GBP/USD Cools Momentum As Pound Traders Weigh Next Options

Photo by Colin Watts on Unsplash

- GBP/USD held steady near 1.2900 on Monday as a new week gets underway.

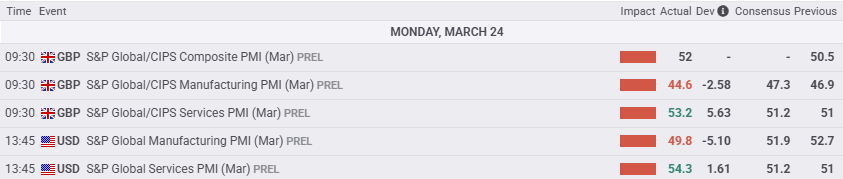

- PMI figures for both the UK and the US came in mixed to start the new week.

- Cable has flubbed a technical grab for the 1.3000 handle, putting a further backslide on the cards.

GBP/USD rankled on Monday, kicking off the new week with a fresh bout of indecision as the pair floats near the 1.2900 handle. Economic data from both the UK and the US came in mixed on Monday, as surveyed businesses waffle on their Purchasing Managers Index (PMI) expectations.

US President Donald Trump has again hit investors with a fresh batch of on-again, off-again tariff threats. Investors have latched onto the suggestion that Donald Trump might be looking at tariff exemptions for his own trade policy “strategy”, bolstering market sentiment enough to keep the Greenback under wraps.

UK PMI data came in mixed early Monday, with the Manufacturing PMI component falling to a fresh 18-month low of 44.6 in March. The Services component rose more than expected, hitting a seven-month high of 53.2, but overall business activity expectations remain tepid at bast amid a wobbling UK economic outlook.

US Manufacturing PMI survey results sank faster than expected in March as tariff threats take a bite out of the physical production outlook. The Manufacturing PMI for March sank to a three-month low of 49.8, slipping back into economic contraction territory as businesses grow increasingly worried about the economic landscape. The Services PMI came in better than expected, rising to 54.3, it’s own three-month high as services operators expect to be able to fully pass on tariff cost increases to consumers.

A data-light economic calendar awaits Tuesday’s market participants, but Cable traders will be looking ahead to Wednesday’s UK Consumer Price Index (CPI) inflation print from February. Headline UK CPI inflation is expected to tick down slightly to 2.9% from 3.0% YoY.

GBP/USD price forecast

GBP/USD has pumped the brakes on a technical decline from recent highs, snapping a two-day losing streak. However, the pair remains on the wrong side of the 1.3000 handle as price action chalks in a new technical ceiling at the key handle.

Cable is still trading well above the 200-day Exponential Moving Average (EMA) at 1.2700, but bullish momentum looks poised to evaporate further as bidders run out of gas. Technical oscillators have been pinned in overbought territory since January, and it may be time for an extended backslide.

GBP/USD daily chart

More By This Author:

Dow Jones Industrial Average Whipsaws But Holds Steady On FridayCanadian Dollar Whipsaws As Tariff Concerns Prompt BoC Policy Planning Shift

GBP/USD Remains Attached To 1.3000 After Fed Rate Hold