G10 FX Week Ahead: Stay On (Carry) Target

The data flow is set to intensify next week, but we think markets will dodge the NFP release on Friday and settle for a low-volatility summer. This should leave markets focused on carry trades, and with the OPEC+ unlikely to exceed output increase expectations, commodity FX may stay supported. In Sweden, the Risksbank should stay firmly on the dovish side.

USD: Dodging the NFP bullet

- Volatility levels are sinking fast again following a brief hiatus around the FOMC meeting. Given the DXY is heavily-weighted to low-yielding European currencies and the JPY, the default position is that DXY will be range-bound until further notice. In the week ahead that further notice will be the pick-up in the US data calendar, including consumer confidence, ADP, ISM and culminating in Friday’s June NFP figure. The recent FOMC meeting suggests the Fed’s trigger-finger will be a little twitchier when it comes to tapering, but unless the NFP figure comes in close to the one million mark, financial markets will probably be set fair for a low volatility summer. And the US has a public holiday July 5th to celebrate Independence Day.

- With $800bn+ currently being parked at the Fed reverse repo facility, clearly any talk of liquidity removal is premature. That should leave the market looking for carry – but probably funded out of EUR, CHF or JPY. Other global market events to look at this week are issues like: i) OECD discussing a new minimum global corporation tax, ii) US Navy exercises in the Black Sea, iii) China celebrating 100 years of the Communist party and iv) the first look at China June PMIs. None of these look an immediate threat to the calm environment (UUP).

EUR: ECB remains one of the last doves standing

- EUR/USD continues to retrace the FOMC induced sell-off, but no-one expects the EUR to lead this recovery. The ECB has made it clear it does not want to be dragged into premature tightening and we should hear that message in the week ahead from a whole host of ECB speakers, especially from Christine Lagarde.

- The data focus will be on the first look at the June inflation data – but consensus expects headline and core to remain subdued around the 1.9% YoY and 0.9% YoY respectively – hardly a trigger for an ECB change of heart. We’ll also see June PMIs across the whole region. These should echo the surprisingly resilient flash estimates we have seen so far – suggesting supply chain disruption might not be as bad as feared. Also look for French regional elections this weekend. Last week’s vote had little impact on markets, where a low turnout saw support for both Macro and LePen marginally decline. Recall France sees Presidential elections in April 2022 (FXE).

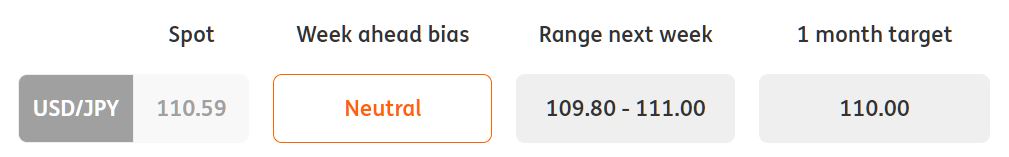

JPY: More big gains for the GPIF?

- The JPY is being used as the preferred funding currency for this summer’s carry trade – with target currencies those backed by tightening cycles. So far these have been exclusively in the EM space, but the list is growing by the week! Short JPY is a consensus view, yet it seems it will take quite a lot to knock the market out of its carry-seeking stance.

- Local interest this week could be the full year results for the world’s biggest pension fund, the Japanese GPIF. Like Norway’s sovereign wealth fund, the GPIF has quite high weightings for equities and thus should have done very well in the fiscal year to March. We’ll also be interested in any changes in its portfolio weightings. We would have thought it would have increased its allocation to FX hedged foreign bond markets, given the collapse in rates at the short end of the curve (FXY).

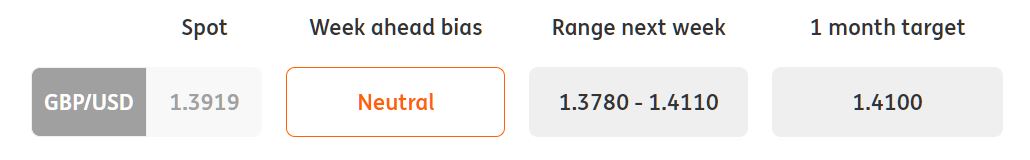

GBP: Calm week ahead

- It should be a calm week on the UK front and for sterling next week. The UK-EU trade dispute has calmed and it seems the grace period on chilled meats imports to NI will be extended. The BoE did not bring too much surprise this week and although a little bit more hawkish than expected, still the MPC refrained from pointing at earlier rate hikes. This suggests some stabilisation in sterling ahead and should EUR/USD continue its slow recovery to and above the 1.20 level, it should bring GBP higher with it.

- On the UK data front, the final 1Q UK GDP reading (Wednesday) should not bring any surprise, while June housing prices data and may mortgage approvals (both on Tuesday) won’t affect sterling at all. As long as the dollar continues reversing some of its last week’s losses, it should be enough to push GBP/USD mildly higher (FXB).

AUD: Quiet week ahead of the 06 July RBA meeting

- The Aussie dollar has followed the rebound in high-beta currencies this week, shrugging off some domestic woes as the spread of the Covid-19 Delta variant forced Sidney into lockdown.

