GBP Forecast: Pound Undeterred By Hawkish Fed Speakers, BoE’s Bailey In Focus

GBP/USD Fundamental Backdrop

The British pound remains in a consolidatory phase at relatively high levels despite attempts by Fed officials to reinforce aggressive rhetoric. While these attempts have been futile, the upcoming statement by Fed Chair Jerome Powell and consequent U.S.-centric data could see the pound take a turn lower. U.S. mortgage applications are already on the rise with talks of moderated rate hikes the current focus, which can ultimately lead to high levels of inflationary pressure – the very thing the Federal Reserve is trying to fight!

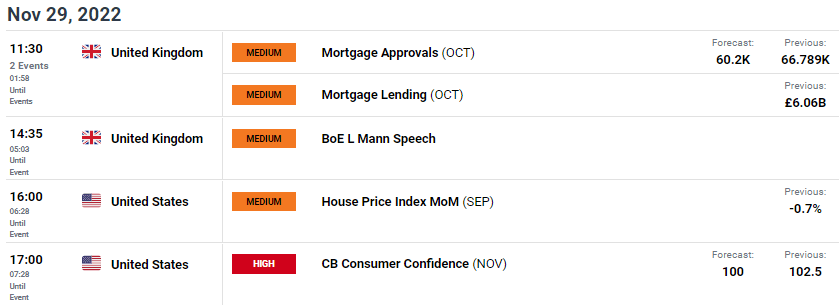

GBP/USD Economic Calendar

Source: DailyFX Economic Calendar

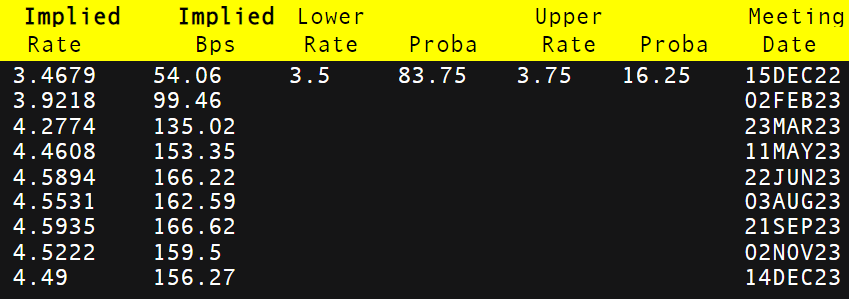

Today’s schedule is not very exciting from a volatility point of view but Bank of England Governor Bailey is scheduled to address the House of Lords and could provide some insight into the actions of the BoE for December’s interest rates decision. Money markets are currently pricing in 54bps which is in line with a 50bps hike considering the depleted state of the UK economy. The BoE’s Mann will also shed light on the current state of affairs and in the absence of UK fundamental data of recent, markets may react more fervently to any surprise BoE guidance.

