentum to confirm the strength of the rebound upwards. This may happen by moving towards the resistance levels 1.3520 and 1.3660. The last level may move the technical indicators towards overbought levels. On the other hand, the currency pair may return to its bearish channel in the long term, if it returns to the vicinity of the support level 1.3280 again.

The currency pair will react today to the release of the weekly US jobless claims and the PMI reading from Chicago.

(Click on image to enlarge)

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more