GBP/JPY Plateaus At Highs Around 182.50

At the start of the week, the GBP lost ground against most of its rivals, including the USD, EUR, and CHF. A cautious market mood and investors consolidating gains which took the pair to a high since 2015 make it difficult for the Sterling to find demand. In addition, political tensions in the British public sector are encouraging investors to stay away from the Pound.

UK government to ignore public sector wage increases

The British government is said to be considering disregarding certain recommendations from pay review bodies regarding increases in public sector wages. This decision is reported to be motivated by concerns over the potential negative impact on the economy, specifically on inflation. In that sense, uncertainty regarding the possibilities of union strikes clashing amid this decision made the GBP lose interest.

That being said, investors will look for additional clues on the Bank of England's (BoE) next steps regarding monetary policy, on Wednesday, at the European Central Bank Forum in Sintra, Portugal.

Last Thursday, the BoE opted for a hawkish surprise, hiking rates by 50 basis points while markets expected 25 bps, and the statement hinted at additional increases this year. The surprise hike as well as Governor Bailey’s commentary from Wednesday may continue to have an impact on Sterling’s price dynamics.

Most economists polled by Reuters predict that the Bank of Japan (BoJ) will step in to halt the Yen's decline if the USD/JPY reaches 145.00. In the meantime, the JPY is currently weakening due to soft inflation figures and the BoJ's dovish stance.

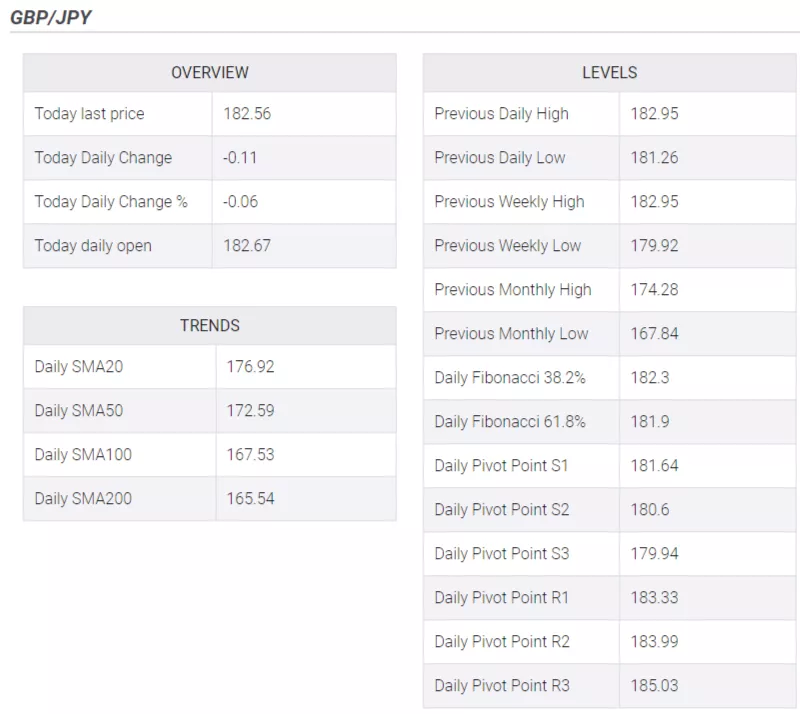

GBP/JPY Levels to watch

Technically speaking, the GBP/JPY maintains a bullish outlook for the short term, as per indicators on the daily chart. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are both showing strength, standing in positive territory and the pair trades above its main moving averages, suggesting that the buyers are in charge. However, both indicate overbought conditions so further downside should not be taken off the table.

If GBP/JPY manages to move higher, the next resistances to watch are at the 183.00 zone, followed by the 183.50 zone and the 184.00 area. On the other hand, the 181.20 level remains the key support level for the cross. If broken, the 180.00 zone and 179.00 level could come into play.

GBP/JPY Daily chart

(Click on image to enlarge)

-638233938708666812.png)

More By This Author:

NZD/USD Price Analysis: H&S In Action Amid Risk-Off Market Mood

Natural Gas Price Analysis: Bulls Cheer 100-EMA Breakout To Refresh Three-Month High, $3.0 In Focus

USD/CAD Slips Below 1.3200 As US Dollar Retreats Ahead Of US/Canada Inflation, Ignores Downbeat Oil Price

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more