GBP/USD Outlook: Bulls Retreating Below 1.37 Amid BoE, UK Politics

The GBP/USD outlook seems vulnerable as the price stays below the key levels and has the tendency to go lower if the US dollar bulls return to the market.

Photo by Colin Watts on Unsplash

Following a sharp correction of the GBP/USD pair on Friday, driven by demand for the US dollar, the pair had a quiet start to the week during the day. Cable trades around 1.3680 at present, with a tight range between 1.3660 and 1.3680.

The pound may find some solace in Friday’s UK GDP data, which exceeded expectations. However, the data suggests that Omicron may have only a modest effect on economic growth.

The Telegraph reported on Friday that Prime Minister Boris Johnson could cancel his Plan B Covid in England. If the Bank of England takes aggressive action, the pound may be supported. Data will be monitored to determine if pre-pandemic levels will be reached and inflation will be tracked.

A change in UK politics could hurt the pound as the Conservative Party calls for Boris Johnson to step down. In May 2020, when the containment rules (Partygate) were in place, the Prime Minister attended a meeting at Downing Street. To divert attention from Partygate, PM might lift coronavirus lockdown, according to Labor

Johnson’s popularity and the strength of sterling will be tested when local elections are held in England, Scotland, and Wales on May 5th. Now that the civil investigation into Partygate has been closed, this benefits the prime minister. Johnson’s removal before that deadline would have been hazardous as no one could be sure what would happen.

The pound faces more significant risks elsewhere due to Brexit. Despite Trouss’ first meeting with EU officials seeming less confrontational, discussions on the Northern Ireland Protocol will remain challenging.

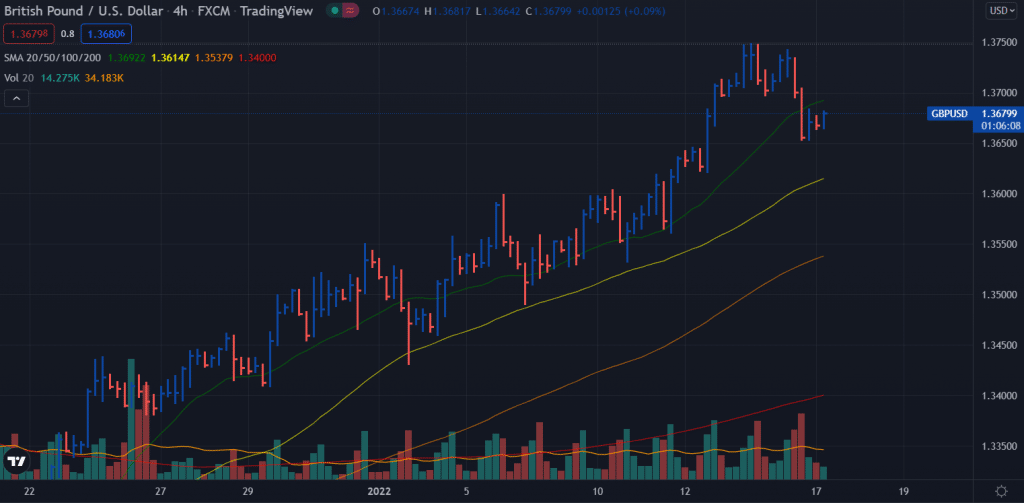

GBP/USD Price Technical Outlook: Signs Of Bearish Reversal

(Click on image to enlarge)

The GBP/USD price consolidates below the 20-period SMA on the 4-hour chart. The volume data shows signs of bearish reversal at the moment. Meanwhile, the average daily range for the pair is at 23% during the Asian session, which is relatively low. The downside target lies at 1.3650 ahead of 1.3600. On the upside, the pair may face hurdles around 1.3700 ahead of 1.3740.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more