GBP/USD Sinks After BoE Holds Rates Steady, UK Retail Sales In The Barrel

Photo by Colin Watts on Unsplash

- GBP/USD backslid over 0.5% on Thursday after the BoE stubbornly held rates steady.

- UK inflation continues to be an overarching problem limiting the BoE’s policy toolkit.

- With the BoE hamstrung, inflation and slowing economic activity pose a double-sided issue for the UK.

GBP/USD tumbled backwards on Thursday, falling a little over one-half of one percent and pushing the Pound Sterling (GBP) back below the key 1.3600 handle against the US Dollar (USD) after a brief spat above the major technical level.

The Bank of England (BoE) held interest rates flat in a 7-to-2 vote, and a general uptick in market unease helped keep the Greenback well-bid across the board.

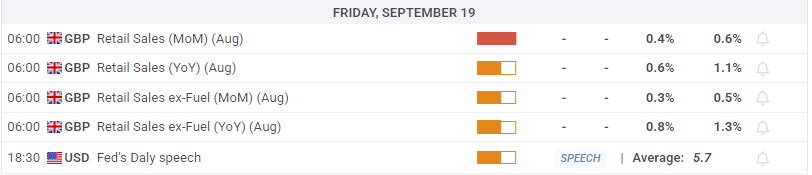

Central bank dust settles, UK Retail Sales up next

UK Retail Sales for August are due on Friday, but the headline figure will provide a mixed bag at best for data watchers. Retail Sales data is not typically adjusted by total sales volume, and high inflation can skew the sales figures to the upside.

Functionally, Retail Sales cannot differentiate between consumers struggling to pay for the same amount of goods with a larger proportion of their paycheque, and consumers properly injecting wage gains into the domestic economy.

GBP/USD daily chart

More By This Author:

Canadian Dollar Pares Away More Gains As U.S. Dollar Recovers GroundDow Jones Industrial Average Leaks Higher As Rate Cut Bolsters Tech

GBP/USD: BoE Has Tough Act To Follow After Fed Cuts Rates