GBP/USD Price Forecast: Sellers Dominate But A Doji Candle Hints At Indecision

Photo by Colin Watts on Unsplash

- GBP/USD breaks channel support but a Doji candle on the daily chart reflects a temporary pause in the trend.

- Momentum indicators signal potential for a deeper correction as volatility tightens and bulls struggle to regain control.

- GBP/USD weekly chart hints at cracks in the medium-term outlook.

GBP/USD is at a technical inflection point, a battleground between weakening bullish momentum and growing bearish pressure. Thursday’s Doji candle on the daily chart, reflects a temporary pause, with the lack of a body signaling that buyers stepped in to defend the 1.3390–1.3370 region, despite early downside pressure.

While the candle hasn’t closed yet, this kind of price action often indicates rejection of lower levels or at least buyer interest emerging near key support. It doesn’t yet confirm a reversal, but it does raise the stakes for both sides.

GBP/USD clings to key support as sellers tighten their grip

GBP/USD has broken below its rising channel and is now hovering above 1.3400 with a major support zone forming at the 23.6% Fibonacci retracement level of the January-July rally near 1.3390.

Price action remains below the 50-day Simple Moving Average (SMA) resistance level of 1.3505 and the 20-day SMA at 1.3579, signaling a notable loss of short-term bullish momentum.

The failed hold above the 1.3500 psychological level and a break below the channel structure suggest that sellers are beginning to assert control.

Momentum indicators confirm the shift. The Relative Strength Index (RSI) is currently around 39 and is shifting closer toward oversold territory but not quite there yet.

Meanwhile, the Average True Range (ATR) sits near 0.00927, showing daily volatility has compressed to about 92–93 pips. When the ATR contracts, it often precedes a breakout, so traders should watch for an increase in volatility, especially near key technical levels.

If price decisively breaks below 1.3390, the next downside targets are the 100-day SMA at 1.3281, followed by the 38.2% Fibo level at 1.3144 zone.

With the short-term trend signaling that selling pressure continues to build , bulls would need to reclaim the 50-day SMA and recover above the 1.3575 zone to shift short-term sentiment back in their favor.

