GBP/USD Climbs As Bessent Softens US Stance, Powell’s Dovish Tilt

Photo by Colin Watts on Unsplash

The Pound Sterling (GBP) recovers some ground, advancing 0.60% against the US Dollar (USD) on Wednesday during the North American session, as China-US tensions ease on comments of US Treasury Secretary Scott Bessent. At the time of writing, GBP/USD trades at 1.3396 after bouncing off daily lows of 1.3309.

Sterling climbs as Treasury Secretary hints at easing US-China trade tension; Fed Chair dovish language

On Wednesday, Bessent proposed a longer pause on high tariffs on Chinese products, in exchange for the recently tightened limits imposed by Beijing on critical rare earths. “Is it possible that we could go to a longer roll in return? Perhaps. But all that’s going to be negotiated in the coming weeks,” he said in a press conference in Washington.

Dovish comments by Federal Reserve (Fed) Chair Jerome Powell weighed on the US Dollar, which is posting losses, according to the US Dollar Index (DXY). Powell acknowledged the weakness of the labor market, adding that the central bank should move to more “neutral” interest rates.

The ongoing US government shutdown could prompt a jump in the unemployment rate, amid expectations of mass federal layoffs. Meanwhile, traders will eye the release of the Fed Beige Book, which could be scrutinized for hints about the status of the economy.

Across the pond, Bank of England (BoE) Governor Andrew Bailey crossed the wires after the release of a soft UK employment print and noted that the data support his view of a softening labor market.

GBP/USD traders’ eyes are on the release of the Autumn Budget by the Chancellor Rachel Reeves. She confirmed that tax rises and spending cuts are on the horizon, confirming expectations, given her pledges about balancing the country's books.

Analysts cited by Reuters stated that GBP/USD could “retreat to the 1.30 support before we maybe see some fiscal tightening that is more than the market is expecting.”

GBP/USD Price Forecast: Remains bearish, despite advancing towards 1.34

The GBP/USD technical view suggests that the ongoing leg-up could be short-lived unless buyers claim 1.3400 on a daily basis. This could pave the way for testing the 20-day SMA at 1.3424, ahead of challenging the 50-day SMA at 1.3474.

Despite this, momentum is bearish as depicted by the Relative Strength Index (RSI), which lies underneath the 50-neutral level.

Conversely, if GBP/USD extends its losses below the October 14 swing low of 1.3248, further downside lies at the 200-day SMA at 1.3183.

Pound Sterling Price This week

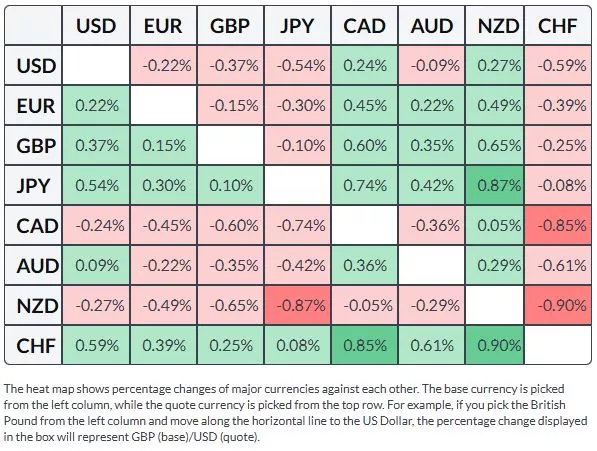

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the New Zealand Dollar.

More By This Author:

EUR/USD Climbs Above 1.16 As Powell’s Neutral Tone Weigh On Dollar

GBP/USD Slides Toward 1.33 As Weak UK Jobs Data Fuels BoE Rate Cut Bets

GBP/USD Slips As Dollar Rebounds, Ahead Of UK Data And Fed Speeches