GBP/USD Slips As US–China Tensions, Cool, Traders Eye Boe Speakers

Photo by Colin Watts on Unsplash

The Pound Sterling slides during the North American session, down 0.18% as tensions between the US and China ease, following last Friday’s escalation, that prompted investors to buy safety assets. At the time of writing, the GBP/USD trades at 1.3325 after hitting a daily high of 1.3366.

Sterling eases amid calmer trade rhetoric and cautious mood ahead of key UK economic releases

Last week, US President Trump threatened to impose 100% duties on China’s goods as retaliation for China’s rare earth export controls. Nevertheless, Trump posted on Sunday in on Truth Social that “Don’t worry about China, it will all be fine!”

Earlier, the Treasury Secretary Scott Bessent said that he still expects Trump to meet Chinese President Xi Jinping at the Asia-Pacific Economic Cooperation summit in South Korea later this month.

Aside from this, the lack of economic data in the US keeps traders entertained with US politics, the government shutdown and Federal Reserve officials crossing the wires.

In the UK, investors remain focused on the release of the Autumn budget. However, the docket will feature jobs data and Gross Domestic Product (GDP) figures in the three months to August.

Bank of England policymakers will speak this week, with six of the nine members of the Monetary Policy Committee (MPC) hitting the wires. Money markets are expecting the BoE to hold rates unchanged, pricing in the next adjustment until March 2026, as inflation is double the bank’s target.

GBP/USD Price Forecast: Technical outlook

The technical picture shows the GBP/USD is trading neutral to slightly tilted to the downside, as price action remains below the 20, 50 and 100-day SMAs, an indication that in the short and medium term, sellers are in charge. Additionally, the Relative Strength Index (RSI) is bearish, trending downward, a sign further downside in the Pound is expected.

If GBP/USD drops below 1.3300, the next support would be 1.3200, followed by the 200-day SMA at 1.3173. On the flip side, if the pair reclaims 1.3400, key resistance levels emerge, like the 20-day SMA at 1.3451, the 50-day SMA at 1.3472 and the 100-day SMA a 1.3490.

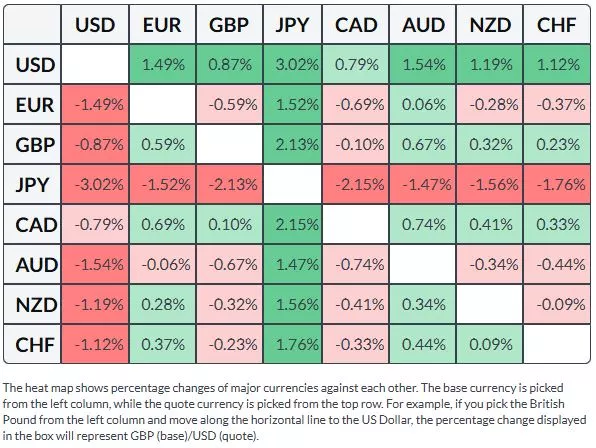

Pound Sterling Price This Month

The table below shows the percentage change of British Pound (GBP) against listed major currencies this month. British Pound was the strongest against the Japanese Yen.

More By This Author:

Gold Surges Near $4,000 As U.S.–China Trade Tensions Ignite Haven DemandEUR/USD Crashes Below 1.16 As Political Turmoil In France, Boost USD

Gold Plunges Below $4,000 As Traders Book Profits And U.S. Dollar Strengthens