GBPUSD Elliott Wave Zig Zag Pattern Forecasting The Path

Hello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GBPUSD. GBPUSD is in process of forming Elliott Wave Zig Zag Pattern in the cycle from the 07.14 low. In the further text we are going to explain the Elliott Wave Pattern and the Forecast.

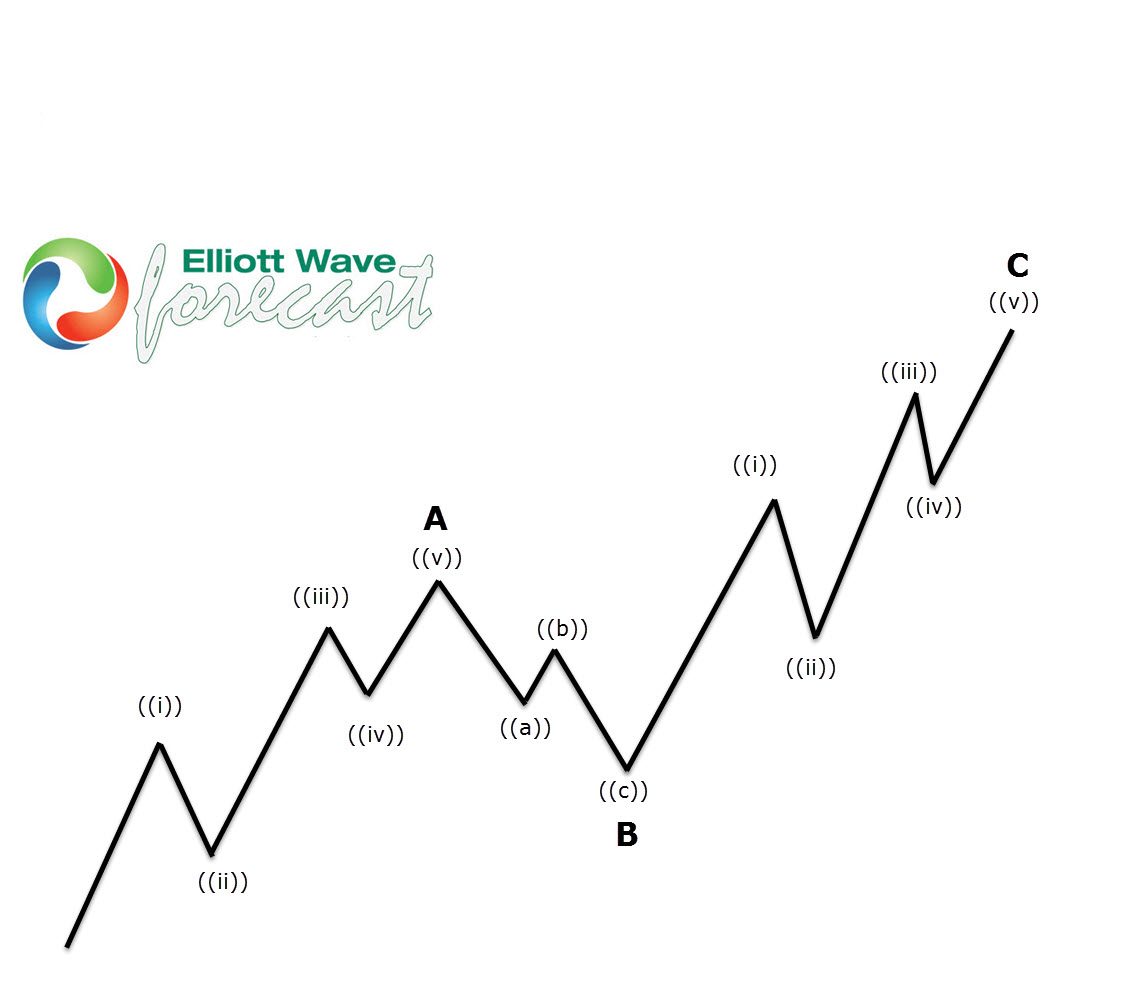

Before we take a look at the real market example, let’s explain Elliott Wave Zigzag pattern.

Elliott Wave Zigzag is the most popular corrective pattern in Elliott Wave theory . It’s made of 3 swings which have 5-3-5 inner structure. Inner swings are labeled as A,B,C where A =5 waves, B=3 waves and C=5 waves. That means A and C can be either impulsive waves or diagonals. (Leading Diagonal in case of wave A or Ending in case of wave C) . Waves A and C must meet all conditions of being 5 wave structure, such as: having RSI divergency between wave subdivisions, ideal Fibonacci extensions and ideal retracements.

