GBP/USD Muddles Through Another Tariff-Heavy Day

Photo by Colin Watts on Unsplash

- GBP/USD remains stuck near 1.3700 as ambiguous market risks pile up.

- Cable traders remain largely on-balance, but Greenback flows could return at any moment.

- A fresh batch of tariff threats atop another tariff delay is mixing poorly, hamstringing market sentiment.

GBP/USD spun a tight circle on Wednesday, trapped near the 1.3700 handle as traders await any kind of meaningful change to macroeconomic factors. The Trump administration has put the pedal to the metal on new tariff threats, issuing notices of additional double-digit tariffs on a handful of countries.

Despite the uptick in planned tariffs from President Trump, market sentiment remains roughly steady for the time being. The Trump team has a terrible track record of enacting and maintaining frequently threatened tariffs, and investors are banking on another delay at some point. The Trump team initially announced sweeping “reciprocal” tariffs, which were delayed to Jul 9, then again to August 1. Trump insists that this time, he really means it, and they won’t be delayed any further.

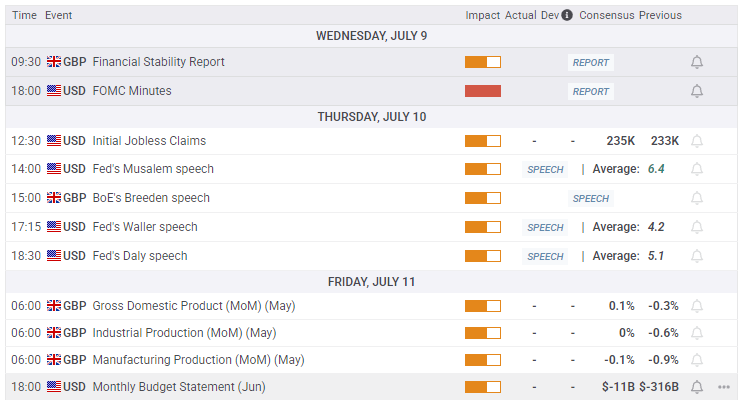

Economic data remains limited this week, with scattered mid-tier data on the offer on both sides of the Atlantic. The Federal Reserve’s (Fed) latest Meeting Minutes showed the Fed remains buried deep in a wait-and-see stance, with central bank policymakers remaining apprehensive about the US’s economic outlook. According to the Fed’s internal rate discussions, headline inflation risks and job market downside factors have both diminished, but the latest rate meeting was held prior to this week’s batch of renewed tariff threats. The spread between individual policymakers on when to cut interest rates again has also widened, with several voting members of the Federal Open Market Committee (FOMC) disagreeing on whether a first rate cut should come in July, or get pushed out to sometime in 2026.

GBP/USD price forecast

GBP/USD continues to churn at the lower end of a near-term pullback after backsliding from multi-year highs near 1.3800 at the beginning of July. Price action has since tilted downward; however, Cable continues to trade on the north side of the 50-day Exponential Moving Average (EMA) near 1.3470. Technical oscillators have eased back from overbought conditions, but near-term downside momentum could still have room to run.

GBP/USD daily chart

More By This Author:

Dow Jones Industrial Average Gains Cautious Ground As Tariff Recycle ContinuesCanadian Dollar Corkscrews As Market Sentiment Roils On Fresh Tariff Threats

Dow Jones Industrial Average Grapples With Recursive Trade Talk