GBP/USD Extends Winning Streak As US Shutdown Fears Hit US Dollar

Photo by Colin Watts on Unsplash

- Pound Sterling climbs above 1.3460 as US budget gridlock sparks worries of shutdown disrupting key economic data releases.

- US Job Openings rise to 7.227 million, while Conference Board Consumer Confidence dips below expectations.

- UK GDP growth beats forecasts at 1.4% YoY, but Sterling strength mainly fueled by broad-based Dollar weakness.

The Pound Sterling (GBP) extends its gains for three straight days on Tuesday, edging up 0.20% as investors sell off the US Dollar (USD) amid fears of a US government shutdown. GBP/USD is trading at 1.3461 at the time of writing.

Sterling gains for third day as political deadlock in Washington drives Dollar sell-off

The lack of progress between the White House and Democratic leaders on funding the US government keeps traders anxious due to concerns that a shutdown might disrupt the release of economic data, like the Nonfarm Payrolls figures, set to be announced on Friday.

Job openings in the US remained steady in August, as vacancies ticked up from 7.208 million in July to 7.227 million, exceeding estimates of 7.2 million. At the same time, the Conference Board (CB) revealed that Consumer Confidence missed estimates of 96.0, dipping from 97.8 in August to 94.2 in September.

The senior economist of the CB, Stephanie Guichard, commented that consumers’ assessment of business conditions deteriorated, while availability for jobs fell for the ninth consecutive month.

UK Gross Domestic Product (GDP) for the second quarter expanded by 1.4% YoY above the consensus and the previous print of 1.2%. The data failed to prop Sterling, which mainly benefited from overall US Dollar weakness.

Despite this, GBP/USD is poised to end the month with losses of 0.40%, but central bank divergence suggests that the pair could resume its uptrend in the near term.

GBP/USD Price Forecast: To consolidate around 1.3300 – 1.3450

The technical picture indicates that GBP/USD trades within the 1.3300-1.3450 range for the last three days, below the confluence of the 50, 100 and 20-day Simple Moving Averages (SMAs) at around 1.3463, 1.3488 and 1.3504.

Although the Relative Strength Index (RSI) is bearish, it continues to trend up towards the RSI’s neutral level. Hence, buyers seem to gather some steam in the short term.

If GBP/USD rises above 1.3500, the next resistance would be 1.3550 and 1.3600. Conversely, if the pair tumbles below 1.3400, the next area of interest would be 1.3323, the September 25 swing low.

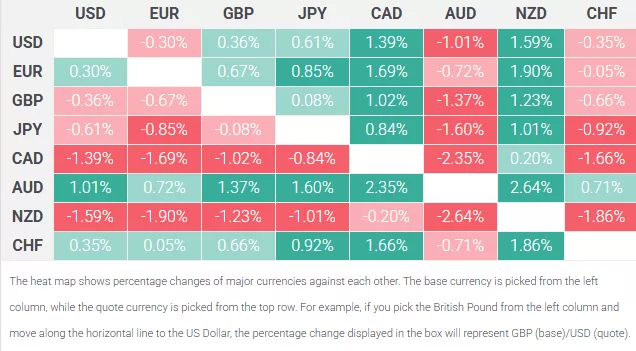

Pound Sterling Price This Month

The table below shows the percentage change of British Pound (GBP) against listed major currencies this month. British Pound was the strongest against the New Zealand Dollar.

More By This Author:

EUR/USD Edges Higher As US Shutdown Fears Weigh On The DollarGBP/USD Rises As Fed Rate Cut Bets Grow, US Shutdown Risks Loom

EUR/USD Rebounded As Fed Rate Cut Bets Strengthened After PCE