Now, let’s see what Elliott Wave Zig Zag looks like in real market example

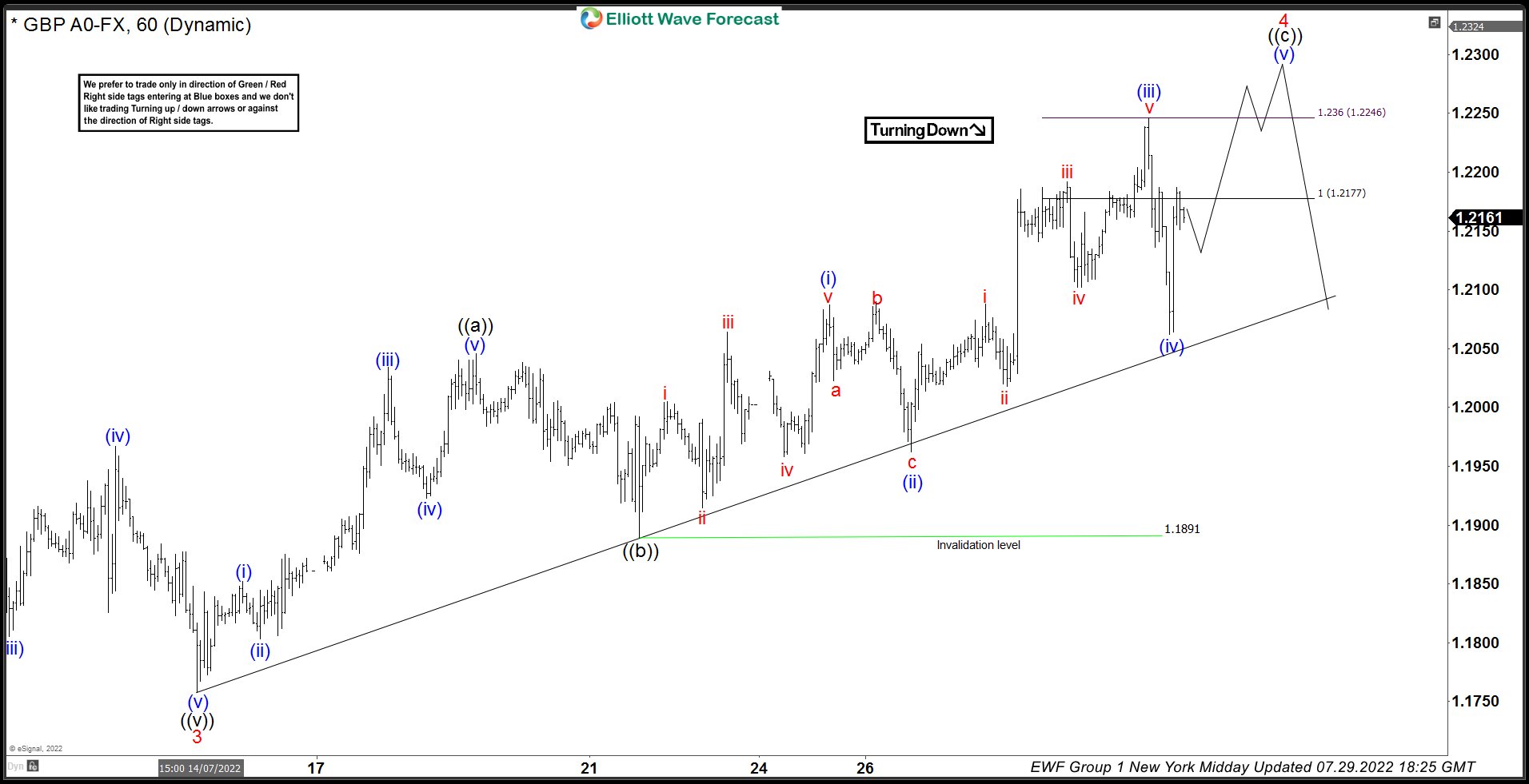

GBPUSD H1 Elliott Wave Analysis 07.26.2022

GBPSD is showing higher high sequences from the 07/14 low. We got 5 waves up in the first leg ((a)). Then the price has given us corrective pattern (7 swings) in ((b)) black, after which we got rally toward new highs again. Current price structure suggests we are in ((c)) leg up as far as 1.1891 pivot holds. Recovery looks incomplete at the moment, calling for further strength toward 1.2170-1.2344 . As the first leg of correction has 5 waves structure, we assume recovery is having form of Elliott Wave Zig Zag. Consequently we expect to see 5 waves up in the ((C)) leg as well. At the moment we are doing (ii) of ((c)) which should be ending soon around trend line.

GBPUSD H1 Elliott Wave Analysis 07.29.2022

1.189 pivot held well during the short term correction and Wave (ii) found support around the trend line as we expected. We got rally in the pair and target area is already reached at 1.2170-1.2344. However there is no any sign yet suggesting cycle is over. If we take a close look at the rally from the 1.1891 low, we can count 3 waves up so far. So, another leg up would be ideal to have 5 waves in ((c)) leg. We believe (iv) blue is done at 1.2056 and we are doing (v) blue toward 1.2289-1.236.

Keep in mind market is dynamic and presented view could have changed in the mean time.

More By This Author:

Starbucks Ended A Double Correction And It Should Continue HigherTop 10 Shipping Stocks In 2022

Goldman Hit Our Target And We See More Downside To Come

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more