GBP/USD Faces Testing Week With UK CPI, BoE And PMIs All On Tap

Photo by Colin Watts on Unsplash

The US dollar fell modestly after a weaker-than-expected retail sales print, helping to lift FX pairs like the GBP/USD off their earlier lows, albeit modestly. The GBP/USD has not gone anywhere fast in the past several weeks, although it does face a potentially volatile week with the upcoming Bank of England rate decision, UK CPI and retail sales, and global PMI data all on tap later this week. Plus, there is the added uncertainty from the upcoming UK general election. Therefore, the economic data calendar is dominated by UK figures, making the GBP/USD one of this week’s important FX pairs to watch.

US retail sales disappoint expectations

Last week’s hawkish-leaning FOMC meeting where the Fed signalled just one rate hike in its dot plots was countered by renewed weakness in US data. As well as disappointing weekly jobless claims and consumer sentiment data, both CPI and PPI measures of inflation came in weaker than expected while import prices surprised with a drop. Still, the dollar rallied, most notably against the euro, thanks to elections uncertainty in France and rise of far-right parties across Europe. That led to a more defensive positioning with equity indices also falling in Europe.

This week, the US data calendar is quite quiet, which could see the greenback give back some of its FOMC-linked gains as investors continue to price in more rate cuts than projected by the Fed.

At last week's FOMC meeting, Jerome Powell characterised the US consumer as 'solid' but judging by today’s release of weaker retail sales data the Fed Chair might start to think otherwise. Sales were expected to have risen by 0.3% month-over-month in May vs. a flat reading the month before. But they came in at just +0.2% while the previous reading was revised lower to -0.2%. Core retail sales were seen rising 0.2% on the month. However, this too disappointed with a print of -0.1% and April was revised to show a drop of 0.1% instead of a 0.2% rise reported initially.

With retail sales disappointing expectations, this should increase market pricing of Fed rate cuts this year. At the time of writing, though, the dollar hadn’t reacted too significantly. This week’s other data highlights include jobless claims, Philly Fed manufacturing index and building permits all on Thursday, and US PMIs and existing home sales on Friday.

If this week’s US data releases fail to impress, then the only other factor that could potentially keep the dollar supported is the ongoing French election risk. This is likely to remain the main driver of the EUR/USD pair, which could potentially keep the dollar supported against other pairs too if risk appetite sours further.

Busy macro week for GBP amid elections uncertainty

Domestically, UK investors have a lot on their plates. As well as key economic data releases that include CPI and retail sales, we also have a Bank of England rate decision coming, and not to mention the UK’s own elections due on July 4.

We have seen the FTSE pull back in recent days as opinion polls continue to show a huge lead for the UK Labour Party, seen as being less business-friendly than the Conservatives. So far this hasn’t hurt the pound much, perhaps because Labour’s manifesto did not reveal any major surprise policy.

In contrast, the Tories have offered a variety of tax cuts, which could be inflationary. These include a further 2% cut to national insurance and abolishing it altogether for self-employed workers. They have also promised to abolish stamp duty for first-time buyers on homes worth up to £425,000.

This week, though, politics might play second fiddle to macroeconomics when it comes to the pound volatility.

In particular, Wednesday and Thursday should be quite busy for the pound, with the release of UK CPI followed by the BoE policy decision a day later.

UK CPI and BoE rate decision

Ahead of the Bank of England’s policy decision on Thursday, we will have seen the latest CPI data a day earlier. Last month, we saw CPI eased closer to the BoE’s target, falling to 2.3% y/y in April from 3.2% in May, with the sharp drop being due to calendar effects after the high monthly figure from March 2023 dropped out of the y/y equation. Still, an even weaker CPI was expected, while the m/m rate was stronger at 0.3%. This time, CPI is expected to have fallen to the BoE’s target of 2% with core CPI seen easing to 3.5% from 3.9% previously.

With wages and services inflation still around 6%, the fight against inflation continues. The BoE is therefore unlikely to make a move yet. It is seen cutting rates in August, according to nearly all of 65 economists polled by Reuters, and most of them expect at least one more reduction this year. If it provides a clear hint of an August cut, then this may hurt the pound in immediate response. However, the risk is the BoE may appear more hawkish.

Global manufacturing and services PMIs

On Friday, we will have UK, Eurozone and US PMIs to look forward to. While the rate of inflation has eased, prices continue to rise across Europe, putting pressure on wages. Services PMIs have pointed to high price pressures as a result, and this is something to monitor. Concerns about demand have been a key theme impacting commodities as households around the world continue to struggle with the cost-of-living crisis. We have seen continued weakness in global manufacturing activity throughout this year, which has raised concerns over economic growth. The trend of weaker industrial PMI data that has been prevalent across Europe and US needs to be arrested to bolster investor confidence.

Week’s macro highlights for GBP/USD

Meanwhile, we will also have UK retail sales to look forward to this week, which has the potential impact the GBP/USD this week.

