GBP/USD Extends Into A Two-Day Bullish Recovery As 1.34 Holds

Photo by Colin Watts on Unsplash

- GBP/USD gained a little over 0.2% on Monday, clawing back recent losses.

- Risk-off Greenback flows loosened their grip further to start the new week.

- Despite a near-term cooling of market tensions, a US government shutdown still looms.

GBP/USD clawed its way into a second consecutive winning market session on Monday, squeezing out another one-fifth of one percent as top-heavy US Dollar (USD) flows continued to recede across the board. The Pound Sterling (GBP) gained just enough room to squeeze back about the 1.3400 handle, and now the latest UK Gross Domestic Product (GDP) growth figures lie ahead on Tuesday.

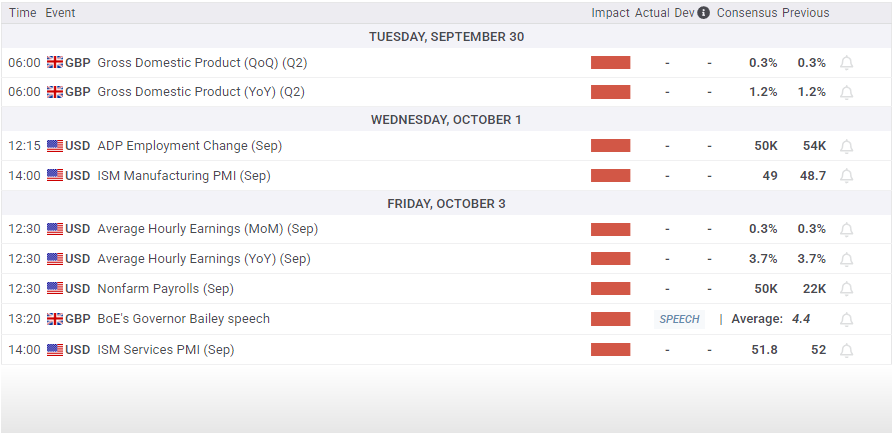

Final Q2 UK GDP growth is expected to hold steady at 0.3% QoQ and 1.2% YoY. The final GDP figure rarely deviates far from consensus. However, a steep enough unexpected tilt in either direction could send the Pound soaring or plummeting, depending on whether the data over- or under-shoots forecasts.

US Nonfarm Payrolls (NFP) data looms ahead later this week, but investor sentiment has battled into an uneasy holding pattern. There is a looming risk that the latest US jobs report may not get released at all this week as the US government barrels toward a funding freeze and temporary shutdown. US President Donald Trump has threatened to terminate thousands of federal jobs if the two sides of US Congress can’t pass a federal government funding bill, effectively taking his own government hostage and threatening to further hamper federal operations.

GBP/USD price forecast

The Pound Sterling has extended a painfully slow bullish recovery after tumbling into seven-week lows last Thursday. GBP/USD is back above the 1.3400 handle for the time being, but near-term price action is poised to face further downside pressure from the 50-day Exponential Moving Average (EMA) acting as a technical ceiling near 1.3480.

Even if intraday bids are able to crack the key MA, the 1.3500 handle is lying in wait just north, littering the top side of the chart with traps for bulls to fall into.

More By This Author:

Dow Jones Industrial Average Hesitates As Government Shutdown LoomsCanadian Dollar Slows Losses, But Weakness Continues

Dow Jones Industrial Average Rebounds After PCE Inflation Print Keeps Rate Cut Hopes Alive