GBP/USD daily chart

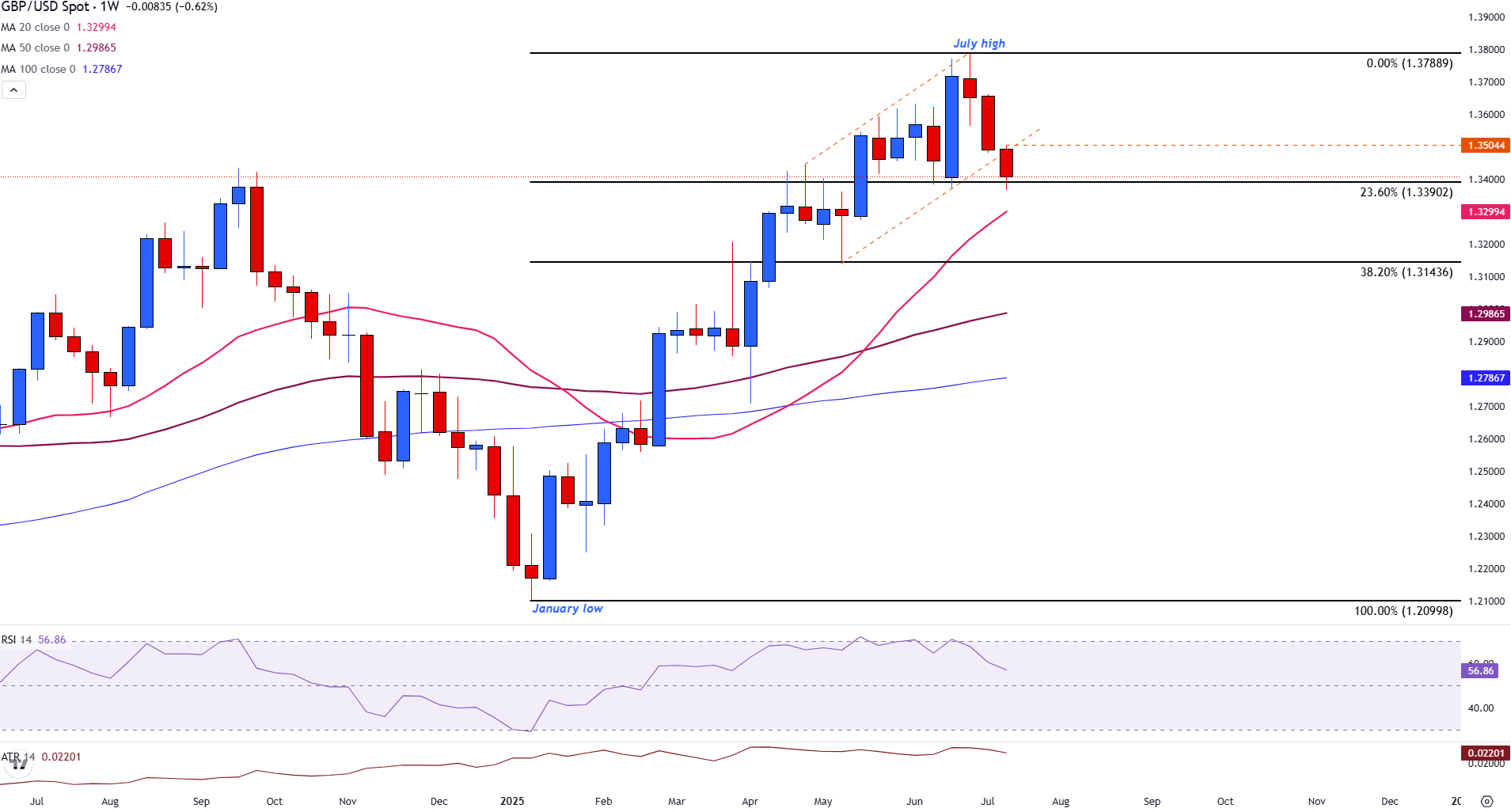

GBP/USD weekly chart hints at cracks in the medium-term outlook

Zooming out, the GBP/USD weekly chart confirms a clear bearish shift. The sharp rejection from the July high near 1.3789, marked by a long upper wick, was the first warning sign. Last week’s full-bodied bearish candle followed through decisively, closing near the lows at channel support reflected strong, sustained selling pressure. This wasn’t just a pullback, it was a clean downside move.

The current weekly candle has a small lower wick after bears failed to break below the 23.6% Fibo level on Thursday. However, the full body of the candle is building onto last week’s downside momentum. The absence of a significant lower wick so far shows little pushback from buyers, reinforcing the idea that sellers are in clear control at this stage. This is a classic bearish continuation candle, particularly concerning given it forming right at a critical support area around 1.3390.

If this price action holds into the weekly close, it would mark a clean break below the 23.6% Fibonacci retracement and could pave the way toward deeper downside levels such as the 20-week SMA at 1.3299, followed by the 38.2% retracement at 1.3144. Momentum is clearly deteriorating, and the structure of this weekly candle makes it harder for bulls to argue for a near-term bounce, unless there’s a significant reversal before Friday’s close.

The weekly Relative Strength Index (RSI) near 57 suggests that the broader trend remains intact, but momentum is clearly weakening.

USD/GBP weekly chart

With GBP/USD holding just above critical support and volatility compressed, the pair is approaching a tipping point, and whichever side seizes control next could define the direction for weeks to come.

More By This Author:

Gold Attempts A Recovery After A Rejection Of $3,300 Support But Dollar Strength Limit GainsWTI Retreats As OPEC+ Supply Rise Outweighs EIA Inventory Draw

EUR/JPY Near YTD Highs On Tariff Threats And Political Uncertainty In Japan

Disclosure: The data contained in this article is not necessarily real-time nor accurate, and analyses are the opinions of the author and do not represent the recommendations of ...

more