Bank Of England Interest Rate Probabilities

Technical Analysis

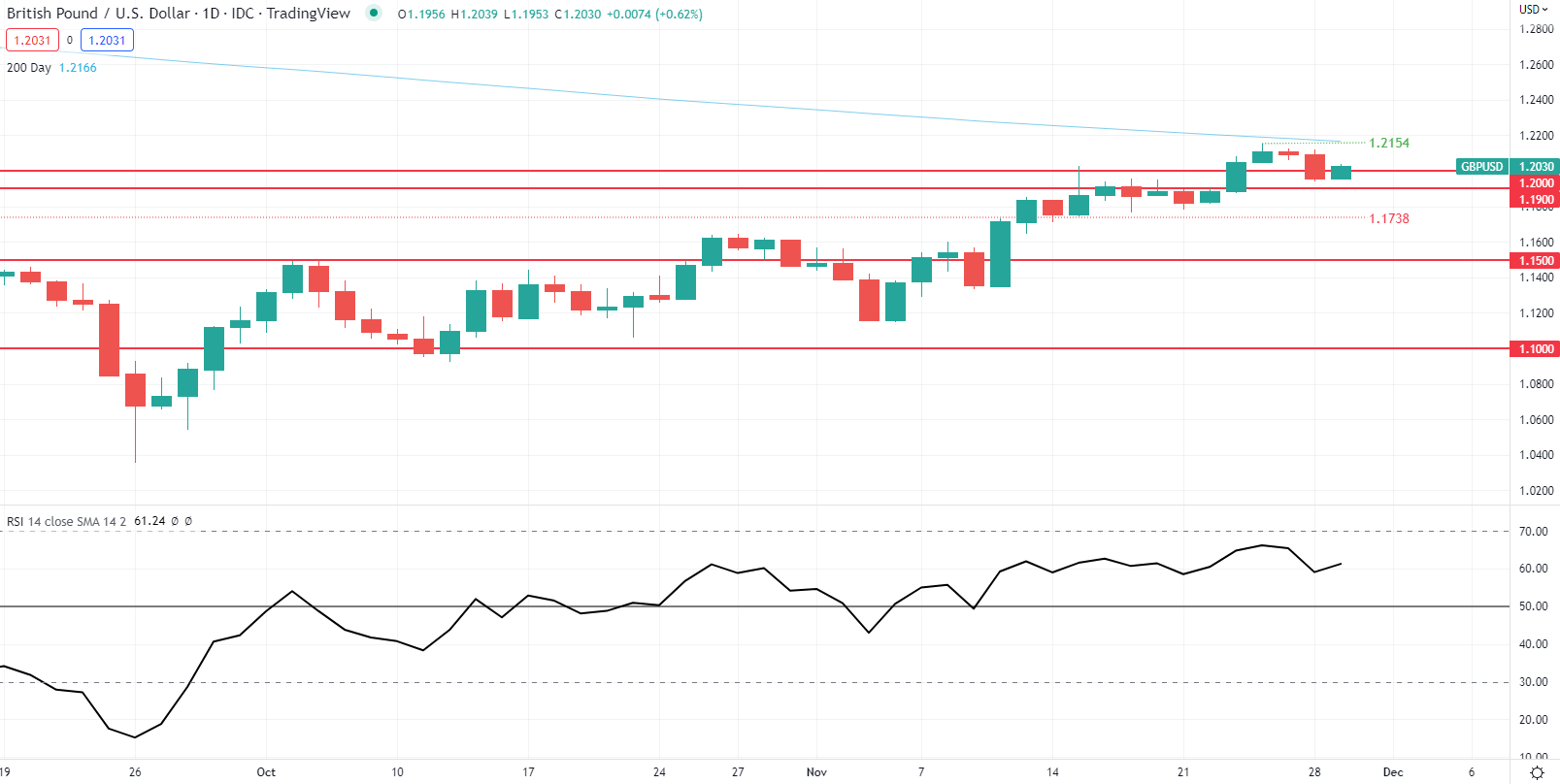

GBP/USD Daily Chart

(Click on image to enlarge)

Chart prepared by Warren Venketas, IG

Daily GBP/USD price action is marginally above the psychological 1.2000 handle with eh Relative Strength Index (RSI) close to overbought levels. There is still room for further upside towards the 1.2154 swing high which should coincide with the 200-day SMA (blue) but taking into account the economic headwinds facing the UK over the U.S., the recent bull run on the cable may be running out of steam.

Key resistance levels:

- 1.2154/200-day SMA

Key support levels:

- 1.2000

- 1.1900

Mixed IG Client Sentiment

IG Client Sentiment Data (IGCS) shows retail traders are currently LONG on GBP/USD, with 55% of traders currently holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning, we arrive at a short-term cautious bias.

More By This Author:

Gold Bulls May Want To Watch US Rate Forecasts, Silver Traders Follow GoldCan Germany’s Inflation Slow Down DAX’s Recovery?

Japanese Yen Weekly Forecast: 140 Key For USD/JPY Ahead Of U.S. Economic Data

Disclosure: See the full disclosure for DailyFX here.