GBP/USD Momentum Falters Ahead Of Hefty Tuesday Docket

Photo by Colin Watts on Unsplash

- GBP/USD coiled on Monday as Cable traders brace for a hard-hitting data docket.

- Technical moment has evaporated, leaving price action strung along key averages.

- UK labor data and US CPI inflation figures will greet Cable traders on Tuesday.

GBP/USD spun in a circle on Monday, wearing worry lines into the charts near 1.3430 as Cable traders buckle down ahead of a slew of key data on both sides of the Atlantic due on Tuesday. United Kingdom (UK) labor figures are due during the upcoming London market session, with United States (US) Consumer Price Index (CPI) inflation due later during the American trading window.

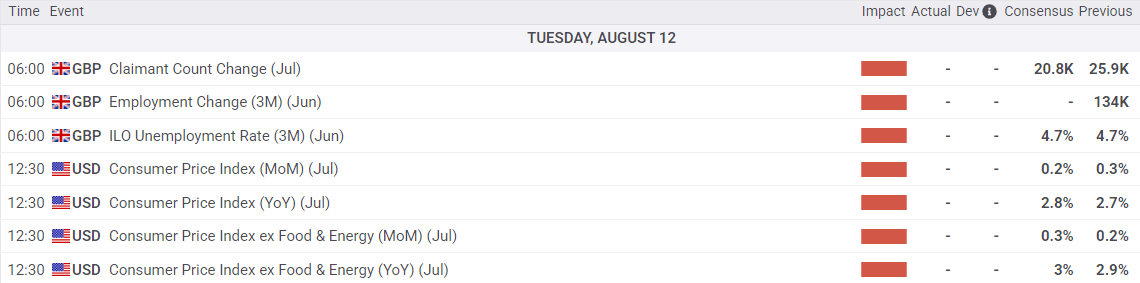

The latest Claimaint Count Change figures for July are due Tuesday, as well as the rolling three-month Employment Change numbers for the quarter ended in July. UK net job gains are expected to ease to 20.8K from 25.9K, while the ILO Unemployment Rate is expected to hold steady around 4.7% over the same period.

UK jobs, US CPI inflation in the barrel

The UK has been grappling with economic policy uncertainty both at home and abroad lately: The UK government’s constantly-changing budget guidelines to shore up a £41B overhang in the spending estimations is making it difficult for businesses and policymakers alike to forecast or make meaningful investment decisions as long as policy commitments remain a day-to-day factor. The Bank of England’s (BoE) latest rate cut, which came as no surprise to markets, hinted that further rate cuts from here may require a more solid grasp of the UK’s domestic economy.

US CPI inflation data from July is due on Tuesday and will draw far more investor attention than usual. Headline and core CPI inflation is expected to tick higher on an annualized basis, and investors will be hoping that an inflation upswing will remain slim enough to not knock the Fed off of its current trajectory on rate cuts. Headline CPI inflation is expected to rise to 2.8% YoY from 2.7%, while core CPI is forecast to tick up to 3.0% YoY from the previous 2.9%.

GBP/USD price forecast

GBP/USD remains hamstrung near the 50-day Exponential Moving Average (EMA) near 1.3430, spinning in place as markets await key fundamental data. A near-term bull run in Cable bids has either drawn to a close or taken a breather, depending on how Tuesday shakes out, but a lower-high technical pattern is weighing the odds in favor of fresh bearish strength in the immediate future.

GBP/USD daily chart

More By This Author:

Dow Jones Industrial Average Trims Lower Ahead Of Key CPI Inflation PrintCanadian Dollar Steadies After Job Losses, Eyes On U.S. CPI Next Week

Dow Jones Industrial Average Finds Gains On Friday