Here’s the full economic calendar for the rest of this week, relevant to the GBP/USD pair.

|

Date |

Time (BST) |

Currency |

Data |

Forecast |

Previous |

|

|

|

|

|

|

|

|

Wed Jun 19 |

7:00am |

GBP |

CPI y/y |

2.0% |

2.3% |

|

Thu Jun 20 |

12:00pm |

GBP |

Monetary Policy Summary |

|

|

|

|

GBP |

MPC Official Bank Rate Votes |

0-2-7 |

0-2-7 |

|

|

|

GBP |

Official Bank Rate |

5.25% |

5.25% |

|

|

1:30pm |

USD |

Unemployment Claims |

235K |

242K |

|

|

|

USD |

Building Permits |

1.45M |

1.44M |

|

|

|

USD |

Philly Fed Manufacturing Index |

4.8 |

4.5 |

|

|

Fri Jun 21 |

7:00am |

GBP |

Retail Sales m/m |

1.6% |

-2.3% |

|

9:30am |

GBP |

Flash Manufacturing PMI |

51.3 |

51.2 |

|

|

|

GBP |

Flash Services PMI |

53.0 |

52.9 |

|

|

2:45pm |

USD |

Flash Manufacturing PMI |

51.0 |

51.3 |

|

|

|

USD |

Flash Services PMI |

53.4 |

54.8 |

|

|

3:00pm |

USD |

Existing Home Sales |

4.08M |

4.14M |

GBP/USD technical analysis and trade ideas

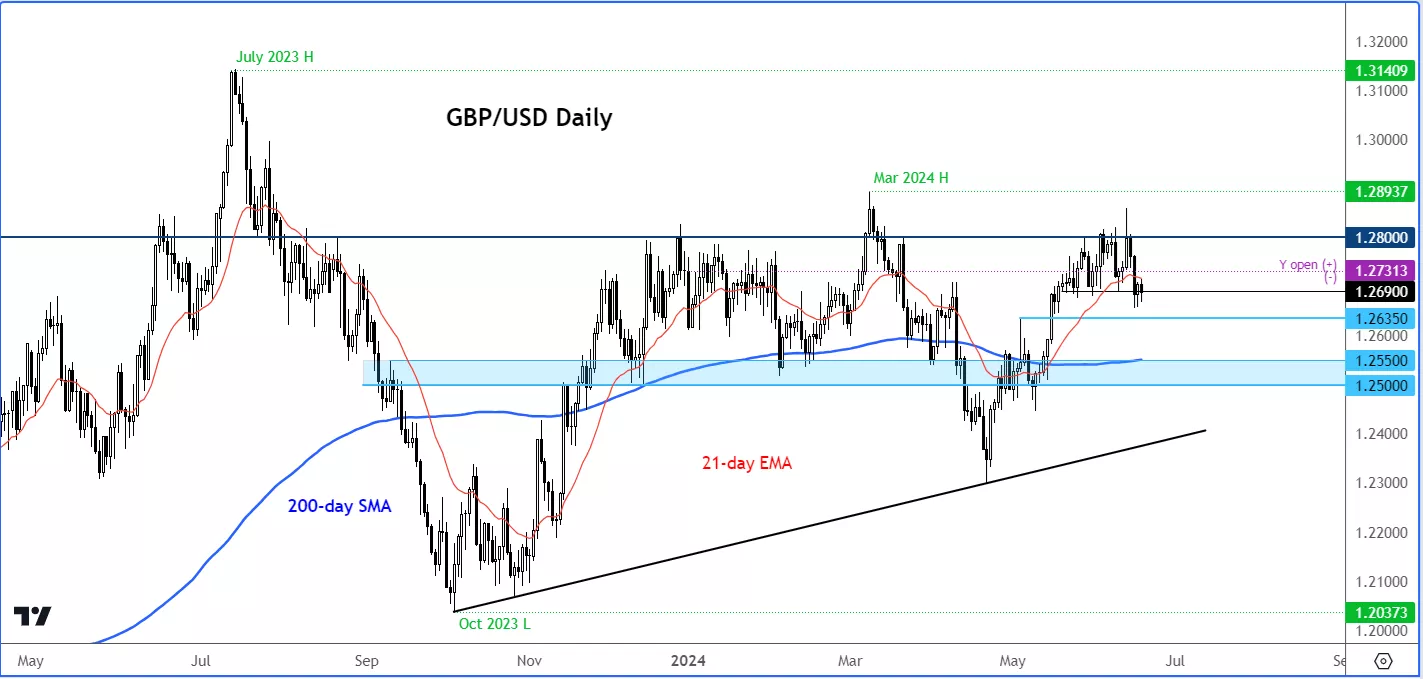

The GBP/USD’s failure to hold the breakout above the 1.2800 handle was met with some selling pressure in the latter half of last week. That resulted in the cable breaking below support at 1.2690, which is now the most important short-term resistance to watch. The next potential levels of support to watch include 1.2635, followed by 1.2550 area. I am on the lookout for a bullish price candle to potentially form around the support levels mentioned to trigger follow-up technical buying towards the top of the recent range.

More By This Author:

Gold’s Bullish Outlook Unaffected Despite Recent Volatility

S&P 500 Continues To Defy Gravity Amid Tech Optimism

EUR/USD Poised For Further Volatility As Focus Turns To Us Cpi And Fomc