GBP/USD Clips Three-Day Losing Streak, Bounces Off Key Technicals

Photo by Colin Watts on Unsplash

- GBP/USD rose 0.33% on Monday, shaking off a three-day downturn.

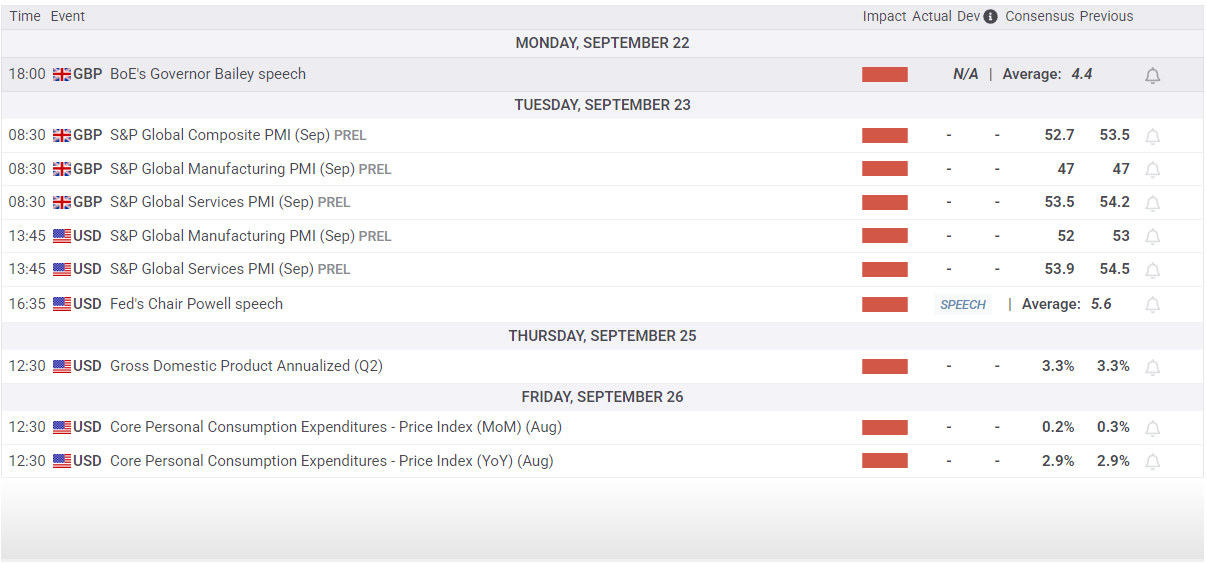

- Tuesday will deliver a double-header of PMI survey results.

- Key US inflation data looms large now that the Fed has pivoted into rate cuts.

GBP/USD rebounded on Monday, snapping a three-day losing streak and chalking in a technical bounce from the 50-day Exponential Moving Average (EMA) as broad-market Greenback flows recede. Cable traders will face a double-header of Purchasing Managers Index (PMI) survey results on Tuesday, and business expectations are expected to take a slight hit on both sides of the Atlantic.

The UK’s Manufacturing PMI for September is forecast to hold steady at 47.0, but the Services PMI component is expected to backslide to 53.5 from 54.2. On the American side of the data docket, September’s PMI results are expected to retreat across the board, with the Manufacturing component set to decline sharply to 52.0 from 53.0. The US Services PMI survey is expected to show business sentiment contracted to 53.9 from 54.5.

Fed narrative fracture could drive further market volatility

The Fed finally delivered a long-awaited interest rate cut last week, and proponents for lower rates are already clamoring for more, waving off fresh inflationary risks. The newest member of the Federal Reserve’s (Fed) Board of Governors and Donald Trump’s hand-picked replacement for Adriana Kugler’s recently-vacated seat, Stephen Miran, raced to proclaim his opinion that Fed rates could easily be two full percentage points lower than they are now, a deeply untraditional monetary policy view that is not shared by anyone else on the Fed board, nor in any meaningful datasets.

GBP/USD price forecast

A fresh bullish turnaround for the GBP/USD pair puts Cable on pace to extend a technical bounce from the 50-day EMA near 1.3500, but the 1.3600 handle remains a significant technical hurdle for near-term price action.

GBP/USD daily chart

More By This Author:

Canadian Dollar Drives Lower As Loonie Races Greenback To The BottomDow Jones Industrial Average Climbs On Monday As Equities Hit All-Time Highs

GBP/USD Sinks After BoE Holds Rates Steady, UK Retail Sales In The Barrel