GBP/USD Price Sliding Towards 1.35 Amid Brexit Talks

While the GBP/USD price is down for the second consecutive day ahead of the London open on Monday. It remains near intraday lows of 1.3520.

In the wake of the monthly jobs report, the US dollar index (DXY) rebounded from a three-week low, causing the cable pair to fall the most in a week. Furthermore, the quote is affected by Brexit and UK political concerns and the cautious mood leading up to Thursday’s Brexit talks between UK Foreign Secretary Liz Truss and European Commission Vice-President Maros Sefcovic, not to mention UK GDP preliminary readings for the fourth quarter to be released Friday.

According to the US Bureau of Labor Statistics (BLS), the January jobs data may have caused Friday’s DXY jump. Although, Nonfarm Payrolls (NFP) rose 467k in December from the median estimate of 150k, up from the previously revised 510k, with the unemployment rate rising from 3.9% to 4.0%, against unchanged expectations. Underemployment has gone from 7.3% to 7.1% for U6, but it is worth noting that it increased from 7.3% to 7.1%. An increase in the hourly wage of 5.7% from 4.9% also pleases the dollar buyers.

The fishermen in Britain are pessimistic about Brexit while British Prime Minister Boris Johnson has hired “mastermind” Isaac Levido to keep his job, UK Express reported. However, according to Dr. Hans Kluge, Director of WHO’s European Region, “for the time being, the number of fatalities in the region has begun to stabilize.” In addition, former economic adviser to Gordon Brown and Boris Johnson Gerard Lyons criticized the Bank of England’s slow pace, citing Bailey’s inability to prevent inflation. He warned of the cost of the living crisis being exacerbated by bank failures due to a complacent attitude towards higher prices.

The US 10-year Treasury yield rose to its highest level in two years following the jobs report but fell to 1.90%. Even after surprising markets with a positive daily close on Friday, shares remain sluggish.

Traders could take a breather earlier in the week after a volatile week due to a light calendar. Nevertheless, Brexit tensions and disappointment in the UK GDP could weigh on the pair.

GBP/USD Price Technical Analysis: Bulls Finding No Respite

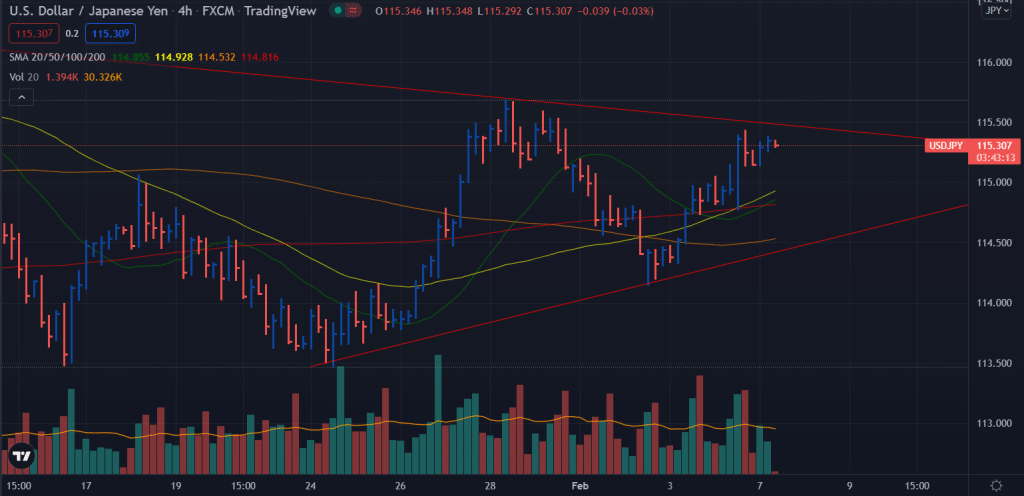

The GBP/USD price remains in hot waters below the 20-period SMA on the 4-hour chart. The pair found minor support around the 200-period SMA. However, the price remains vulnerable and may fall below the 1.3500 mark. The next support emerges at 1.3460 ahead of 1.3400.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more