- RBA rate expectations have inevitably shifted to the hawkish side after the June FOMC meeting, and the market is now pricing in 45bp of tightening in two-year time, up from 25bp before the Fed’s hawkish shift. Still, rate expectations remain low when compared to Canada and New Zealand, where markets are pricing almost 100bp of tightening in the next two years. This means that there is still sizeable room for AUD to benefit from the RBA sounding hawkish at the 06 July meeting. Before then, there are no clear domestic catalysts for AUD, as the data calendar is rather dry. The only event to note in the week ahead is RBA Governor’s Lowe speech on Tuesday, which is one day before the start of the Bank’s blackout period, and it looks unlikely we’ll get many policy headlines. AUD should remain mostly driven by external factors, and should benefit from a potential continuation of recovery among pro-cyclical currencies (FXA).

NZD: Good momentum may linger

- The Kiwi dollar was the best performing currency for most of this past week, leading the recovery in commodity FX and significantly trimming the post-FOMC losses. Indeed, fundamentals continue to make NZD a very attractive buy-the-dip opportunity, thanks to one of the most hawkish central banks in G10 and now also a much more balanced positioning.

- Market expectations for the RBNZ have continued to move on the hawkish side, with the OIS market now pricing in a the first hike already in early 2022 (the RBNZ signalled no change until 2H22), starting to set the bar quite high for another hawkish surprise at the 15 July RBNZ meeting. One variable we continue to see as central for monetary policy (although not explicitly mentioned by the RBNZ) is the housing market, and a first look at June’s house prices next week will tell us whether the RBNZ will continue to feel the pressure to normalize policy earlier than expected for curbing the housing bubble. So far, it appears that the Government’s measures to stop the rise in house prices have not had a material impact. There are no other domestic drivers to highlight in the week ahead, but NZD’s attractive rate profile may clear the way for a bit more strength in NZD should the global environment continue to allow it.

CAD: Oil should not get on the recovery path

- A continuation of the rebound in the loonie in the coming days will likely be more dependent on external factors (global risk appetite and oil market developments) rather than domestic ones. The data calendar in the week ahead only includes growth figures for April, which are likely to have been heavily impacted by Covid-19 containment measures enforced in most of Canada at the time. We think markets may disregard a disappointing read as an outdated piece of information, especially considering haw fast the vaccination roll-out has been: the government is now aiming at having 75% of the population fully vaccinated by July.

- The OPEC+ meeting will be the most relevant event for CAD next week. As discussed by our commodities strategists in “OPEC+ expected to ease cuts further”, we expect a 500M bbls/d output increase to be largely expected by the market, and any smaller hike may actually provide extra steam to crude’s bullish momentum. If indeed oil survives the OPEC+ meeting without a price correction, we see no major impediments for USD/CAD to keep shedding post-FOMC gains (FXC).

CHF: CPI reminds why SNB is so dovish

- EUR/CHF has been grinding higher and perhaps the move won’t gain momentum until the ECB pulls back from aggressive PEPP purchases. That may not be until September. The coming week though should serve as a reminder as to why the SNB is so dovish. June CPI should come in at just 0.7% YoY. Remember CPI doesn’t reach the Swiss National Bank’s 2.0% target over the SNB’s three-year horizon. A far cry from EM central banks battling inflation in the 6-8% YoY area.

- We will also see the June KOF activity indicator. This should stay very strong following the German Ifo – yet as above looks unlikely to move the needle on the SNB’s super-dovish setting (FXF).

NOK: OPEC+ meeting the key event for NOK next week

- The key event for NOK next week will be the OPEC+ meeting (Thursday) and its implication for the oil price. While the OPEC+ is to increase production, this is largely expected and an increase around 500Mbbls/d should not come as a surprise. With the global economic recovering, this should not put a downward pressure on the oil price - our commodity strategists still see ICE Brent averaging around US$70/bbl over the second half of this year. This, coupled with the hawkish NB which we expect to hike rates twice in 2H21, should keep NOK supported and EUR/NOK is set to grind lower, towards and below the 10.00 level in summer

- It is a very quiet week on the Norwegian data front next week. June PMI Manufacturing (Thursday) and the June unemployment rate (Friday) should not affect NOK much.

SEK: Riksbank to remain very cautious

- The main focus is on the Riksbank meeting (Thursday). Despite the recent shift to the hawkish side by many central banks (in the G10 FX, the Fed, the BoC and the NB provide the case in point) Riksbank should remain firmly stuck to the dovish spectrum within the global central banking community. The economy has been doing well, the economic data have been solid and the Riskbank forecast for inflation may be upgraded, yet a more hawkish tilt is fairly unlikely next week. Crucially, the Riksbank interest rate forecast should remain unchanged and still forecast no interest rate increases over the forecast horizon.

- This means SEK should remain laggard vs those cyclical G10 currencies, where domestic central banks have moved towards policy normalisation (NOK and CAD in particular). Still, as long the global environment remains risk friendly and USD continues reversing its last week’s gains, the bias is for a modestly lower EUR/SEK. On the Swedish data front, the focus will also be on June Economic Tendency Indicator (Tuesday) and June Manufacturing PMIs (Thursday) (FXS).

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!