GBP/USD Eases Ahead Of Bloated Data Docket

Photo by Colin Watts on Unsplash

- GBP/USD slipped back below 1.3500 on Tuesday.

- The back half of the week brings plenty of meaningful data and policy releases.

- UK CPI inflation data and Fed meeting minutes are on deck for Wednesday.

GBP/USD eased lower on Tuesday, edging back below 1.3500 as Cable traders await a reason to make a move. The trading week opened up with little of note on the economic data docket, leaving markets to react to headline flows that remained constrained.

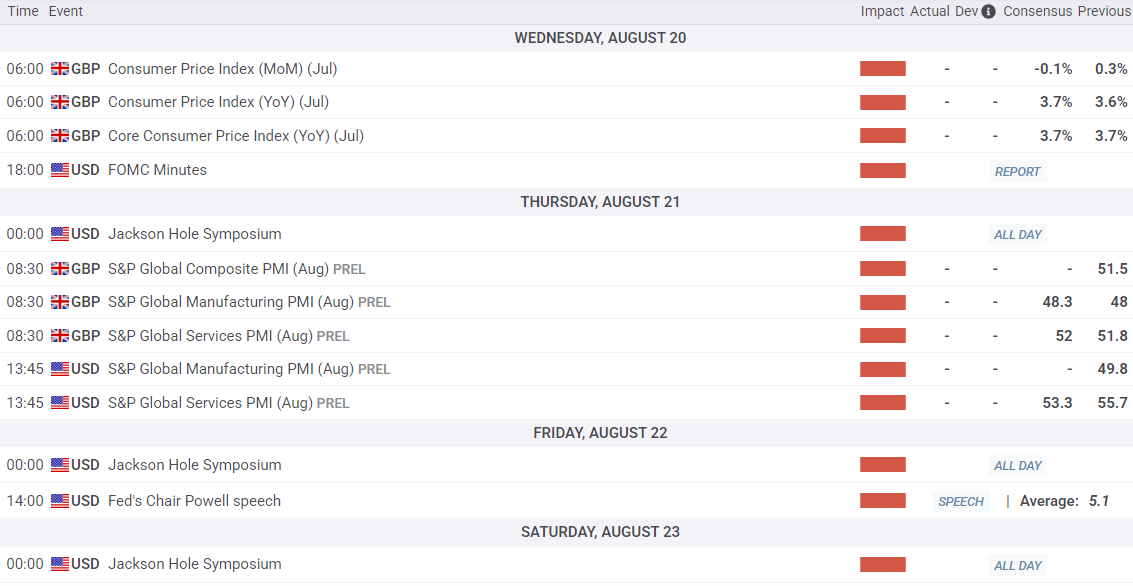

All of that changes beginning on Wednesday. The United Kingdom’s (UK) latest Consumer Price Index (CPI) inflation figures will be released during the upcoming London market session, followed by the latest interest rate decision meeting minutes from the Federal Reserve (Fed) during the New York market hours.

Core UK CPI inflation is expected to hold steady near 3.7% YoY, while headline inflation figures for the same period are expected to tick up to 3.7% from 3.6%. The Fed’s latest meeting minutes are unlikely to reveal any new information, but will nonetheless give policy watchers fresh bones from the same carcass to gnaw on.

Global Purchasing Managers Index (PMI) will drop on Thursday for both the UK and the US, and this year’s Jackson Hole economic symposium also gets underway. UK PMI figures are generally expected to rise on both the services and manufacturing components, while a contraction in US services PMI figures is expected.

GBP/USD price forecast

Tuesday’s bearish continuation has put GBP/USD on pace for a fresh challenge of technical support at the 50-day Exponential Moving Average (EMA) near 1.3450. However, Cable is still firmly entrenched deep in bull country, with the pair trading well north of the 200-day EMA near 1.3170.

GBP/USD daily chart

More By This Author:

Dow Jones Industrial Average Fizzles After Tech Rally StumbleGBP/USD Softens Ahead Of Data-Heavy Week

Dow Jones Industrial Average Cools Ahead Of Jackson Hole Week