GBP/JPY Price Analysis: Held Steady Around 191.00 Amid Thin Liquidity Conditions

Image Source: Pixabay

- The GBP/JPY currency pair hovered around the 191.00 level on Friday, as trading was subdued due to the Easter holiday.

- Technical indicators illustrated the potential for movement, as the key levels at 191.57 and 190.74 marked immediate targets.

- Future direction hinges on breaking through resistance at the 192.00 mark or the support seen at the 190.00 level.

On Friday, the GBP/JPY currency pair remained steady at around the 191.00 mark, almost flat, as the financial markets remained closed in observance of the Easter holiday. In the meantime, Fed Chair Jerome Powell crossed the newswires, saying that monetary policy is well placed to react to a range of different data paths.

GBP/JPY Price Analysis: Technical Outlook

The daily chart seemed to suggest the GBP/JPY pair was trading sideways, capped on the upside by the Tenkan-Sen formation at the 191.57 level. Since the pair fell below the latter, the exchange rate remained beneath the 191.40 area, which seemingly opened the door for further downside.

A push below 191.00 in the coming days could pave the way for a deeper pullback. The next support would be the Kijun Sen structure at the 190.74 mark, followed by the March 25 low of 190.33. A breach of the latter would expose the next support level at 190.00.

On the other hand, if the GBP/JPY duo manages to stay afloat and rallies above the Tenkan-Sen, that would open the door to challenge the 192.00 level. Further gains could be seen above that level, with the 193.00 mark in view, followed by the current year-to-date high of 193.53.

GBP/JPY Price Action – Daily Chart

(Click on image to enlarge)

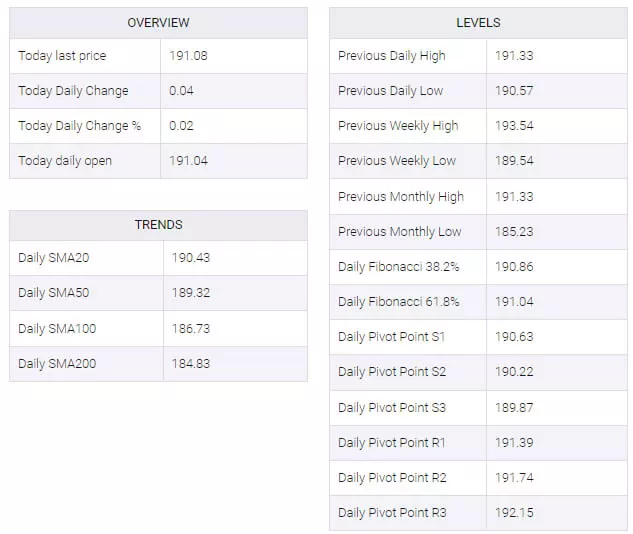

GBP/JPY Technical Levels

More By This Author:

EUR/USD Holds Steady As Core PCE Meets ExpectationsUSD/JPY Stalls Amid Mixed Market Mood, Intervention Concerns

AUD/USD Stands Its Ground Amid US Data, Ahead Of Aussie’s CPI

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more